Ensure compliance with the latest laws and easily adjust Gift Canada Forms online. Locate, fill out, and eSign your documents with DocHub easily.

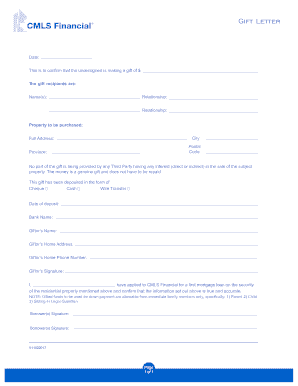

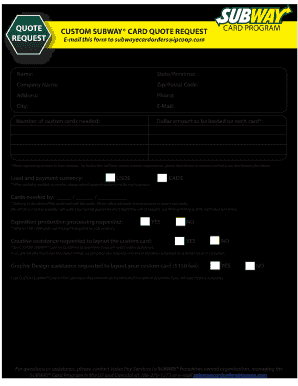

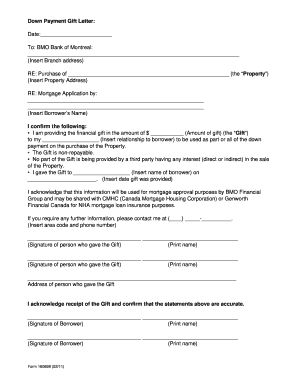

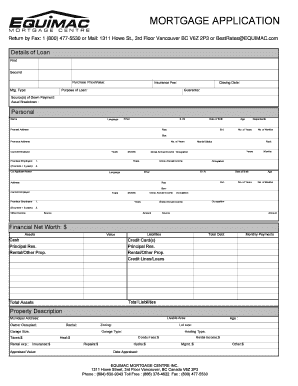

Your workflows always benefit when you can discover all the forms and documents you require on hand. DocHub delivers a a huge library of document templates to relieve your day-to-day pains. Get hold of Gift Canada Forms category and easily discover your document.

Begin working with Gift Canada Forms in several clicks:

Enjoy smooth form management with DocHub. Check out our Gift Canada Forms online library and locate your form today!