Definition & Meaning

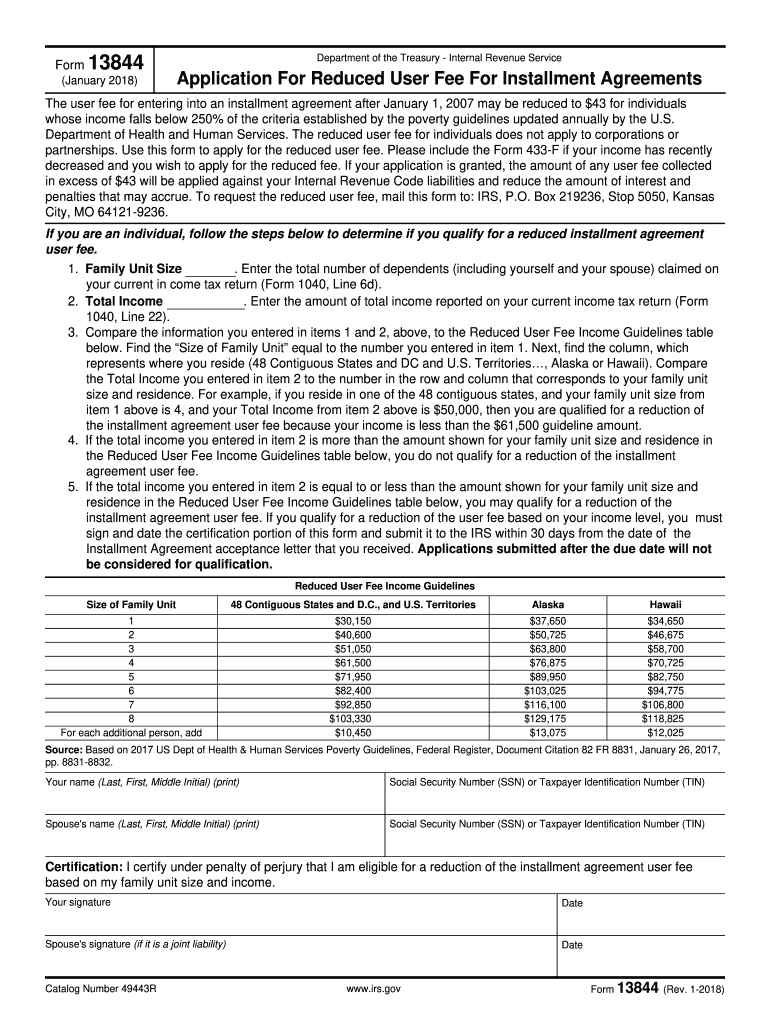

Form 13844, issued by the IRS, serves as an application for a reduced user fee of $43 for installment agreements. It is designed for individuals whose income is below 250% of the poverty guidelines, enabling them to manage their tax liabilities in a financially manageable way. The form outlines specific eligibility criteria that applicants must meet, focusing on family size and total income. It is important to note that this fee reduction opportunity is not available to corporations or partnerships.

How to Use the Form 13844

To utilize Form 13844 effectively, applicants should first assess whether they meet the income eligibility requirements. The form is typically used as part of the process to establish an installment agreement with the IRS when the applicant's financial situation justifies a reduced fee. After the form has been filled out accurately, it should be submitted to the designated IRS address specified in the instructions. Ensuring all information is complete and correct is vital to avoid processing delays.

Steps to Complete the Form 13844

-

Download the Form: Obtain the latest version of Form 13844 directly from the IRS website or a reliable source.

-

Read the Instructions: Before filling out the form, carefully read through all instructions provided to ensure you understand every requirement.

-

Fill Personal Information: This includes your name, social security number, and address.

-

Calculate Income: Accurately report your total income, factoring in family size to ensure it falls below the specified 250% poverty level.

-

Attach Supporting Documentation: Include any additional documentation that supports your income claims and eligibility.

-

Review and Submit: Double-check all entered information for accuracy before submitting the form by mail to the IRS address provided.

Eligibility Criteria

Eligibility for using Form 13844 requires that an individual's total income is below 250% of the federal poverty guidelines. The determination is influenced by the applicant's family size. It is crucial to verify these calculations with up-to-date figures, which can typically be accessed through federal resources or the IRS directly.

Application Process & Approval Time

The application process for a reduced user fee begins with accurately completing Form 13844 and ends with its submission to the IRS. Upon submission, the IRS reviews the details against federal poverty guidelines to determine eligibility. The review and approval process time can vary, often depending on IRS workload and the completeness of the submitted documentation. Applicants should receive a confirmation or further communication from the IRS within several weeks.

Key Elements of the Form 13844

Form 13844 contains critical sections that capture essential information needed by the IRS to evaluate an applicant's eligibility for the reduced fee option. These include:

- Personal Information: Basic details of the applicant.

- Income Details: Comprehensive reporting of total household income.

- Family Size: Information about the total number of dependents or family members in the household.

- Declaration and Signature: Confirmation by the applicant attesting that the information provided is accurate.

IRS Guidelines

IRS guidelines for Form 13844 emphasize the necessity for accurate financial reporting and adherence to submission criteria. The guidelines specify how family size should be considered against income levels to meet the criteria under the federal poverty level. It also establishes procedures for submitting completed forms and any required additional documentation to support your application.

Filing Deadlines / Important Dates

No specific annual deadline is provided for Form 13844, but timely submission in alignment with filing for an installment agreement is critical. Users should aim to submit the form as soon as they identify eligibility to benefit from immediate reduction of user fees. It's advisable to be aware of general IRS tax timelines to ensure all related activities are conducted in compliance.

Required Documents

Supporting documents are often necessary to accompany a Form 13844 submission. These can include:

- Income Statements: Such as pay stubs or W-2 forms to verify reported income.

- Family Size Documentation: Tax returns or similar documentation that clarify the number of household members.

- Additional Financial Information: Any other financial records that can substantiate the need for a reduced fee status.

Providing detailed and correct documentation ensures your application is processed efficiently, reducing potential for delays.