Definition and Explanation of Tax Attribute Carryovers for Alaska

Tax attribute carryovers allow taxpayers to defer certain tax benefits from one year to future tax periods. In Alaska, these carryovers can include net operating losses, capital losses, and charitable contributions specific to Alaska state tax regulations. They enable taxpayers to optimize tax liabilities by offsetting future taxable income with past deductions, facilitating tax planning and financial management.

Examples of Tax Attribute Carryovers

-

Net Operating Losses (NOL): If a business has a net operating loss in a given year, this loss can be carried forward to offset taxable income in future years.

-

Capital Losses: Individual taxpayers or businesses can carry forward capital losses to offset future capital gains, thus reducing tax liability.

-

Charitable Contributions: Excessive charitable contributions exceeding the adjusted gross income limits can be carried forward for deduction in future tax periods.

How to Use the Tax Attribute Carryovers in Alaska

To effectively use tax attribute carryovers, taxpayers must accurately enter the carryover amounts in the appropriate sections of their Alaska state tax returns. These carryovers should be reported in detail to ensure they are correctly applied to offset future taxes. It is crucial to maintain comprehensive records of all relevant financial activities to support the carryover claims.

-

Calculate Available Carryovers: Begin with the prior year’s ending balances and apply any utilized portions to the current year.

-

Update Annual Figures: Consistently review and update potential carryover amounts based on annual financial outcomes.

-

File Correctly: Ensure correct entries into the designated sections on the tax forms to avoid discrepancies or errors.

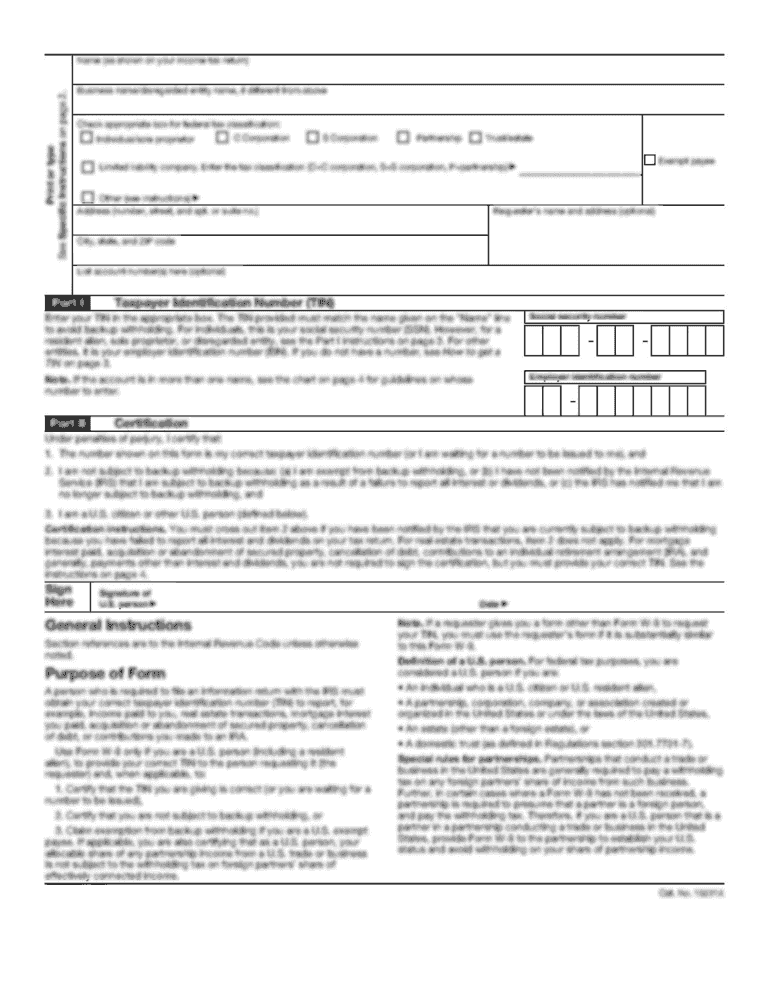

Steps to Complete the Tax Attribute Carryovers Form

Filling out the Tax Attribute Carryovers form in Alaska involves several key steps:

-

Gather Documentation: Compile all relevant financial records, including prior year tax returns and supporting documents showing losses or contributions.

-

Identify Carryover Types: Ascertain the types of carryovers applicable, such as net operating losses or capital losses, and check the eligibility against Alaska’s specific tax rules.

-

Fill Out the Form: Enter all necessary data into the designated fields on Form 6385, ensuring accuracy in calculations for NOL and other carryovers.

-

Review and File: Double-check entries for compliance with Alaska state rules and submit the completed form with your Alaska state tax return.

Legal Use and Compliance

Adhering to legal guidelines when claiming tax attribute carryovers is essential for compliance and avoiding penalties. In Alaska, these carryovers must be documented accurately, with full consideration of state-specific tax policies.

Penalties for Non-Compliance

-

Fines and Penalties: Misreporting or failing to comply with the rules may result in penalties.

-

Revocation of Carryover Benefits: Future use of these tax attributes may be restricted if rules are violated.

Maintaining an accurate, audited trail of all relevant financial documents and careful adherence to legal stipulations is vital to maximizing benefits without incurring legal issues.

Key Elements of the Tax Attribute Carryovers Form

Net Operating Loss Calculations

-

Basis Adjustment: Ensure any adjustments required under state regulations are made to the carryforward NOL.

-

Year Tracking: Taxpayers should track each year’s NOL separately to ensure accuracy in application.

Capital Loss Deduction Limits

-

Annual Reporting: Verify that only allowable portions of capital losses are reported for each applicable tax year.

-

Adjustments for State Rules: Adjust deductions to align state-specific caps and rules that may differ from federal regulations.

State-Specific Rules

Alaska has specific rules for the application of tax attribute carryovers that may differ from federal regulations. Taxpayers must familiarize themselves with these rules to ensure compliance and accurate tax liability estimation.

-

Specific Limits: State-specific limits may apply, which could impact the amount of the carryovers applicable each year.

-

Carryover Periods: Ensure the understanding of permitted carryover periods as they might differ from federally prescribed periods.

Who Typically Uses the Tax Attribute Carryovers in Alaska?

Tax attribute carryovers are utilized by both individuals and businesses situated in Alaska that have experienced financial variabilities, allowing them to optimize future taxable income levels:

-

Small Businesses and Corporations: Leverage net operating losses to offset taxable income.

-

Individual Taxpayers: Utilize capital loss and contribution carryovers to manage annual tax liabilities effectively.

IRS Guidelines and Considerations

Although primarily a state form, it’s important that users of Alaska’s tax attribute carryover options adhere to overarching IRS guidelines that dictate federal tax policies. Comparing and contrasting these alongside Alaska’s rules helps ensure seamless integration and compliance between state and federal tax obligations.

-

Compatibility: Ensure that data entered on Alaska forms aligns with figures used on corresponding IRS documents to avoid discrepancies.

-

Annual Reconciliation: Regularly reconcile state and federal tax claims to ensure comprehensive coverage of liabilities.