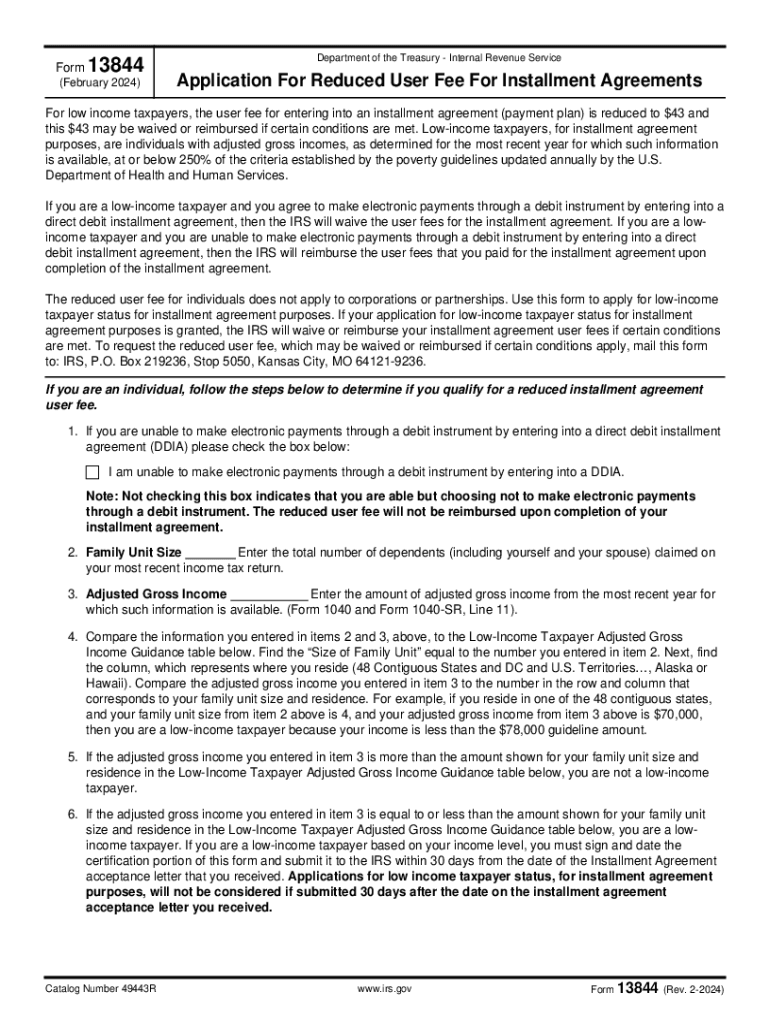

What is Form 13844 (Rev 2-2024)?

Form 13844, officially designated as the IRS Tax Form 13844, is a document utilized by low-income taxpayers in the United States to apply for a reduced user fee for entering into an installment agreement with the IRS. Specifically, this form allows eligible individuals to pay a user fee of only $43, substantially lower than the standard fees typically charged for this service. The fee waiver is essential for many taxpayers struggling to meet their tax obligations, especially during challenging financial situations.

Understanding the Purpose of Form 13844

The primary purpose of Form 13844 is to facilitate access to affordable tax payment solutions. Taxpayers with limited income can apply for installment agreements that enable them to pay their tax debts over time instead of facing immediate penalties or withholding of funds. This aligns with the IRS’s mission to provide equitable tax collection while considering taxpayers' financial constraints.

Eligibility Criteria for Form 13844

To qualify for the reduced user fee, taxpayers must meet specific income thresholds based on their adjusted gross income relative to federal poverty guidelines. The IRS provides detailed instructions on who qualifies, ensuring that the process remains accessible to those in genuine need.

How to Obtain Form 13844 (Rev 2-2024)

Obtaining Form 13844 is straightforward. Taxpayers can access it through several avenues:

- IRS Website: The form can be downloaded directly from the IRS’s official site, ensuring the latest version is utilized.

- Tax Software: Many popular tax filing software programs include Form 13844, streamlining the process for users familiar with electronic filing.

- Tax Assistance Centers: Local IRS offices can provide physical copies of the form for those who prefer in-person assistance.

Accessing the form is the first step in the application process, and it is crucial to ensure the correct version is used to avoid delays.

Steps to Complete the Form 13844 (Rev 2-2024)

Filling out Form 13844 involves precise steps to ensure all required information is accurately reported. Here’s a structured process to guide you:

-

Gather Required Information: Collect your tax information, including your tax identification number and details about your income and expenses.

-

Download the Form: Ensure you have the latest version of Form 13844 to avoid any issues with outdated information.

-

Fill in Personal Information:

- Enter your name, address, and Social Security number (or Individual Taxpayer Identification Number) as required.

- Provide your most recent tax filing status.

-

Determine Eligibility:

- Review the income guidelines and check if you meet the threshold for reduced fees.

- Complete the necessary calculations regarding your adjusted gross income.

-

Review and Submit:

- Double-check all entries for accuracy to avoid processing delays.

- Submit the application either online via an approved service, through mail, or in person at a tax assistance location.

Completing this form carefully is critical to ensuring eligibility for the reduced fee process.

Important Terms Related to Form 13844 (Rev 2-2024)

Understanding specific terminology related to Form 13844 can enhance comprehension and ensure effective use of the form. Key terms include:

-

Adjusted Gross Income (AGI): This is your gross income after applying certain adjustments. It is a pivotal factor in determining eligibility for the reduced user fee.

-

Installment Agreement: This refers to an arrangement with the IRS allowing taxpayers to pay their owed taxes in smaller increments over time, rather than in one lump sum.

-

User Fee: The fee charged by the IRS for processing an installment agreement, which can be reduced through the use of Form 13844 for qualified individuals.

Understanding these terms can aid in successfully navigating the tax implications related to the use of Form 13844.

IRS Guidelines for Form 13844 (Rev 2-2024)

The IRS provides comprehensive guidelines for utilizing Form 13844, including detailed instructions on filling out the form, eligibility requirements, and submission procedures. Important points from these guidelines include:

-

Notification of Approval: After submitting Form 13844, the IRS will notify the applicant regarding the decision. This process may take several weeks, and patience is advised.

-

Security Measures: The IRS emphasizes the importance of submitting the form securely, protecting taxpayer personal information during and after the application process.

-

Clarification of Terms: Detailed explanations about definitions related to the form are available on the IRS website, ensuring clarity for applicants.

Following these guidelines will promote a smoother application experience and increase the likelihood of successful approval for the reduced fee.

Filing Deadlines for Form 13844 (Rev 2-2024)

It is crucial to be aware of significant deadlines when filing Form 13844 to ensure timely submission and processing. Key dates include:

-

Tax Filing Deadlines: The form should be submitted as part of the overall tax filing process. Typically, this aligns with the April tax deadline.

-

Extension Procedures: Taxpayers seeking additional time to submit their tax returns may still file Form 13844 to secure the reduced fee, but the overall timeline for payment arrangements must still comply with IRS standards.

Awareness of these deadlines helps taxpayers plan effectively, reducing stress during filing seasons and ensuring compliance with IRS regulations.