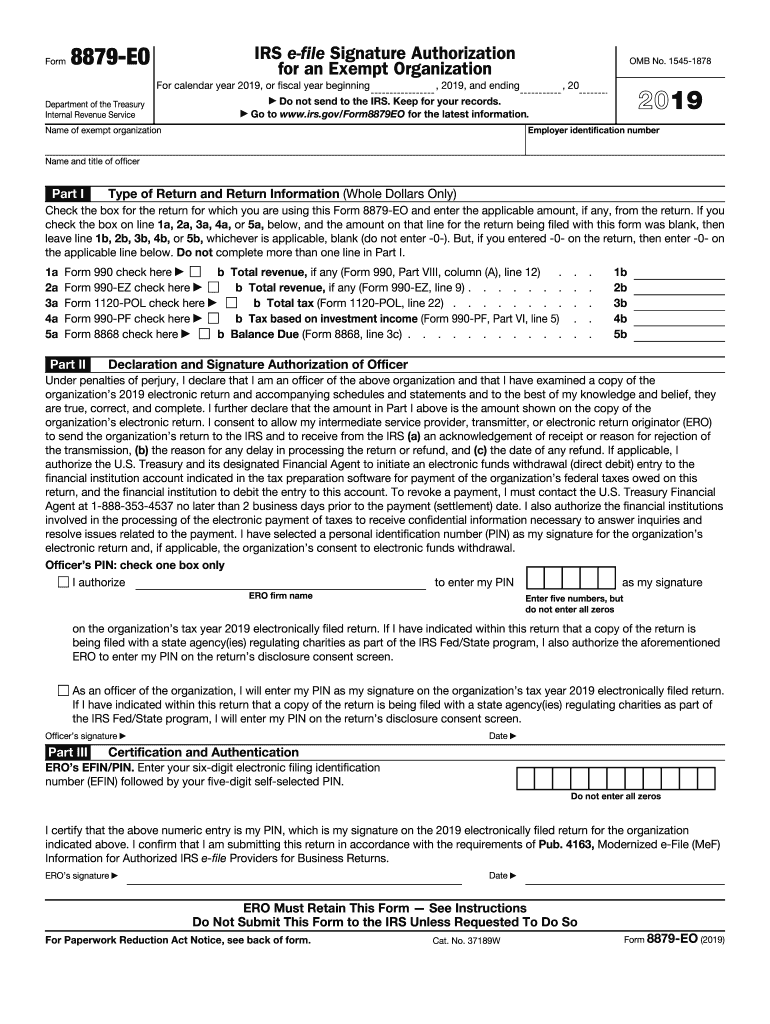

Definition and Meaning of Form 8879-EO

Form 8879-EO is an essential IRS document that allows officers of tax-exempt organizations to electronically sign their tax returns. This form serves as a declaration that the information provided on the return is accurate and complete to the best of the signer's knowledge. The key purpose of Form 8879-EO is to simplify the filing process for exempt organizations, enabling a smooth electronic submission while adhering to regulatory requirements.

The form includes specific sections that cover vital return information, an officer's declaration regarding the return's accuracy, and the roles and responsibilities of both the officer and the electronic return originator (ERO). Importantly, Form 8879-EO must be retained by the ERO and is not submitted to the IRS unless expressly requested, making it crucial for compliance and record-keeping.

Process of Using Form 8879-EO

The use of Form 8879-EO is straightforward, but it involves a few critical steps to ensure compliance. Here's a general procedure for using the form:

- Access the Form: Download Form 8879-EO from the IRS website or obtain it via your accounting software.

- Complete Tax Return: Before signing the form, ensure that all necessary information is filled out in the tax return for the exempt organization.

- Review Confirmation: The officer must review the completed tax return for accuracy and completeness.

- Complete Form 8879-EO: Fill in the required sections of Form 8879-EO, which includes officer information and a declaration of correctness.

- Electronic Signature: The officer electronically signs the form using a secure Personal Identification Number (PIN). This step verifies the identity of the signer.

- Retention: The ERO must retain the signed form as proof of authorization and for compliance with IRS regulations.

Using Form 8879-EO streamlines the electronic filing process, ensuring that exempt organizations can meet their tax obligations in an efficient manner.

Steps to Complete Form 8879-EO

Completing Form 8879-EO involves specific steps to ensure it is filled out correctly. Here are the detailed steps:

-

Obtain Necessary Information:

- Identify the organization name, employer identification number (EIN), and tax year for which the return is filed.

-

Fill in Return Information:

- Enter the total income, total deductions, and other critical financial metrics of the exempt organization as they appear on the tax return.

-

Officer Declaration:

- The officer must declare that the return information is true and accurate. This section includes a statement of understanding concerning the responsibilities involved in the filing process.

-

Officer's Signature & PIN:

- The officer provides an electronic signature through the input of a Personal Identification Number. This PIN must be kept confidential and is a crucial security feature.

-

Finalize and Submit:

- After ensuring all information is complete, the ERO submits the electronic return to the IRS, retaining the signed Form 8879-EO in their records.

These steps help ensure compliance with IRS guidelines while enabling tax-exempt organizations to fulfill their filing responsibilities efficiently.

Who Typically Uses Form 8879-EO

Form 8879-EO is primarily utilized by organizations that have received tax-exempt status under the Internal Revenue Code. The following groups typically use this form:

- Nonprofit Organizations: Many nonprofit entities, including charities and foundations, utilize Form 8879-EO to file tax returns.

- Social Welfare Organizations: Groups classified under Section 501(c)(4) often need to submit Form 8879-EO as part of their tax-filing process.

- Trade Associations: Industry-related associations that have obtained tax-exempt status also use this form when submitting their returns.

The versatility of Form 8879-EO in serving various exempt organizations ensures that these groups can efficiently manage their compliance requirements.

Legal Use of Form 8879-EO

Form 8879-EO is legally recognized under the guidelines set forth by the IRS for electronic filing of tax returns. Its legal use includes several crucial aspects:

- Compliance with IRS Rules: The form serves as an affirmation that the signer understands and meets the responsibilities tied to submitting the tax return electronically.

- Record Keeping: Form 8879-EO must be retained by the ERO for a minimum of three years, as required by IRS regulations, providing a legal safeguard in the event of an audit.

- Legally Binding: An electronic signature on the form is considered legally binding, comparable to a handwritten signature, which ensures that the individual accepting responsibility for the return is fully accountable for its accuracy.

The legal framework surrounding Form 8879-EO bolsters the integrity of electronic tax submissions, enhancing both accountability and transparency for exempt organizations.

Important Terms Related to Form 8879-EO

Understanding key terminology related to Form 8879-EO can clarify its relevance and usage. Below are essential terms:

- Electronic Return Originator (ERO): This is an individual or entity that initiates the electronic submission of tax returns on behalf of taxpayers. EROs are often accountants or tax professionals.

- Personal Identification Number (PIN): This serves as a secure authentication method for electronic signatures, ensuring that only authorized personnel can sign the return electronically.

- Tax-Exempt Status: Refers to the designation granted by the IRS that exempts qualifying organizations from paying federal income tax.

Familiarity with these terms aids in navigating the complexities associated with Form 8879-EO, and ensures compliance within the regulatory framework.

Filing Deadlines for Form 8879-EO

Filing deadlines are critical in the context of Form 8879-EO as they dictate when tax returns must be submitted to the IRS. Generally, the deadlines are:

- Annual Return Filing: Most tax-exempt organizations must file their annual returns by May 15th or the 15th day of the fifth month after the end of their fiscal year.

- Extensions: Organizations can apply for a six-month extension by submitting Form 8868. However, Form 8879-EO must still be signed by the original due date for the extension to be valid.

Organizations must pay close attention to these deadlines to avoid penalties and maintain their good standing with the IRS. Failure to file timely can result in automatic penalties and jeopardize tax-exempt status.

Required Documents for Form 8879-EO

To complete Form 8879-EO effectively, certain supporting documents are necessary. Key documents include:

- Previous Tax Returns: Access to the organization’s prior year's tax returns can help in accurately completing the current year’s form.

- Financial Statements: Recent balance sheets and income statements are needed to substantiate the financial figures reported on the tax return.

- 501(c)(3) or 501(c)(4) Determination Letter: This is the official letter received from the IRS confirming the organization’s tax-exempt status, which is crucial for validation.

- Identification of the Organization's Officers: Information about the individuals authorized to sign, including names, addresses, and positions within the organization, should be readily available.

Having these documents prepared can significantly streamline the process of completing Form 8879-EO, ensuring accurate and compliant submissions.