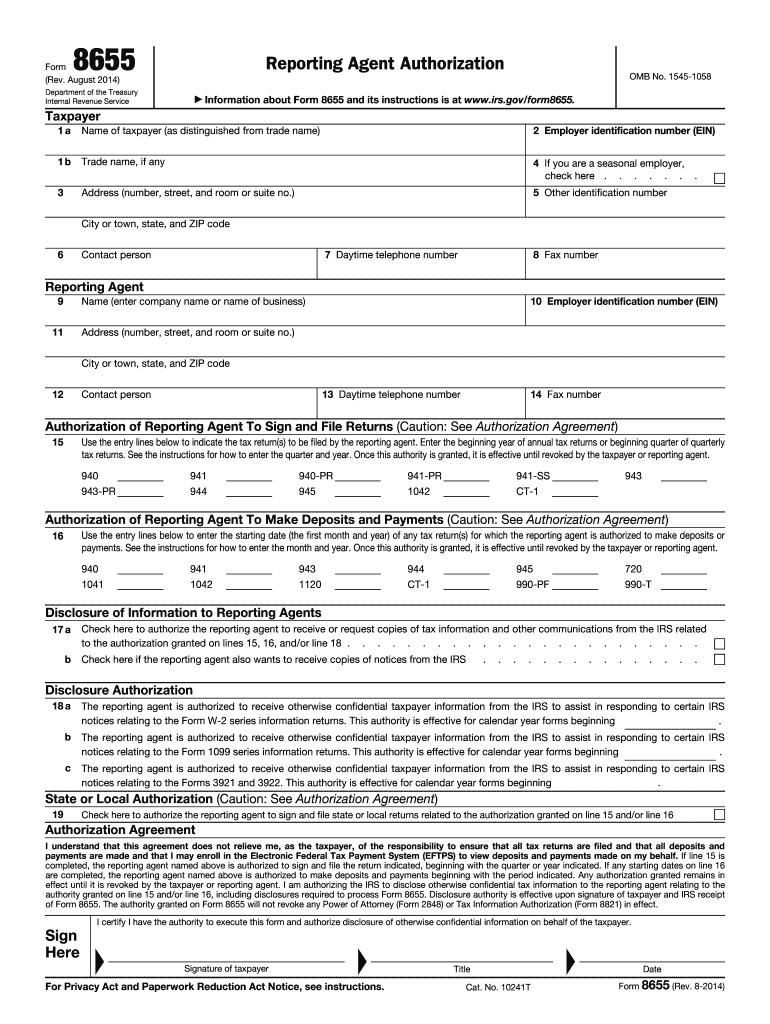

Definition and Purpose of Form 8655

Form 8655, also known as the "Reporting Agent Authorization," is a crucial document used by taxpayers in the United States. Its primary function is to authorize a reporting agent to act on behalf of the taxpayer with respect to certain tax matters. This authorization allows the designated agent to file tax returns, make payments, and obtain confidential tax information directly from the IRS. The form outlines the roles and responsibilities of both the taxpayer and the reporting agent, establishing a legal framework for the agent's actions. The authorization remains effective until the taxpayer revokes it, ensuring that the agent can manage ongoing tax responsibilities without needing frequent reauthorization.

- The taxpayer maintains ultimate responsibility for any taxes due.

- The reporting agent must adhere to compliance obligations as outlined by the IRS.

Steps to Complete Form 8655

Completing Form 8655 requires several steps to ensure that the authorization is valid and properly submitted. Here’s a detailed guide on how to fill out the form:

-

Obtain the Form:

- You can download Form 8655 from the IRS website or obtain it from a tax professional.

-

Provide Taxpayer Information:

- Enter the name, address, and Employer Identification Number (EIN) or Social Security Number (SSN) of the taxpayer.

- If applicable, indicate the type of entity (e.g., corporation, partnership).

-

Designate the Reporting Agent:

- Include the agent’s name, address, and the IRS-issued preparer tax identification number (PTIN) if available.

-

Specify Tax Types:

- Clearly state which types of tax the agent is authorized to handle. Common options include employment taxes, excise taxes, or federal tax deposits.

-

Sign and Date the Form:

- The taxpayer must sign and date the authorization. If a corporate entity is involved, the business officer must sign.

-

Submit the Form:

- Send the completed form to the appropriate IRS office, as indicated in the form instructions.

- Accurate completion is essential to avoid processing delays.

Who Typically Uses Form 8655

Form 8655 is generally utilized by a range of taxpayers, including individual business owners, corporations, and partnerships. Here are common scenarios:

- Small Businesses: Many small business owners authorize reporting agents to handle payroll taxes and compliance matters, allowing them to focus on operations.

- Accountants and Tax Professionals: Professionals providing tax preparation services frequently use Form 8655 to represent clients, ensuring accurate filing and payment management.

- Corporations: Larger entities may designate reporting agents to efficiently manage complex tax obligations, reducing the administrative burden on internal staff.

- Non-profit Organizations: Non-profits often rely on reporting agents to ensure compliance with federal tax obligations while focusing on their mission.

Important Terms Related to Form 8655

Understanding key terminology associated with Form 8655 is essential for accurate use and compliance. Some important terms include:

- Reporting Agent: A person or entity authorized to act on behalf of a taxpayer for specific tax matters.

- PTIN (Preparer Tax Identification Number): A unique identifier assigned to tax professionals by the IRS, essential for filing returns on behalf of clients.

- EIN (Employer Identification Number): A federal tax identification number for businesses that is necessary when completing the form.

- Tax Compliance: The adherence to tax laws and regulations by taxpayers and their designated agents.

IRS Guidelines for Form 8655

It is crucial to adhere to IRS guidelines when using Form 8655 to ensure compliance and avoid penalties. Some of the key guidelines include:

-

Signature Requirements: Only the taxpayer or an authorized individual may sign the form. If a corporate officer is signing, their authority must be established.

-

Submission Protocol: Form 8655 should be submitted to the IRS office as indicated in the instructions. Do not send it to the reporting agent.

-

Revocation Procedures: Taxpayers can revoke the authorization at any time by submitting a written notice to the IRS, along with a completed Form 8655 stating the revocation.

-

Updates: If there are changes in the reporting agent’s details, a new Form 8655 must be submitted to maintain accurate records with the IRS.

-

Staying informed about these guidelines will enhance compliance and facilitate smoother communication with the IRS.

Examples of Using Form 8655 in Practice

Practical applications of Form 8655 can help illustrate its importance and functionality. Here are scenarios where this form is beneficial:

- Business Tax Compliance: A small business owner hires a CPA to handle payroll taxes. By completing Form 8655, the CPA can file returns and make tax payments on behalf of the business, ensuring timely compliance.

- Complex Tax Situations: A corporation with multiple entities may designate a reporting agent to streamline filing responsibilities. This ensures that tax returns are efficiently prepared while mitigating the risk of errors or omissions.

- Nonprofit Management: A non-profit organization may rely on a third-party tax professional to manage its tax filings, using Form 8655 to authorize them to represent the organization before the IRS.

These examples highlight the versatility of Form 8655 in various tax scenarios, showcasing its essential role in tax compliance and management.