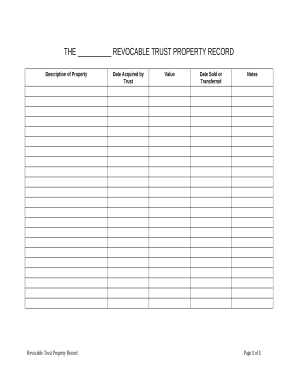

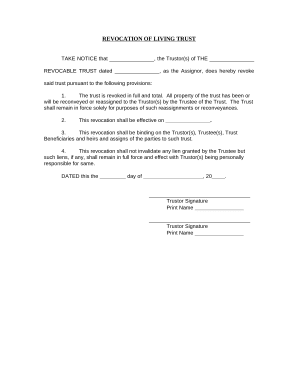

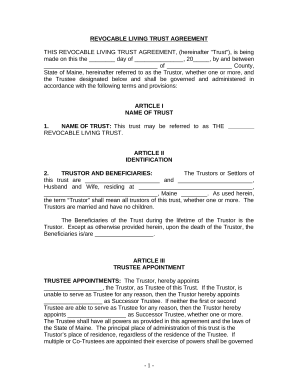

Preview and obtain Family trust Balance Sheet Templates to ensure the precision and transparency of your financial statements. The DocHub online catalog offers numerous ready-made modifiable templates.

Papers administration consumes to half of your office hours. With DocHub, you can easily reclaim your time and increase your team's productivity. Get Family trust Balance Sheet Templates collection and explore all templates related to your day-to-day workflows.

Effortlessly use Family trust Balance Sheet Templates:

Accelerate your day-to-day document administration using our Family trust Balance Sheet Templates. Get your free DocHub account right now to explore all forms.