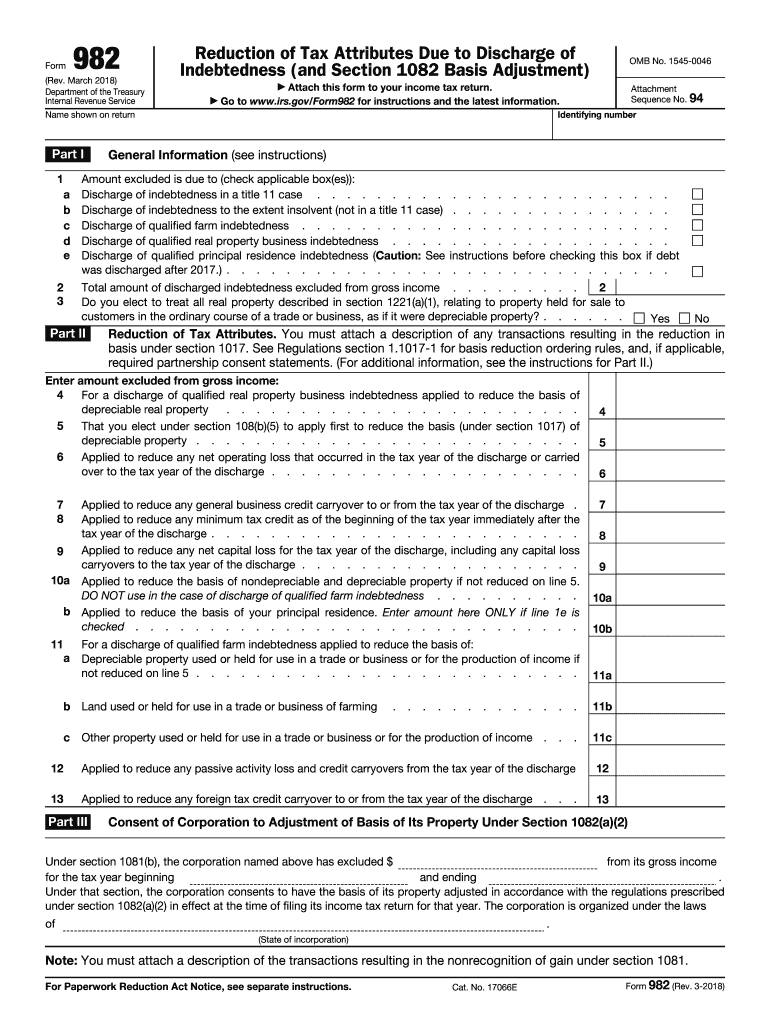

Definition and Purpose of IRS Form 982

IRS Form 982, officially titled "Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment)," is essential for taxpayers to report the reduction of tax attributes following the discharge of indebtedness. This form is primarily used when an individual's or entity's debt is forgiven, canceled, or discharged, a situation that can lead to unexpected tax implications because the forgiven debt can be considered taxable income. Form 982 helps individuals and businesses detail the type and amount of discharged debt and allows them to claim exceptions or exclusions, such as insolvency or qualified principal residence indebtedness, to reduce their taxable income.

Eligibility Criteria for Using IRS Form 982

Understanding whether you need to file IRS Form 982 depends on various factors. Generally, individuals or entities may need to complete this form if they have received any form of debt relief or cancellation during the tax year. Some common scenarios requiring Form 982 include bankruptcies, insolvencies, or cancellations of credit card debts and mortgages. Taxpayers must determine if they qualify for specific exceptions or exclusions, such as:

- Insolvency: If your total liabilities exceed the total fair market value of your assets, you might be able to exclude all or part of the canceled debt under the insolvency exemption.

- Qualified Principal Residence Indebtedness: Formerly discharged mortgage debt related to a primary residence could be excluded.

- Bankruptcy: Debts discharged as part of a bankruptcy case generally can be excluded from income.

Each of these situations examines the circumstances surrounding the debt discharge to determine eligibility for exclusions.

Steps to Complete IRS Form 982

Effectively filling out IRS Form 982 requires attention to detail and a comprehensive understanding of the debt discharge specifics. Here is a step-by-step guide to navigate the form:

- Provide Personal and Contact Information: Begin by filling in your name and identifying number, usually your Social Security Number or Employer Identification Number for businesses.

- Identify the Reason for Filing the Form: Indicate the type of debt discharge and applicable exclusions or exceptions on part I of the form.

- Calculate the Amount of Discharged Debt: Report the total amount of discharged debt that qualifies for exclusion.

- Reduction of Tax Attributes: Use part II to show any applicable reductions in tax attributes, like net operating losses or capital loss carryovers, based on the discharged amount.

- Section 1082 Basis Adjustments: If applicable, in part III, complete the basis adjustments for property you’ve elected to treat as if it had decreased in basis due to the reduction of tax attributes.

Consultation with a tax professional is often recommended to ensure proper completion and adherence to IRS guidelines.

Key Elements of IRS Form 982

Form 982 consists of several critical sections tailored to demonstrate the debt relief details and their tax implications. The main parts are:

- Part I: General Information: This section asks for basic taxpayer information and the event leading to debt cancellation.

- Part II: Reduction of Tax Attributes: Crucial for detailing how the cancellation affects specific tax attributes, such as reducing tax credits or loss carryforwards.

- Part III: Basis Reduction of Qualifying Property: Applicable for those needing to adjust the basis of specific properties due to debt discharge, having further implications for future gains or losses on sales.

Each part is designed to capture detailed financial adjustments and must correlate with the information reported on your tax return.

Examples of Using IRS Form 982

Consider a scenario where an individual, John, has had $50,000 of credit card debt canceled by a creditor. If John's liabilities exceed the fair market value of his assets by $60,000, he qualifies for the insolvency exclusion. By completing Form 982, he reports the $50,000 under the insolvency exclusion, reducing his taxable income accordingly.

Another case involves a small business receiving debt relief from loans. The business must complete Form 982 to report the debt relief and adjust its tax attributes, such as reducing net operating losses.

These examples underscore the importance of this form in managing unexpected tax consequences from debt relief.

Legal Use and Compliance of IRS Form 982

Form 982 must be filed to adhere to the U.S. tax laws, particularly under IRS guidelines concerning canceled debts. Taxpayers aim to establish compliance with Section 108 of the Internal Revenue Code. Proper filing of this form is crucial to avoid the potential understatement of income and subsequent penalties.

Failing to report debt cancellations or incorrectly filing this form can lead to legal ramifications and might trigger IRS audits, fines, or both. Therefore, meticulous completion and adherence to IRS requirements are imperative.

Software Compatibility with IRS Form 982

Filing taxes accurately while ensuring compliance is easier using tax software compatible with IRS Form 982. Programs like TurboTax, H&R Block, and QuickBooks provide features for inputting discharge debt details, automatically populating fields for the form. They offer structured guidance to help taxpayers navigate exemptions applicable to their situations.

Using such tax software can significantly streamline the preparation process, minimizing the risk of errors and ensuring that the appropriate documentation accompanies your federal tax return.

Penalties for Non-Compliance with IRS Form 982

Non-compliance with IRS Form 982 can result in significant fines and penalties. If a taxpayer fails to report discharged debt accurately, they may face penalties associated with underreporting income. The IRS could levy fines, additional taxes, or even criminal charges in cases of willful evasion.

To mitigate these risks, taxpayers should verify the accuracy of their debt discharge information and consult experts when necessary. Understanding and adhering to necessary procedural and documentation requirements can prevent costly penalties and the stress of legal challenges from the IRS.