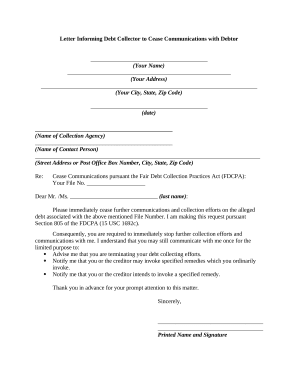

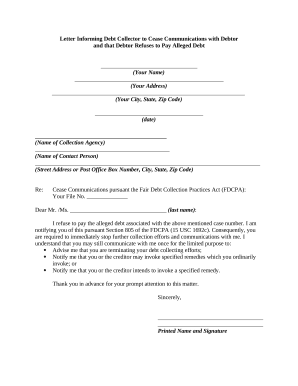

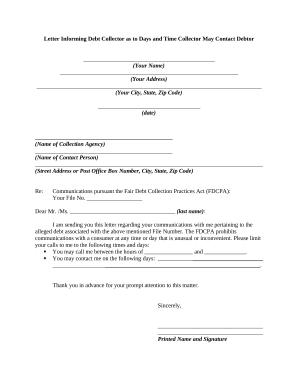

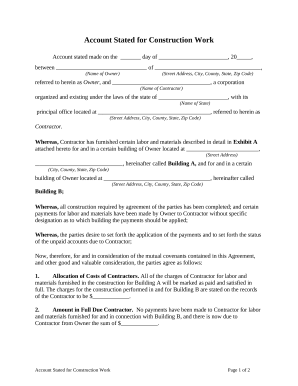

Speed up your file management using our Debt Collection library with ready-made document templates that meet your needs. Get your form, edit it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively with your documents.

The best way to use our Debt Collection:

Discover all the possibilities for your online document administration using our Debt Collection. Get your free free DocHub profile right now!