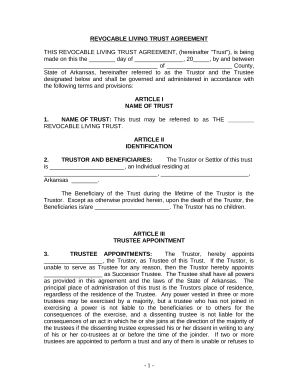

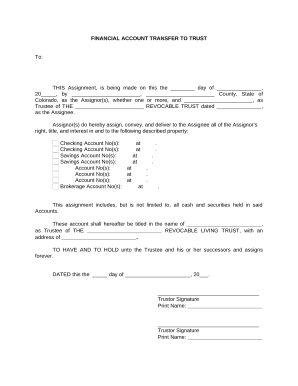

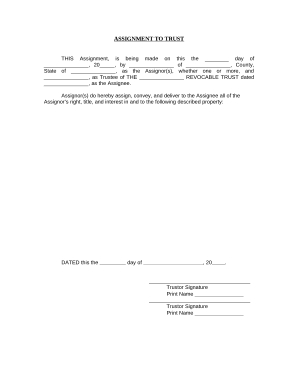

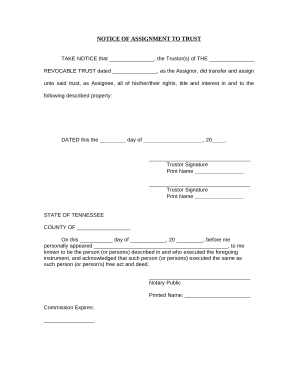

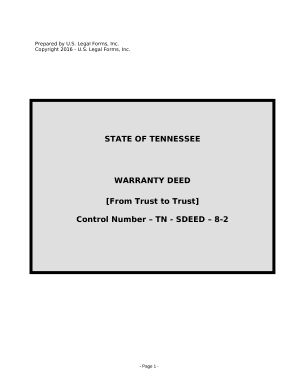

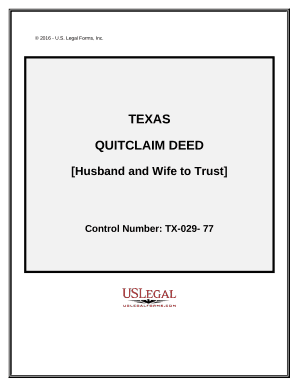

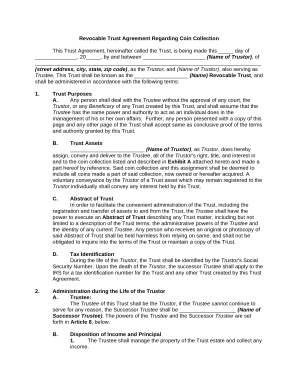

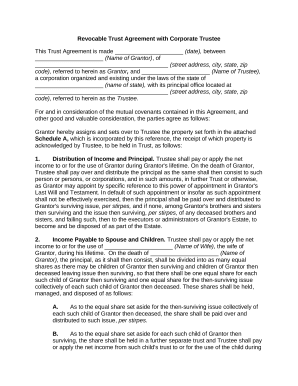

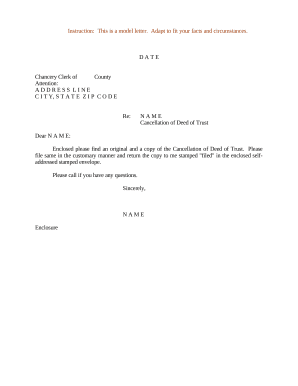

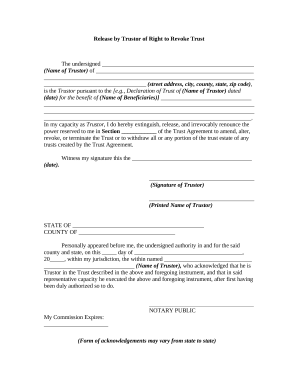

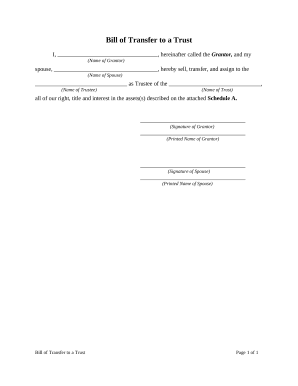

Handle Trust Forms quickly online

Document management can stress you when you can’t discover all of the forms you need. Luckily, with DocHub's extensive form collection, you can find all you need and swiftly take care of it without switching between software. Get our Trust Forms and start utilizing them.

Using our Trust Forms using these basic steps:

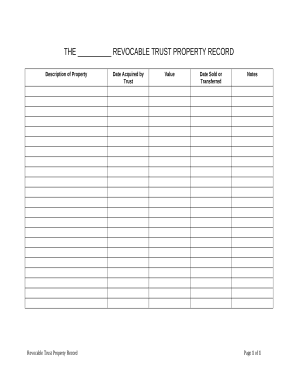

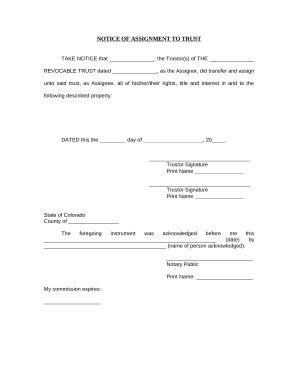

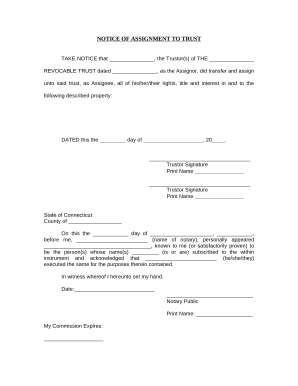

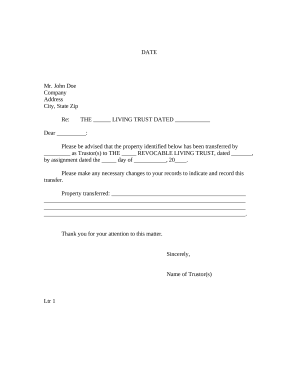

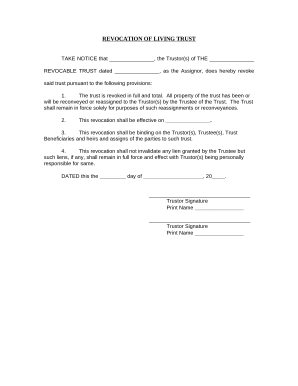

- Check Trust Forms and select the form you need.

- Review the template and click on Get Form.

- Wait for it to upload in the online editor.

- Alter your document: add new information and pictures, and fillable fields or blackout some parts if required.

- Complete your document, save changes, and prepare it for sending.

- When all set, download your form or share it with other contributors.

Try out DocHub and browse our Trust Forms category easily. Get a free profile right now!