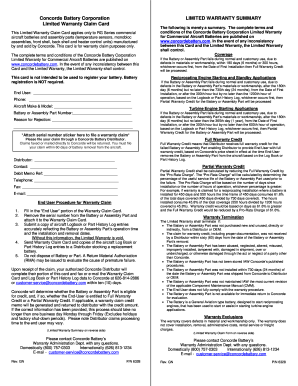

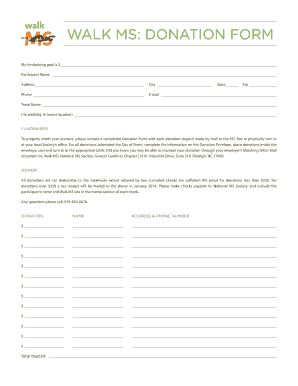

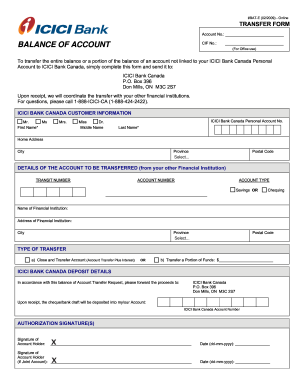

Improve your fundraising efforts with DocHub's customizable Card receipt Donation Forms templates. Create a lasting impact on contributors with professional and customized fundraising documents.

Accelerate your document management with the Card receipt Donation Forms collection with ready-made document templates that meet your needs. Access your document, change it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with your forms.

The best way to manage our Card receipt Donation Forms:

Examine all of the possibilities for your online file administration with the Card receipt Donation Forms. Get your free free DocHub account right now!