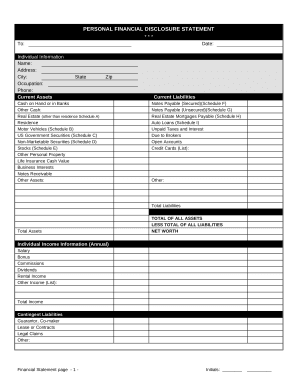

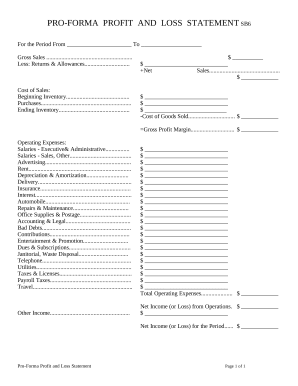

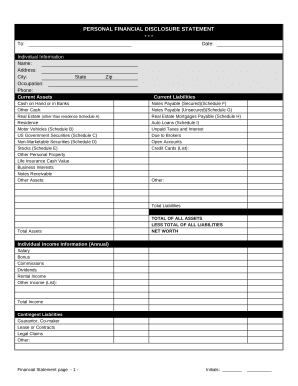

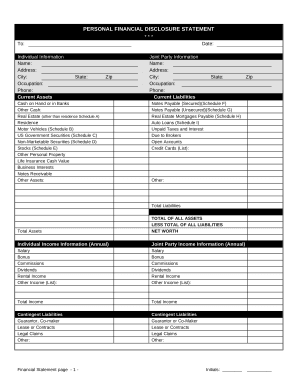

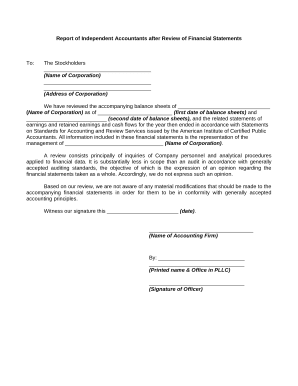

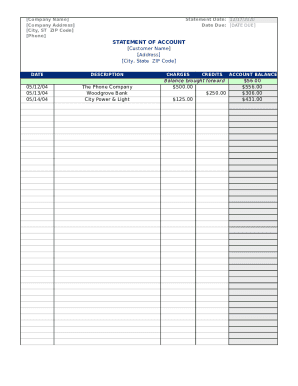

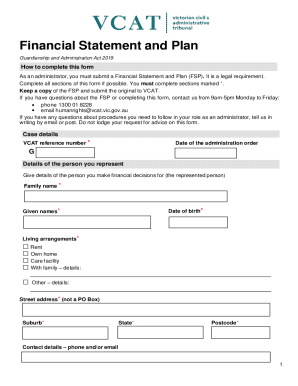

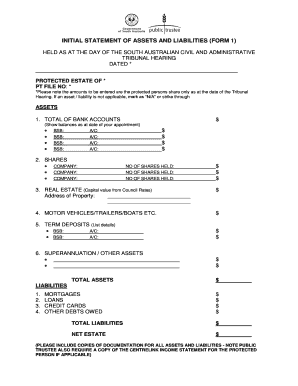

Gain all the right capabilities when managing Income statement statement of cash flows Balance Sheet Templates and enhance your efficiency. Adjust and handle your balance sheets online with a free DocHub account.

Your workflows always benefit when you are able to obtain all the forms and documents you will need at your fingertips. DocHub provides a vast array of templates to alleviate your everyday pains. Get a hold of Income statement statement of cash flows Balance Sheet Templates category and quickly find your form.

Start working with Income statement statement of cash flows Balance Sheet Templates in several clicks:

Enjoy smooth document managing with DocHub. Discover our Income statement statement of cash flows Balance Sheet Templates category and find your form right now!