Definition & Meaning

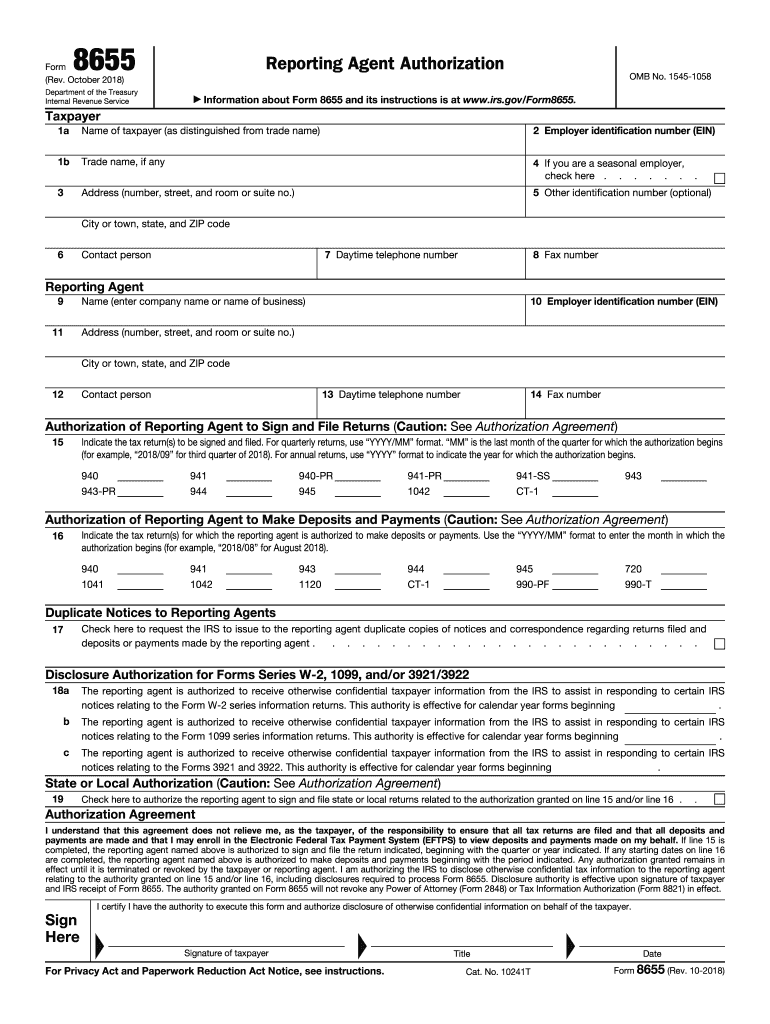

Form 8655, officially titled "Reporting Agent Authorization," is a formal document used primarily by taxpayers within the United States to authorize a reporting agent to handle certain aspects of their tax-related responsibilities. This includes signing and filing specific tax returns, making deposits and payments, and receiving confidential tax information from the Internal Revenue Service (IRS). The form serves as a crucial tool for both individuals and businesses that rely on third-party agents for efficient tax management.

Purpose and Scope

The central purpose of Form 8655 is to streamline tax processes by empowering designated representatives to undertake specified tax tasks on behalf of taxpayers. This authorization is essential for ensuring that all necessary actions are performed accurately and on time. It allows reporting agents access to confidential information, facilitating better tax preparation and filing services. The scope includes electronic filing and payment of taxes, making it a widely used document for businesses and self-employed individuals seeking professional assistance.

How to Use the Form 8655

Form 8655 serves as a written consent by a taxpayer to authorize a third party, known as a reporting agent, to perform specific functions regarding tax filings and communications with the IRS. For efficient use, taxpayers must fill out the form entirely and accurately, specifying the tasks the agent is authorized to perform. This can include filing payroll tax returns, making federal tax deposits, and communicating with the IRS on the taxpayer’s behalf.

Step-by-Step Usage Procedure

-

Select a Qualified Reporting Agent: Ensure that the chosen agent is reputable and experienced in handling IRS matters.

-

Fill Out the Taxpayer Section: This section requires personal or business information, such as the name, address, and Employer Identification Number (EIN) of the taxpayer.

-

Define Authorization: Clearly specify which tax matters are included in the authorization, such as specific forms and tax periods.

-

Agent Information: Provide detailed information about the reporting agent, including their name, address, and contact details.

-

Authorization and Signature: The taxpayer must sign the form to validate the authorization. Without a signature, the form is not considered legally binding.

-

IRS Submission: The completed form must be submitted to the IRS as per the specified method for it to take effect.

Electronic vs. Paper Submissions

Currently, Form 8655 can be filed both online and by mail. Electronic submission is often preferred for faster processing and acknowledgment from the IRS. Nevertheless, mailing a physical copy is a viable option, especially for those who prefer traditional methods or require a paper trail.

Steps to Complete the Form 8655

Completing Form 8655 effectively involves attention to detail and a methodical approach. Each section of the form requires specific information to ensure successful authorization.

Detailed Instructions for Completion

-

Taxpayer Information: Provide complete details as requested, including legal name, address, and Employer Identification Number (EIN).

-

Tax Form Numbers: Enter the form numbers for which authorization is granted. This clarifies the extent of authorization.

-

Reporting Agent's Authority: Clearly outline the actions the agent is permitted to perform. This may include filing returns, making payments, and communicating with the IRS.

-

Duration of Authorization: While the form often grants ongoing authorization, it’s critical to specify any time limitations if the authorization is meant to be temporary.

-

Sign and Date: Both the taxpayer and the agent must sign and date the form. This is crucial as unsigned forms are invalid.

-

Duplicate Copies: Keep a copy for your records and one for the reporting agent. This ensures both parties have the necessary documentation.

Why Should You Use Form 8655

Utilizing Form 8655 provides significant advantages, especially for businesses or individuals who engage in extensive tax operations. The primary benefit is delegating tax responsibilities to specialists, ensuring accuracy and compliance.

Practical Benefits

-

Efficiency: Delegating tasks to a reporting agent allows taxpayers to focus on their core activities without the constant burden of tax administration.

-

Expertise: Reporting agents typically possess extensive knowledge of IRS regulations, enhancing the accuracy of tax filings and payments.

-

Time-saving: The form expedites processing by allowing seasoned professionals to handle submissions, reducing the overall time spent on tax matters.

Important Terms Related to Form 8655

Understanding terms associated with Form 8655 is essential for both taxpayers and reporting agents. This knowledge ensures proper utilization and compliance.

Key Terminology

-

Reporting Agent: A third-party authorized to perform specified tax-related tasks on behalf of the taxpayer.

-

Employer Identification Number (EIN): A unique number assigned by the IRS to businesses operating in the United States for tax purposes.

-

Authorization: The formal permission granted by the taxpayer to the agent to act on their behalf regarding specified tax matters.

-

Confidential Tax Information: Sensitive data regarding an individual’s or entity’s tax situation, which the IRS safeguards against unauthorized access.

Legal Use of the Form 8655

The use of Form 8655 confers legally binding authority upon a reporting agent to act on behalf of the taxpayer. This legal empowerment aligns with IRS regulations and demands strict adherence to the provided authorizations.

Compliance Requirements

-

Accuracy: Ensure all information provided on the form is accurate to avoid processing delays or disputes with the IRS.

-

Revocation: Taxpayers retain the right to revoke authorization at any time, and directions for doing so are included in the form's instructions.

-

Confidentiality: Authorized agents must comply with all privacy laws and regulations, maintaining confidentiality of the taxpayer’s sensitive information.

Key Elements of the Form 8655

Several fundamental components make up Form 8655, each serving a specific role in the authorization process. Understanding these elements is crucial for effective use.

Principal Components

-

Taxpayer and Agent Identification: Ensures both parties are correctly identified, preventing misallocation of responsibilities or errors in processing.

-

Authorization Details: Specifies the various tasks the agent is authorized to handle, such as filing different types of returns or communicating on the taxpayer's behalf.

-

Signature Requirement: The form must include the signature of the taxpayer to be valid. This serves as a legal acknowledgment of the authorization granted to the agent.

IRS Guidelines

The IRS provides specific guidelines for the correct use of Form 8655. Compliance with these guidelines maximizes the form's effectiveness and prevents legal discrepancies.

Navigating IRS Instructions

-

Precise Completion: Follow IRS instructions precisely when filling out the form to avoid errors or omissions that could invalidate the document.

-

Timelines: Adhere to any deadlines established by the IRS for the submission and processing of Form 8655.

-

Updates and Changes: Stay informed about any changes in IRS policies or procedures regarding reporting agent authorizations, as these may impact how Form 8655 is processed.

Understanding these aspects of Form 8655 ensures its effective use, allowing taxpayers to leverage professional expertise while maintaining compliance with IRS regulations.