Explore dozens of customizable and no-cost Death benefit Application Forms with DocHub. Adjust, fill, and invite other contributors to collaborate on your application documents in real-time.

Papers administration takes up to half of your business hours. With DocHub, you can reclaim your time and effort and boost your team's efficiency. Get Death benefit Application Forms online library and investigate all document templates relevant to your everyday workflows.

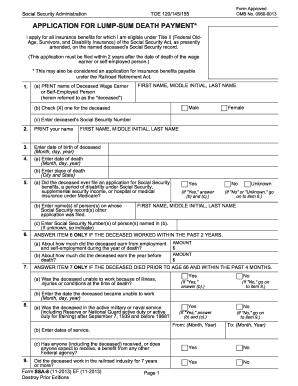

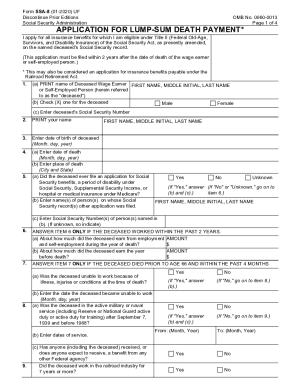

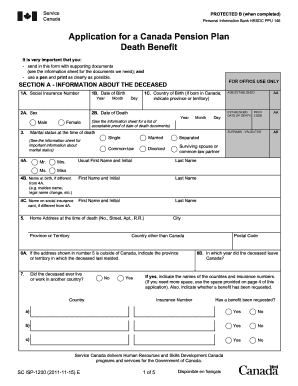

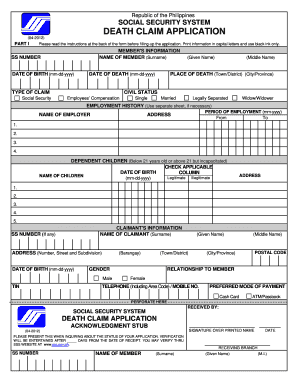

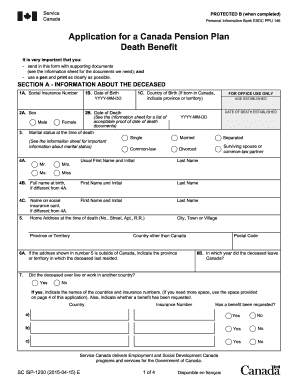

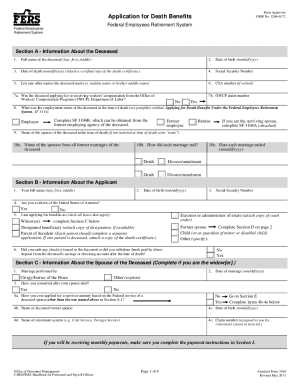

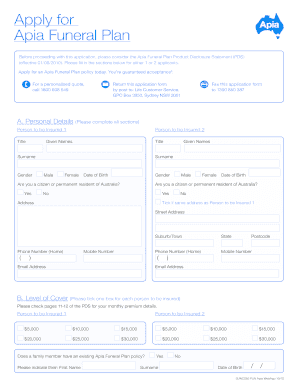

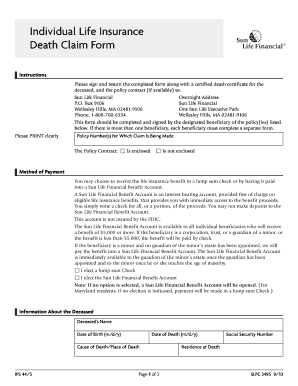

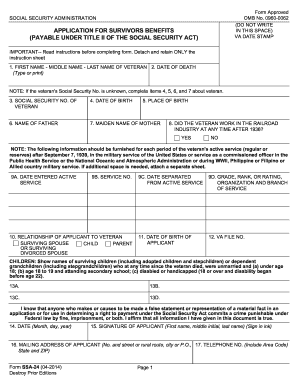

Easily use Death benefit Application Forms:

Boost your everyday document administration with the Death benefit Application Forms. Get your free DocHub account today to explore all templates.