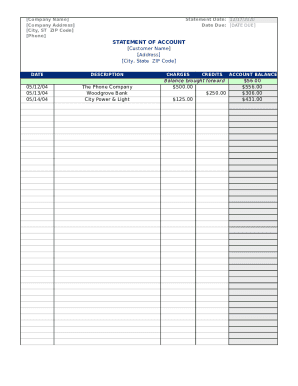

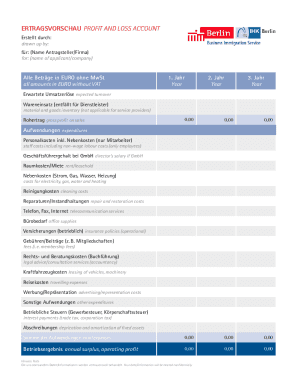

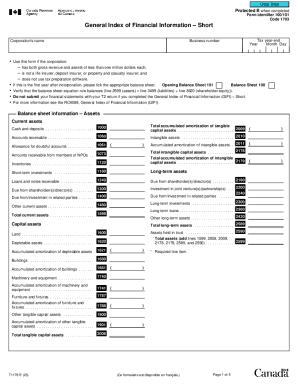

Discover Non-profit organization Balance Sheet Templates and effortlessly organize them online without logging off from your DocHub profile. Adjust and customize your financial statements, distribute them with your collaborators, and safely store complete documents in your profile.

Document management can stress you when you can’t locate all the forms you require. Fortunately, with DocHub's vast form collection, you can discover everything you need and promptly take care of it without changing between software. Get our Non-profit organization Balance Sheet Templates and begin working with them.

Using our Non-profit organization Balance Sheet Templates using these easy steps:

Try out DocHub and browse our Non-profit organization Balance Sheet Templates category easily. Get a free profile right now!