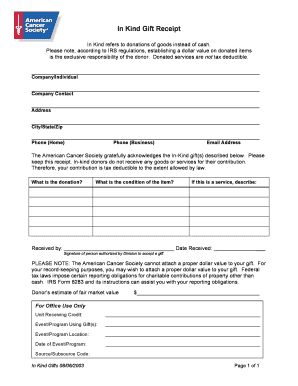

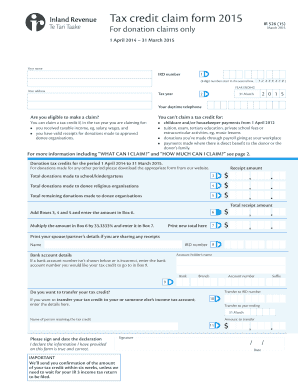

Get customizable Artwork gift to non profit Donation Forms library and find the document you need. Fill out, eSign, and distribute templates with simplicity using DocHub.

Form management consumes to half of your business hours. With DocHub, it is easy to reclaim your time and effort and improve your team's efficiency. Get Artwork gift to non profit Donation Forms online library and explore all templates relevant to your day-to-day workflows.

Effortlessly use Artwork gift to non profit Donation Forms:

Accelerate your day-to-day document management with our Artwork gift to non profit Donation Forms. Get your free DocHub account today to explore all forms.