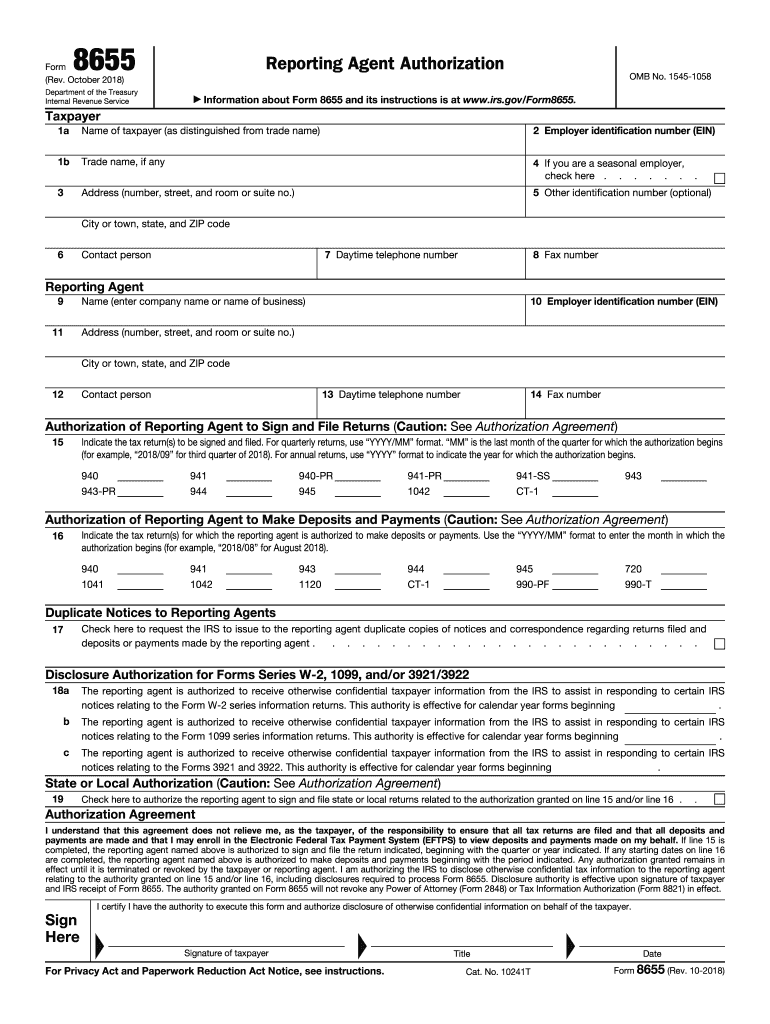

Definition and Purpose of Form 8655

Form 8655 is an official IRS document known as the "Reporting Agent Authorization" form. This form allows taxpayers to designate a reporting agent to handle specific tax responsibilities on their behalf. The primary purpose of Form 8655 is to give permission to the designated reporting agent to sign and file certain tax returns, make payments, and access confidential taxpayer information from the IRS. This delegation is particularly important for businesses or individuals who wish to simplify their tax processes by allowing a trusted third party to manage their tax-related tasks.

Understanding the responsibilities outlined in Form 8655 is crucial for both taxpayers and reporting agents. The form explicitly details the duties of the reporting agent, which include ensuring timely filing of tax documents and compliance with IRS regulations. Additionally, Form 8655 stipulates that the electronic filing of returns is mandatory when utilizing the reporting agent's services. Clarity in these responsibilities helps prevent misunderstandings and ensures compliance with tax obligations.

How to Use Form 8655

Using Form 8655 involves several key steps, allowing taxpayers to effectively assign their tax-related responsibilities to a reporting agent.

-

Obtain the Form: Taxpayers can download Form 8655 from the IRS website or other authorized sources. It's also available as a fillable PDF, making it easier to complete electronically.

-

Fill Out the Form: The taxpayer must provide essential information, including their name, address, taxpayer identification number (TIN), and the name and TIN of the reporting agent. Additionally, the form requires specifying which types of tax returns the agent is authorized to file.

-

Sign and Date: The form must be signed by the taxpayer, affirming the designation of the reporting agent. The date of the signature must also be included to validate the authorization period.

-

Submit the Form: Once completed and signed, Form 8655 must be submitted to the IRS and properly retained by both the taxpayer and the reporting agent for their records.

-

Confirm Authorization: It’s advisable for the taxpayer to confirm with the reporting agent that they have received the authorization and that there are no issues with the submission.

Important Terms Related to Form 8655

Several important terms are associated with Form 8655, which are crucial for understanding its implications and functionality:

-

Reporting Agent: A third party authorized to handle specific tax-related tasks on behalf of a taxpayer, including filing tax returns and making payments.

-

Taxpayer Identification Number (TIN): A unique number assigned to taxpayers, which is required to complete the form accurately.

-

Electronic Filing: The process of submitting tax returns online, which is mandatory when a reporting agent is involved.

-

Confidential Taxpayer Information: Sensitive data that the IRS protects; Form 8655 allows the reporting agent access to certain information as stipulated by the taxpayer.

-

Authorization: The official consent given by the taxpayer to the reporting agent, empowering them to perform specific tax functions on their behalf.

Understanding these terms can enhance both the taxpayer's and reporting agent's compliance and efficacy in using Form 8655.

Steps to Complete Form 8655

Completing Form 8655 requires careful attention to detail to ensure accuracy and validity. Here are the structured steps involved:

-

Download or Access the Form: Secure a copy of Form 8655, either by downloading it from the IRS website or through tax software that includes IRS forms.

-

Fill in the Taxpayer Information: Input the taxpayer's full name, address, and TIN in the designated sections. Accuracy in this information is essential to avoid processing delays.

-

Designate a Reporting Agent: Provide the name and address of the reporting agent. Ensure that their TIN is also included to validate the agent's identity with the IRS.

-

Select Tax Filing Options: Indicate which specific tax responsibilities the reporting agent is authorized to handle. This may include income tax returns or employment taxes.

-

Provide a Signature: The taxpayer must sign and date the form, confirming their authorization of the reporting agent.

-

Review the Form: Conduct a thorough check for any errors or omissions. Ensure that all fields are appropriately filled in before submission.

-

Submit the Form: Send the completed Form 8655 to the IRS, and ensure both the taxpayer and reporting agent maintain copies for their records.

Following these steps helps in ensuring that Form 8655 is processed correctly and expedites the reporting agent's ability to manage their tax responsibilities.

Who Typically Uses Form 8655

Form 8655 serves various taxpayer groups who find it advantageous to designate reporting agents for tax purposes:

-

Businesses: Companies, especially small and medium-sized enterprises, often appoint reporting agents to manage tax compliance efficiently. This allows business owners to focus on operations rather than tax filing.

-

Self-Employed Individuals: Freelancers and independent contractors may use Form 8655 to authorize a reporting agent to handle their tax obligations, ensuring that filings are accurate and timely.

-

Tax Professionals: CPAs and enrolled agents regularly use this form to represent their clients in tax matters. Their expertise facilitates better compliance and utilization of tax benefits.

-

Nonprofit Organizations: These entities often seek to ease their administrative burdens by designating reporting agents to handle their tax filings, ensuring adherence to strict nonprofit tax regulations.

Form 8655 thus applies broadly across various sectors, providing flexibility and efficiency in managing tax responsibilities.