Definition & Meaning of the REG-3-MC Form

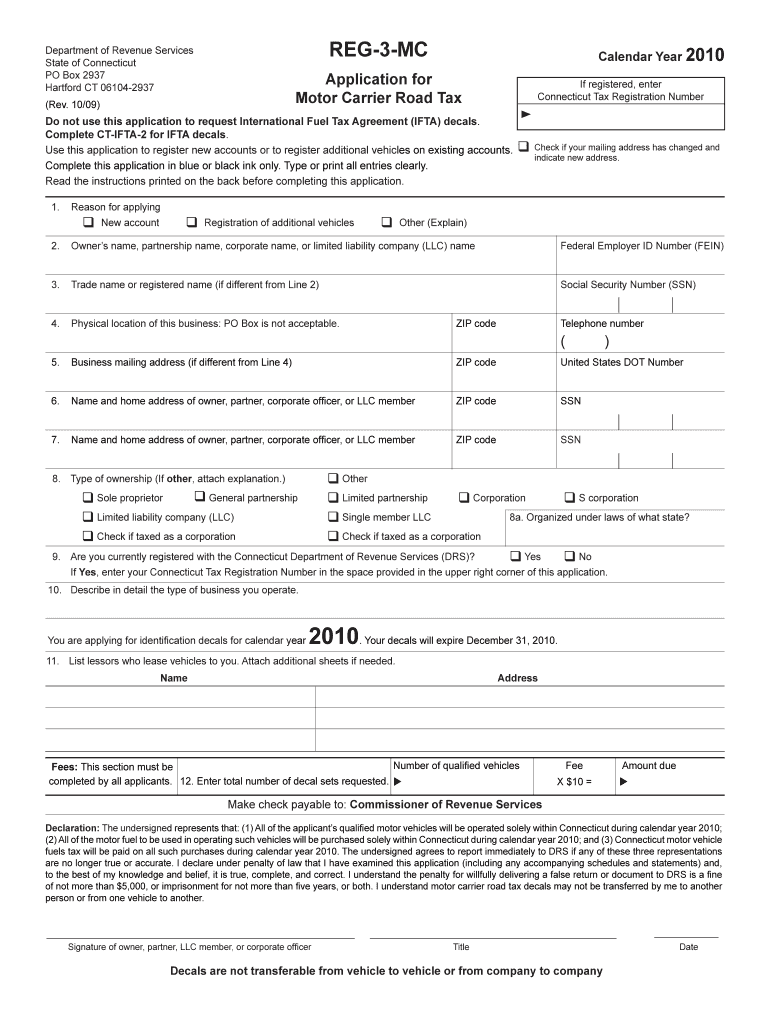

The REG-3-MC form, officially known as the Application for Motor Carrier Road Tax, is a critical document utilized by individuals and businesses engaged in motor carrier operations within the United States. It is primarily issued by the Connecticut Department of Revenue Services. This form is essential for registering new accounts or additional vehicles, enabling carriers to fulfill their tax obligations related to road usage. It encompasses a range of important details, such as vehicle ownership information, business operations, and requests for non-transferable decals that designate tax compliance.

Key Elements of the REG-3-MC Form

-

Ownership Details: Clear identification of the vehicle owner, whether an individual or a corporate entity, is necessary. This includes providing full legal names and contact details.

-

Business Operations Information: Carriers must supply comprehensive descriptions of their business activities, which may include fleet size, types of goods transported, and primary routes frequented.

-

Decal Requests: As part of regulatory compliance, applications require motor carriers to request specific decals that confirm tax payments. These decals must be visibly displayed and are considered non-transferable between vehicles.

Steps to Complete the REG-3-MC Form

-

Gather Required Information: Before starting, collect all relevant documentation, such as vehicle registration papers and company certification of incorporation.

-

Fill Out Ownership Information: Enter details such as the owner’s full name, address, and contact information in the designated sections of the form.

-

Provide Business Operation Details: Clearly specify the nature of the carrier’s operations, types of cargos, and regularly traveled routes.

-

Request Decals: Indicate the number of decals required, making sure they align with the number of vehicles in operation that need to be compliant.

-

Review and Submit: Carefully review the entire form for accuracy and completeness before submitting it through the appropriate method.

How to Obtain the REG-3-MC Form

The REG-3-MC form can be acquired directly from the Connecticut Department of Revenue Services website, where it is available for download. Alternatively, it can often be obtained in person from department offices. Ensure you have the latest version of the form to avoid any compliance issues.

Eligibility Criteria for REG-3-MC Application

Applicants must be involved in motor carrier activities that cross state lines or partake in significant intrastate movements that require tax compliance. Both new carriers and those adding vehicles to an existing fleet are eligible to utilize this form for registration purposes. It is vital that applicants meet the specific requirements set by the Connecticut Department of Revenue Services.

Filing Deadlines & Important Dates

-

Annual Renewal: Carriers must renew their registration annually, with deadlines typically set at the start of the fiscal year.

-

Decal Renewal: Decals need to be renewed simultaneously with the filing of this form to avoid penalties or fines.

-

Updated Vehicle Information: Any changes in vehicle ownership or fleet size should be reported within a stipulated period to maintain compliance.

Legal Use of the REG-3-MC Form

The REG-3-MC form ensures that motor carriers meet their tax obligations and demonstrates compliance with road usage regulations. Proper filing of this document is crucial for legality, allowing vehicles to operate lawfully across different jurisdictions. Incorrect or incomplete submissions may lead to legal challenges or operational suspensions.

Important Terms Related to the REG-3-MC Form

-

Decal: A proof of payment and registration sticker required to be placed on each compliant vehicle.

-

Motor Carrier: An entity that transports goods or passengers via vehicle fleets, subject to state taxation.

-

Intrastate/Interstate Commerce: Refers to transportation activities within a state or between states, respectively, affecting tax liabilities.

Understanding these terms will assist applicants in accurately completing the REG-3-MC and adhering to regulatory standards.