Definition and Purpose of Schedule E (Form 990) Schools

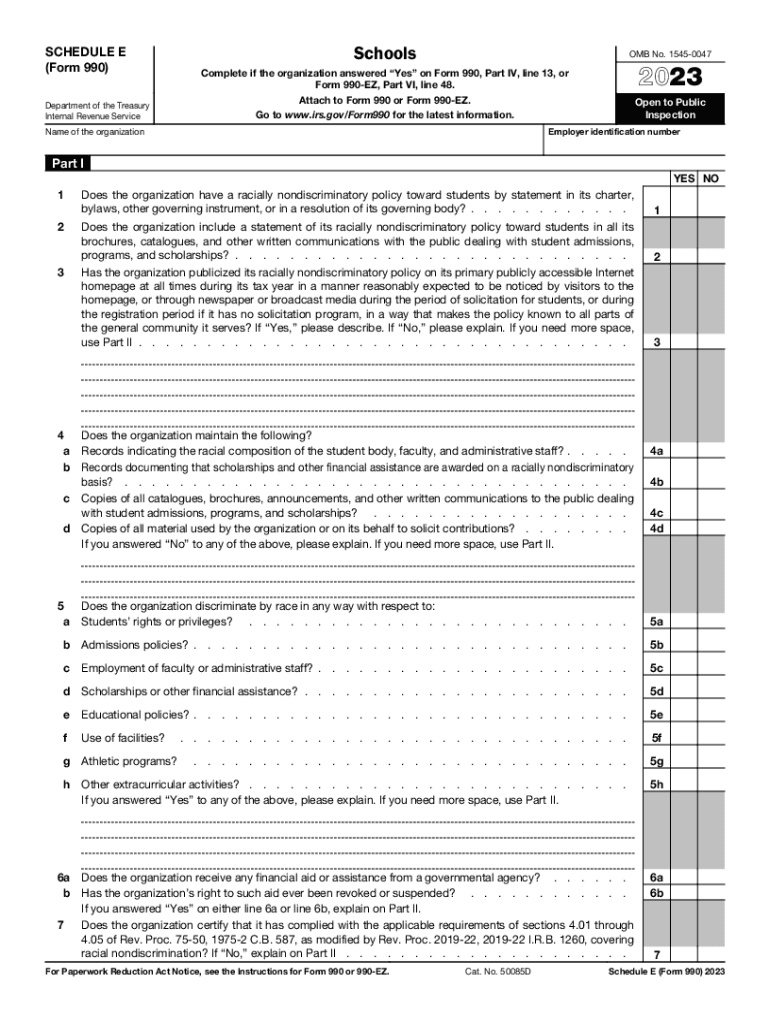

Schedule E (Form 990) is a necessary document for private educational institutions to demonstrate compliance with U.S. Internal Revenue Service (IRS) guidelines about racial nondiscriminatory policies. This form is crucial for both tax-exempt status management and transparency in school operations. Private schools must report their adherence to nondiscriminatory policies in student admissions, scholarship programs, and employment practices. This ensures not only regulatory compliance but also helps schools maintain an inclusive environment.

Key Aspects:

- Racial Nondiscrimination: Schools need to confirm their procedures for maintaining nondiscriminatory practices in various functions.

- Community Awareness: Publicizing nondiscriminatory policies effectively to inform students, parents, and the broader community.

How to Use the 2023 Schedule E (Form 990) Schools

Schools must integrate Schedule E (Form 990) into their annual IRS submissions. This involves gathering and organizing the required documentation that relates to non-discriminatory policies and practices.

Steps for Use:

- Compile Necessary Data: Gather information about student admissions, scholarships, and employment to demonstrate nondiscriminatory practices.

- Publicize Policies: Ensure that the nondiscriminatory policies are accessible through websites, brochures, and other communication channels.

- Documentation: Maintain accurate and timely records to support the claims made in Schedule E.

Obtaining the 2023 Schedule E (Form 990) Schools

To access Schedule E (Form 990), schools can visit the IRS official website. The form can be downloaded, filled out, and submitted online, enhancing convenience and accessibility.

Methods to Obtain:

- IRS Website: Direct download of the latest form version.

- Tax Preparation Software: Integrated within platforms like TurboTax and QuickBooks, simplifying the process for users.

- Professional Assistance: Engaging tax professionals or consultants to procure and fill out the form accurately.

Steps to Complete the 2023 Schedule E (Form 990) Schools

Completing Schedule E involves several precise steps that ensure all required information is correctly reported.

Detailed Steps:

- Download the Form: Obtain from the IRS site or supporting software.

- Fill in Organizational Information: Include the school’s legal name, address, and identification numbers.

- Detail Nondiscriminatory Policies: Provide thorough information on how these are applied in admissions and employment.

- Compile and Attach Supporting Documents: Ensure all records that substantiate the claims are attached.

- Review and Submit: Double-check for accuracy before electronic or physical submission.

Legal Use and Compliance with the 2023 Schedule E (Form 990) Schools

Organizations must adhere to federal guidelines by using Schedule E to certify they do not engage in discriminatory practices. Misreporting or omission of required data could lead to significant legal penalties and impact the school's tax-exempt status.

Legal Implications:

- Exemption Compliance: Vital to sustaining tax-exempt status with the IRS.

- Accurate Representation: Misrepresentation may lead to fines and loss of reputation.

- Regular Updates: Policies need continuous updating to meet current legal standards.

Key Elements of the 2023 Schedule E (Form 990) Schools

Certain sections of the Schedule E are critical for demonstrating compliance and must be completed with due diligence.

Primary Elements:

- Admissions Policy: Details on inclusive admissions practices.

- Scholarship Allocation: Description of nondiscriminatory scholarship opportunities.

- Employment Records: Evidence of equitable employment decisions.

- Public Awareness: Information on how these policies are communicated publicly.

Required Documents for the 2023 Schedule E (Form 990) Schools

Gathering appropriate documentation is essential for a legitimate and successful filing of Schedule E. Required documents substantiate the information provided on the form.

Important Documents:

- Racial Composition Reports: Analysis of the demographic makeup of the student body.

- Policy Statements: Formal documents outlining nondiscriminatory policies.

- Advertising Materials: Copies of brochures and web pages showing nondiscriminatory statements.

IRS Guidelines Related to the 2023 Schedule E (Form 990) Schools

Following IRS guidelines ensures that schools meet the standards for racially nondiscriminatory practices, impacting their federal tax status.

Guidance Focus:

- Annually Updated Forms: Schools must use the most current version of Schedule E.

- Comprehensive Reporting: Detailed reporting on policies and their implementation.

- Continued Compliance: Annual review and public disclosure of practices are necessary to adhere to IRS mandates.

By thoroughly understanding and addressing each of these areas, schools can effectively manage their obligations under the 2023 Schedule E (Form 990) Schools requirements, ensuring they support both community inclusivity and retain their tax-exempt status.