Definition and Meaning of IT-203 C

The IT-203 C is a specific form used by nonresidents and part-year residents of New York State to report income earned within the state for tax purposes. It helps these individuals accurately calculate their tax liability based on their residency status and the income earned during their time in New York.

This form is particularly significant as it allows users to ensure compliance with state tax laws while receiving credits or refunds for taxes withheld. The IT-203 C is tailored to address the unique tax situations faced by individuals who do not meet the criteria of full-year residents, making it essential for proper tax reporting in New York.

How to Use the IT-203 C

Using the IT-203 C involves several crucial steps to ensure accurate reporting. Here's a practical approach:

- Obtain the Form: You can download the IT-203 C from the New York State Department of Taxation and Finance website or request a physical copy if preferred.

- Gather Required Information: Collect all necessary financial documentation, including W-2s, 1099 forms, and other proof of income to report.

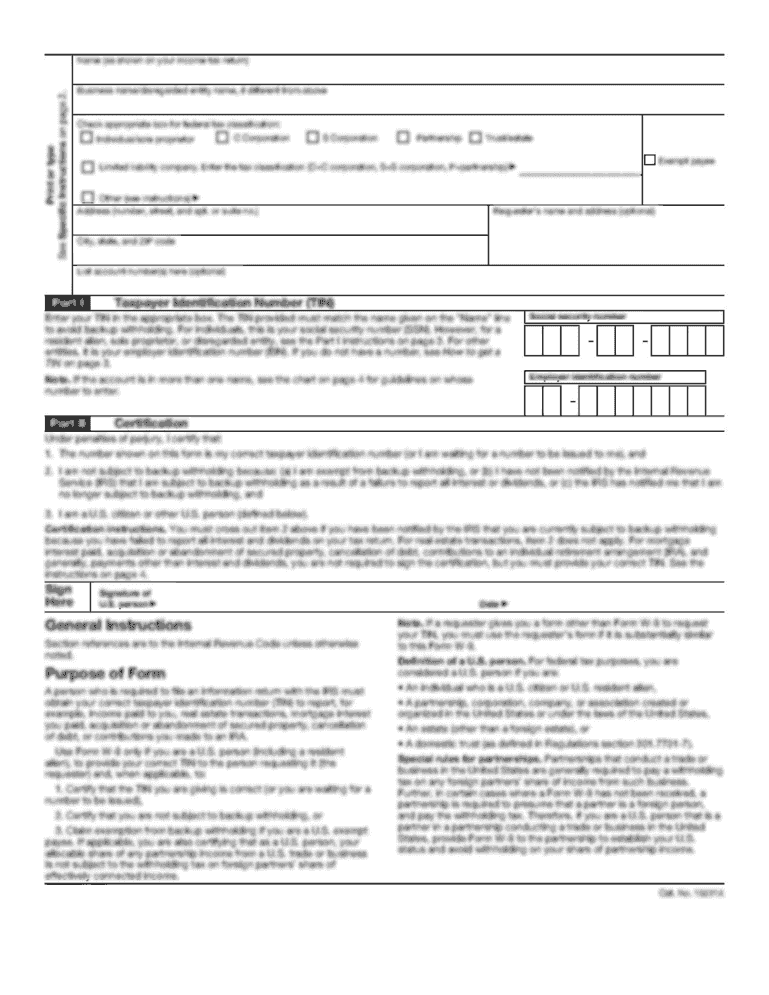

- Complete Personal Information: Fill out your identifying details, such as name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Report Income: Provide accurate details regarding your New York-source income. This involves listing wages, rental income, or any other earnings that qualify for state taxation.

- Deductions and Credits: Calculate any applicable deductions and tax credits to reduce your tax liability. The IT-203 C provides guidance on what can be claimed for nonresidents.

- Review and Submit: After completing the form, review all entries for accuracy, sign, and ensure it is filed by the deadline.

Understanding these steps helps avoid common pitfalls and ensures compliance with New York tax regulations.

Steps to Complete the IT-203 C

Completing the IT-203 C form can be broken down into manageable steps. This process maximizes accuracy and efficiency.

-

Personal Information Section:

- Fill in your name, address, and contact information.

- Input your SSN or ITIN correctly to avoid processing delays.

-

Income Section:

- Report all sources of income earned in New York State.

- This includes wages, tips, salaries, and other compensations reported on W-2s.

-

Adjustments Section:

- Identify any adjustments to your federal adjusted gross income (AGI) that apply to New York residents.

- This can include specific deductions unique to nonresidents.

-

Calculation of Tax:

- Using the instruction guide, calculate the amount of tax owed based on your taxable income.

- Review the tax rates applicable to nonresidents for accurate calculation.

-

Sign and Date:

- Ensure you sign and date the form before submission.

- An unsigned form may be deemed invalid by the tax authorities.

By following these detailed steps, taxpayers can simplify the completion of the IT-203 C.

Important Terms Related to IT-203 C

Familiarity with certain key terms enhances understanding of the IT-203 C process:

- Nonresident: An individual who does not reside in New York for the entirety of the year but earns income within the state.

- Part-Year Resident: A person who resides in New York for part of the tax year and earns income during that time.

- New York-source Income: Income that is earned from activities or employment conducted in New York State.

- Tax Credits: Amounts that can reduce the tax owed, often based on specific expenses or status.

- Deductions: Expenses that reduce the total income on which tax is calculated.

- Adjusted Gross Income (AGI): Total income reported to the IRS minus specific deductions.

Understanding these terms is essential for effective completion and compliance with the IT-203 C.

Filing Deadlines and Important Dates

Being aware of filing deadlines is essential to avoid penalties and ensure compliance. Key dates for the IT-203 C include:

- Filing Deadline: The IT-203 C form must generally be filed by April 15 for the preceding tax year.

- Extension Requests: If needed, taxpayers may request a six-month extension for filing, which allows additional time until October 15 but allows additional time, provided the extension request is submitted before the original deadline.

- Payment Due Dates: Taxpayers should ensure that any taxes owed are paid by the filing deadline to avoid late fees and interest.

Adhering to these important dates is critical for all taxpayers using the IT-203 C.

Required Documents for IT-203 C

When completing the IT-203 C, certain documents are necessary to ensure accuracy and compliance. Collect these essential items:

- W-2 Forms: Essential for reporting wages, salaries, and tips.

- 1099 Forms: Needed for reporting non-employment income such as freelance work or interest income.

- Proof of Residency: Documents that demonstrate residency status, if applicable.

- Other Income Evidence: Financial records from trusts, pensions, or other sources of income earned in New York.

Gathering all relevant documents ahead of time can streamline the filing process and reduce the likelihood of errors.

Who Typically Uses the IT-203 C

The IT-203 C is commonly used by a variety of individuals. Key users include:

- Nonresident Workers: Individuals living outside New York who work within the state, earning income subject to state taxes.

- Part-Year Residents: Those who moved into or out of New York during the tax year and need to report income based on their residency status.

- Students and Temporary Workers: College students or temporary workers engaged in internships or short-term employment within New York.

Understanding who uses the IT-203 C helps clarify its importance in the broader context of New York State tax compliance.