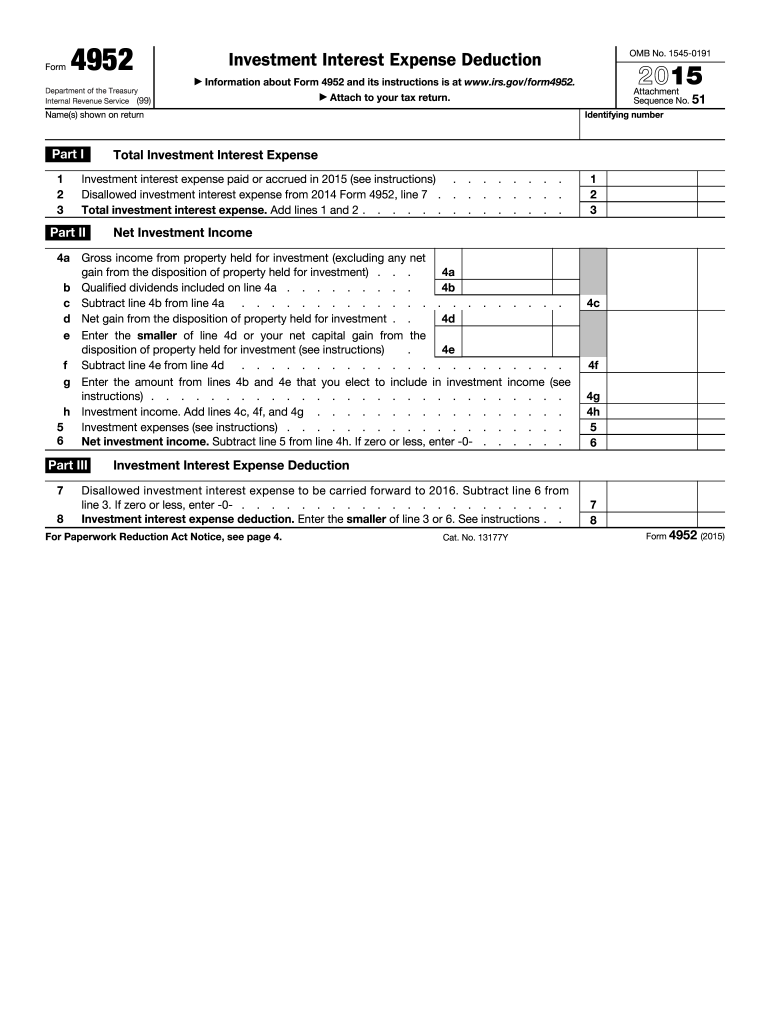

Definition & Purpose of Form 4952

Form 4952 is used by individuals, estates, or trusts to calculate the deductible amount of investment interest expense for the tax year 2015, along with any carryover to future years. This form primarily deals with reporting total investment interest expenses, net investment income, and specific deductions related to investment activities. Its ultimate goal is to determine the deductible investment interest expense that can be claimed on your tax return.

The form involves thorough instructions to report different types of income and expenses associated with investments. Understanding how to utilize these instructions can lead to significant tax efficiency. The key focus is on debt incurred to purchase or carry property held for investment purposes, which generally includes both income-producing assets and appreciable assets.

Steps to Complete the 2015 Form 4952

-

Gather Necessary Documents: Ensure you have all relevant financial statements and reports, including investment account summaries.

-

Calculate Investment Interest Expense: Begin by identifying all investment-related interest expenses incurred during the year.

-

Determine Net Investment Income: Analyze your income sources to identify net investment income, which includes interest, dividends, annuities, and certain gains.

-

Complete Part I - Total Investment Interest Expense: Enter your calculated total investment interest expenses on the form following the guidelines provided in this section.

-

Complete Part II - Net Investment Income: Input your net investment income computed from your financial statements.

-

Calculate Allowable Deduction: Compute the allowable deduction by applying the formulas and limitations provided in the form’s instructions.

-

Determine Carryover Amount: Identify any excess investment interest expenses that can be carried forward to future tax years if the full deduction cannot be utilized within the current year.

Each step requires careful review and accurate data entry based on financial records and specific tax-year parameters.

How to Obtain the 2015 Form 4952

Obtaining the 2015 Form 4952 can be done through several methods:

-

Direct Download from the IRS Website: The form is available for download directly from the IRS website, ensuring you have the most updated version for that tax year.

-

Tax Preparation Software: Platforms like TurboTax or QuickBooks may provide access to historical forms as part of their documentation packages.

-

Professional Tax Services: You may request the form through a certified public accountant or professional tax preparer who has access to archived forms.

-

IRS Office Visit: Obtain the form by visiting a local IRS office, where staff can provide guidance as needed.

Ensuring access to the accurate form version is crucial for compliance and ease of tax filing.

Who Typically Uses the 2015 Form 4952

The 2015 Form 4952 is typically utilized by:

-

Individuals with Investment Interest Expenses: Those who have borrowed funds specifically for acquiring securities or other investment assets.

-

Estates and Trusts: Financial entities managing investment portfolios on behalf of the beneficiaries.

-

High-net-worth Individuals: Often engage in substantial investment activities and may carry forward interest from previous years.

-

Taxpayers with Complex Investment Portfolios: Those with diverse holdings needing accurate reflection of interest expenses in their tax calculations.

Understanding whether you fit into one of these categories helps in determining the form’s utility for your tax needs.

Important Terms Related to 2015 Form 4952

Knowing the essential terminology associated with Form 4952 is crucial for accurate completion:

-

Investment Interest Expense: The interest paid on loans allocable to property held for investment purposes.

-

Net Investment Income: Includes interest, dividends, royalties, and similar investment returns, minus related expenses.

-

Carryover: When investment interest expense exceeds net investment income, the excess can be carried forward.

-

Deduction Limitations: Restrictions on how much of the investment interest expense can be deducted based on net investment income.

Familiarity with these terms is paramount for leveraging the form to your financial benefit.

IRS Guidelines for Form 4952

The IRS provides specific guidelines on how to complete and submit Form 4952:

-

IMods and Updates: Ensure that you are using the correct version relevant to the 2015 tax year, as IRS forms may undergo annual updates.

-

Instruction Manual: Follow the detailed instructions provided by the IRS with the form. This includes examples that illustrate common scenarios.

-

Validation and Compliance: Ensure all figures entered on the form align with your official financial documentation to avoid discrepancies or audits.

Adhering precisely to these guidelines can prevent errors and facilitate smooth interaction with IRS review processes.

Filing Deadlines and Important Dates

Understanding the deadlines associated with Form 4952 is vital:

-

Standard Tax Filing Deadline: Typically April 15th of the following year, unless adjusted for weekends or holidays.

-

Extension Provisions: Taxpayers may file for an extension, usually until October 15th, allowing more time to complete Form 4952 accurately.

-

Amendments: If interest deduction amounts are changed, you may need to file an amended return, using IRS Form 1040X, to adjust previously claimed amounts.

Meeting these deadlines is essential to avoid penalties or interests on taxes owed.

Penalties for Non-Compliance with Form 4952

Failing to accurately file Form 4952 can result in several penalties:

-

Underpayment of Tax Liabilities: If interest deductions are misreported, additional taxes may be owed, along with penalties.

-

Interest on Unpaid Taxes: Accumulates if applicable deductions are claimed incorrectly, resulting in an IRS audit.

-

Revocation of Carryover Benefits: Misreporting might affect the ability to carry over excess interest expenses to future tax years.

Awareness of these potential penalties underscores the importance of meticulous and precise form completion.