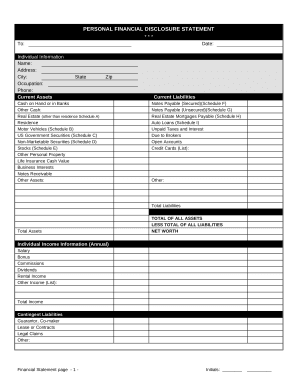

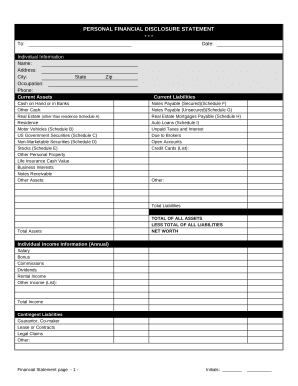

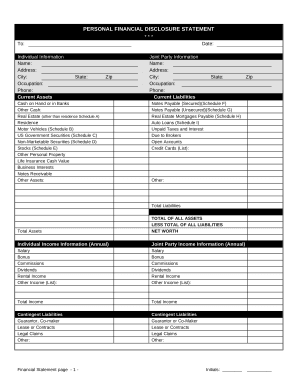

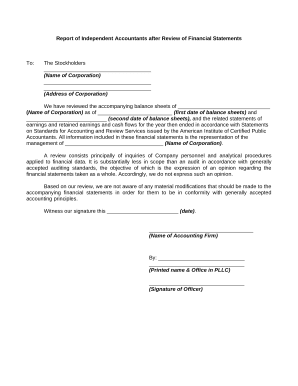

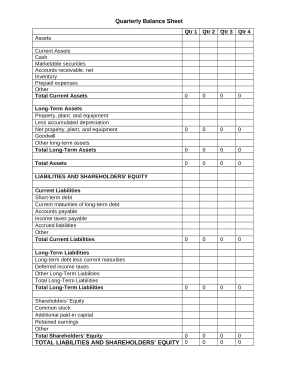

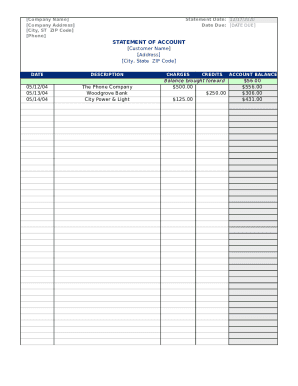

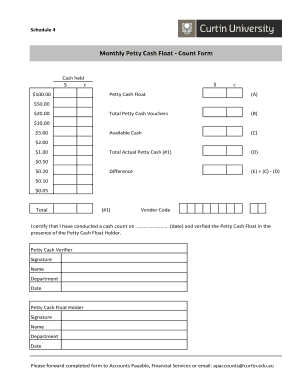

Discover Cash flow Balance Sheet Templates and effortlessly organize them online without logging off from your DocHub profile. Adjust and tailor your financial statements, share them with your collaborators, and securely store finished documents in your account.

Boost your document management with the Cash flow Balance Sheet Templates online library with ready-made document templates that suit your requirements. Get the document, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively together with your documents.

The best way to use our Cash flow Balance Sheet Templates:

Explore all of the possibilities for your online document management with our Cash flow Balance Sheet Templates. Get a totally free DocHub profile right now!