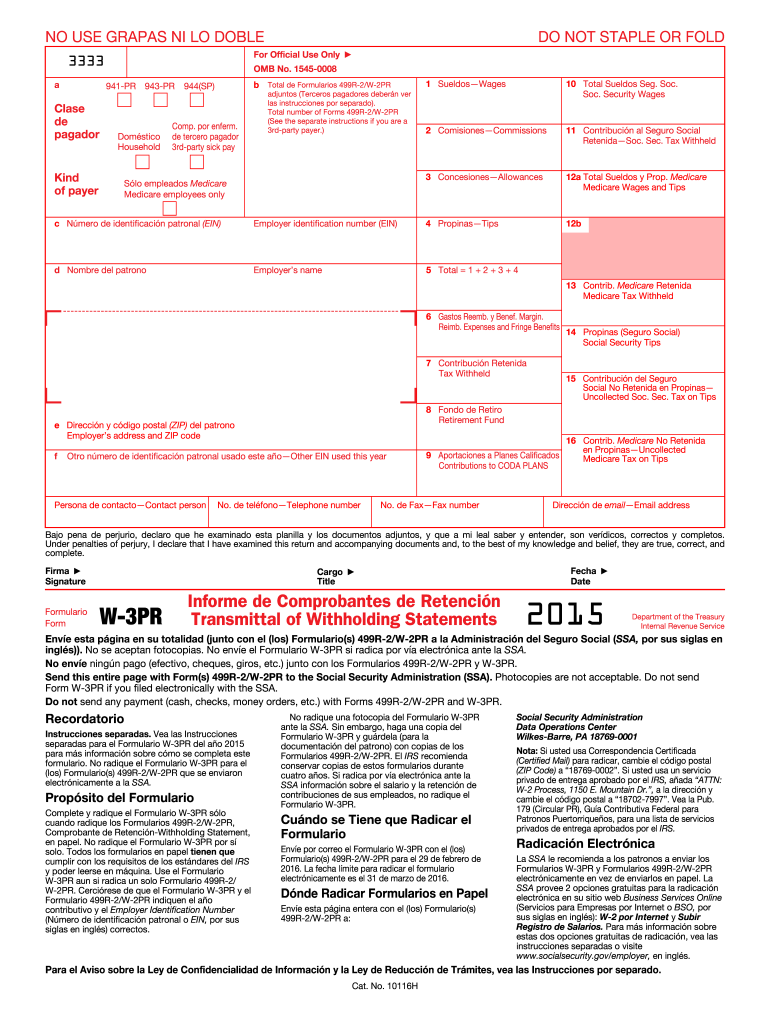

Definition & Significance of the 2015 W-3PR Form

The 2015 W-3PR form is an important document used by employers in Puerto Rico when submitting employee wage and tax information to the Social Security Administration (SSA). It serves as a summary of the accompanying W-2 forms and provides a record of income paid to employees as well as the taxes withheld throughout the year. Understanding the purpose of the W-3PR is essential for ensuring compliance with tax regulations and proper reporting of income.

Key aspects of the W-3PR form include:

- Summary Reporting: It summarizes the total wages paid and taxes withheld as reported on individual W-2 forms.

- Employee Count: The form includes a count of employees for whom W-2 forms were filed, thereby aiding the SSA in maintaining accurate records.

- Compliance: Filing the W-3PR ensures that employers meet their tax obligations, preventing potential penalties from incorrect submissions.

Steps to Complete the 2015 W-3PR Form

Completing the 2015 W-3PR form requires meticulous attention to ensure all necessary information is correctly entered. Each section of the form must be filled out according to the guidelines provided by the SSA.

- Gather Employee Information: Collect all W-2 forms for the applicable year. Review each for accuracy regarding employee names, Social Security numbers, and wages reported.

- Complete Employer Information:

- Enter the employer's name, address, and Employer Identification Number (EIN).

- Indicate the total number of forms submitted.

- Fill Out Wage and Tax Information:

- Total wages, tips, and other compensation paid to employees must be accurately reported.

- Total taxes withheld, including Medicare and Social Security taxes, must also be included.

- Sign and Date: The form must be signed by an authorized individual from the company, indicating the information is validated.

How to Obtain the 2015 W-3PR Form

Obtaining the 2015 W-3PR form can be accomplished through several channels. The options include:

- IRS Website: The IRS has made various forms, including the W-3PR, available for download on its official website. For employers located in Puerto Rico, the form can typically be accessed in the relevant section dedicated to forms and publications.

- Local IRS Office: Employers can also obtain copies of the form by visiting local IRS offices. Staff can provide assistance and ensure the correct forms are obtained.

- Tax Software: Various tax preparation software options, including those that integrate with payroll systems, often provide the forms in a fillable format, streamlining the submission process.

Important Deadlines for the 2015 W-3PR Form

Timely submission of the 2015 W-3PR form is critical to avoid penalties. Key deadlines considered include:

- Filing Deadline: Employers must submit the W-3PR form to the SSA by January 31 of the year following the tax year. For 2015, the deadline was January 31, 2016.

- Extended Deadlines for Corrections: If errors are discovered after submission, employers have until September 30 to make corrections to avoid penalties.

Understanding these dates and adhering to them will ensure compliance and avoid potential financial penalties.

Who Typically Uses the 2015 W-3PR Form

The W-3PR form is specifically utilized by:

- Employers in Puerto Rico: All employers who have paid employees in Puerto Rico during the tax year must file this form alongside the W-2 forms.

- Organizations with Employees: Organizations, including non-profits and corporations, that have staff working in Puerto Rico use this form to report federal income tax withholding and social security information.

- Payroll Services: Payroll companies providing services to clients in Puerto Rico also handle the preparation and submission of the W-3PR form as part of their reporting obligations.

Utilization of this form plays a critical role in maintaining compliant records in accordance with SSA requirements.