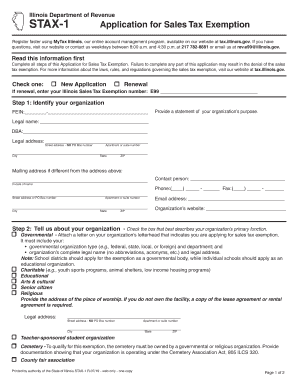

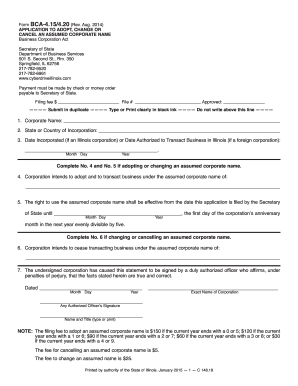

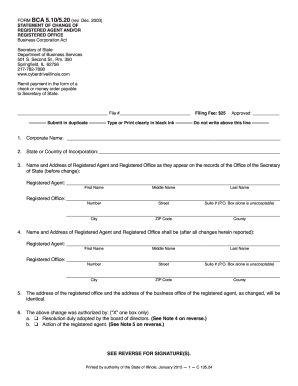

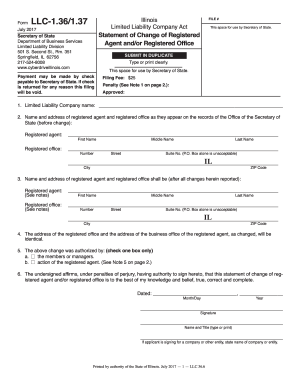

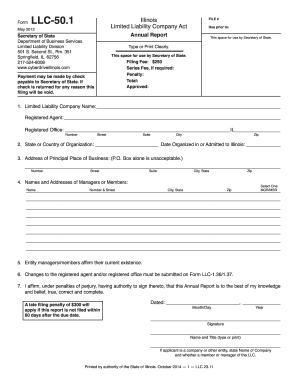

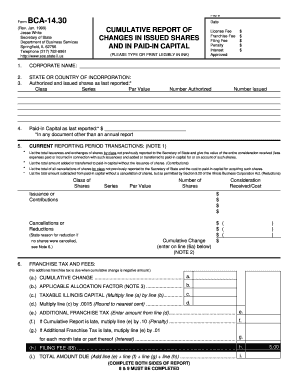

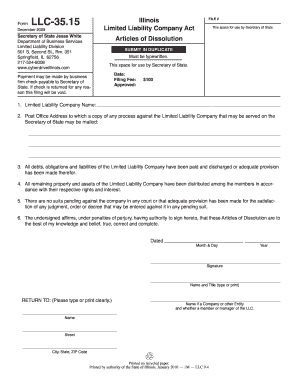

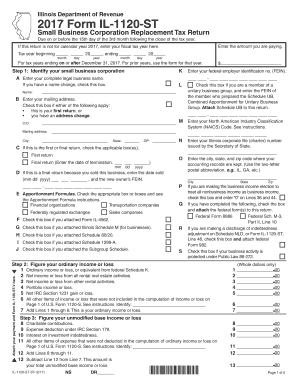

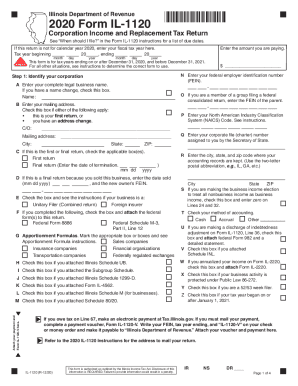

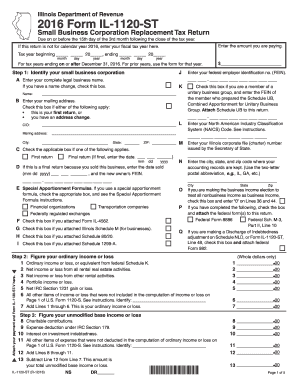

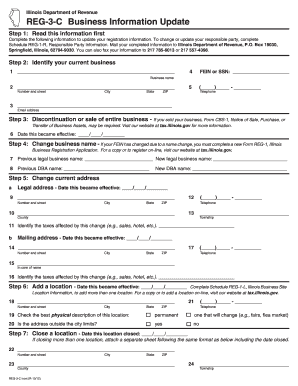

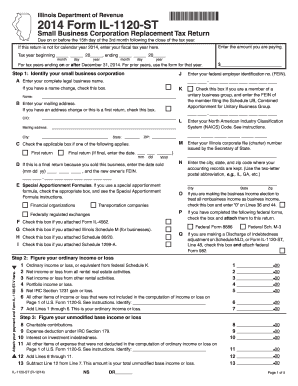

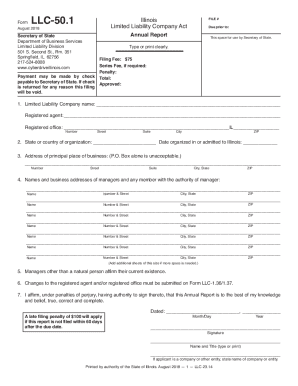

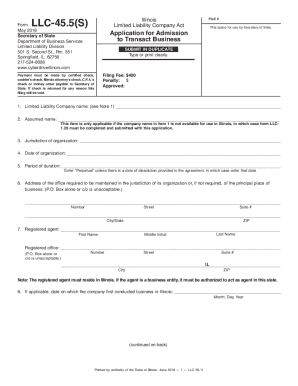

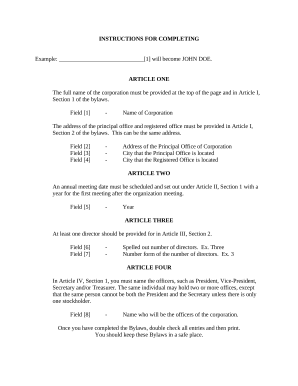

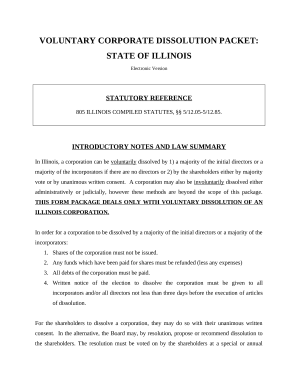

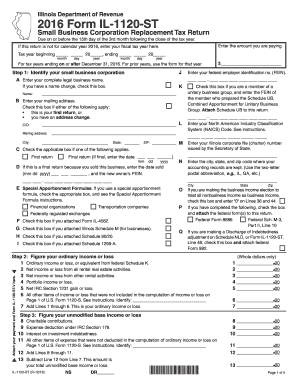

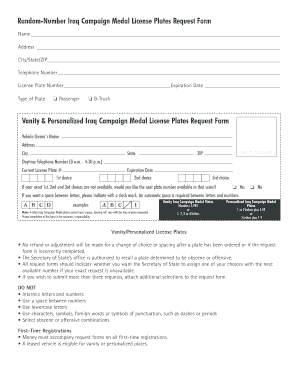

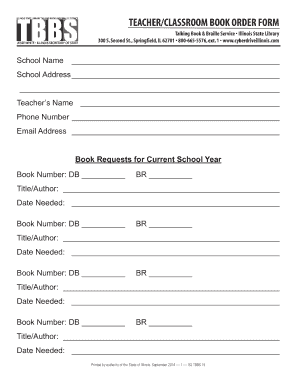

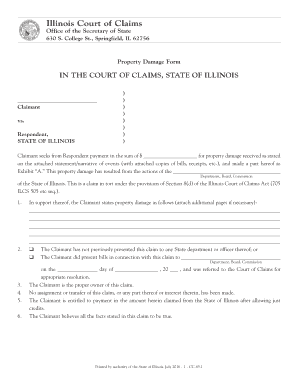

Streamline your business procedures with essential Illinois tax Business Forms. View, access, and modify forms all in one place - improve your precision and transparency with ease.

Improve your file management with the Illinois tax Business Forms online library with ready-made templates that suit your needs. Get your document template, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

The best way to use our Illinois tax Business Forms:

Examine all the possibilities for your online document management with the Illinois tax Business Forms. Get a totally free DocHub account today!