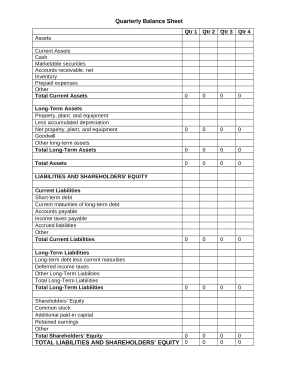

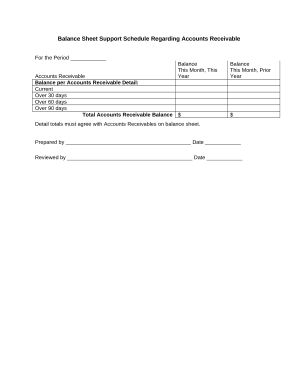

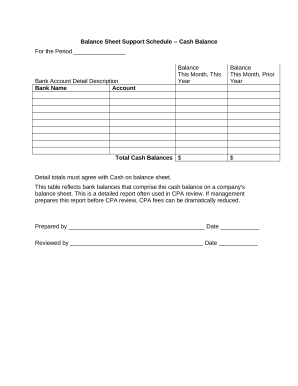

Monitor your Pages Balance Sheet Templates and boost your data accuracy and relevancy. Maintain your business transparency and easily adjust, fill out, and keep your documents in your DocHub account.

Document administration can overpower you when you can’t find all of the documents you need. Luckily, with DocHub's considerable form library, you can get all you need and promptly deal with it without switching among apps. Get our Pages Balance Sheet Templates and begin working with them.

Using our Pages Balance Sheet Templates using these simple steps:

Try out DocHub and browse our Pages Balance Sheet Templates category easily. Get your free account right now!