Definition and Purpose of Form 13844

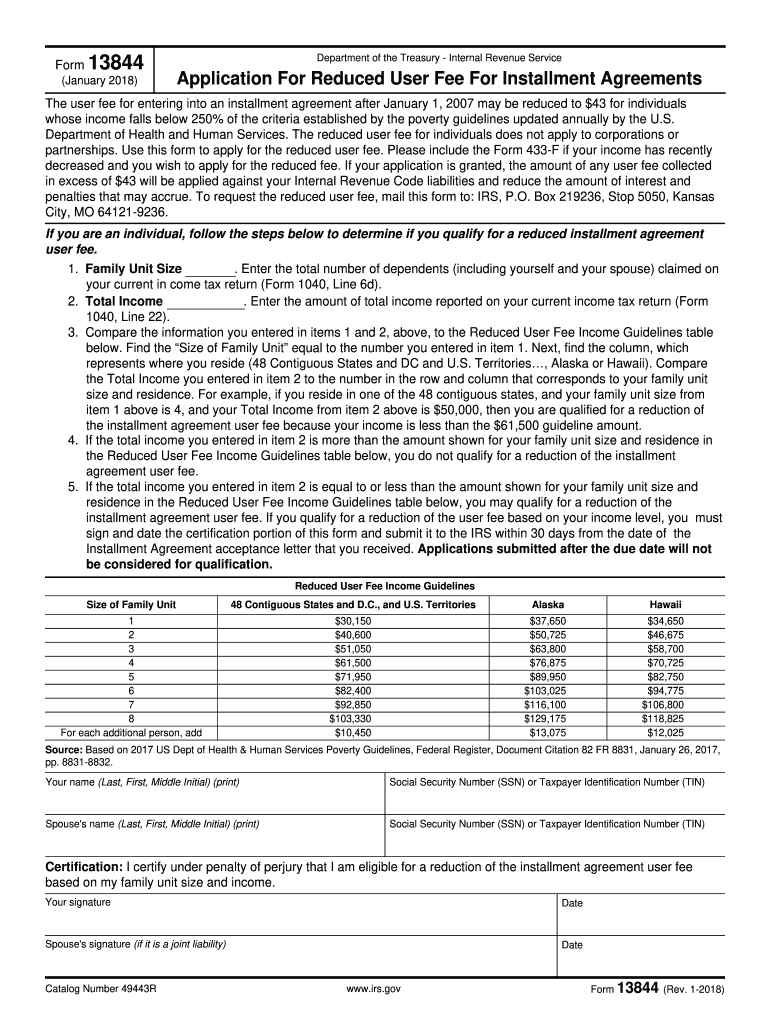

Form 13844, officially known as the IRS Form 13844, is a request used by individuals to apply for a reduced user fee of $43 for installment agreements with the IRS. This form is particularly relevant for taxpayers whose income is below 250% of the federal poverty guidelines. It aims to alleviate the financial burden on low-income individuals seeking to settle their tax debts through an installment agreement, providing necessary relief in tax compliance.

The eligibility for this reduced fee hinges on specific income and family size criteria, which are designed to ensure that individuals facing financial hardship can still manage their tax obligations without overwhelming costs. This form is essential for qualifying taxpayers to initiate a formal request for this fee waiver, ensuring access to affordable payment options.

Eligibility Criteria for Form 13844

To qualify for the reduced fee under Form 13844, applicants must meet certain eligibility criteria. Understanding these conditions is crucial for successful application:

-

Income Level: Applicants' total income must be less than 250% of the federal poverty guidelines. This threshold adjusts annually based on the federal government’s poverty guidelines.

-

Family Size: The number of individuals in the household influences eligibility. As family size increases, the income limits are adjusted accordingly, allowing more individuals to qualify.

-

No Corporate Applicability: The reduced fee does not extend to corporations or partnerships; it strictly applies to individuals filing as single or head of household.

These criteria ensure that the program's benefits are directed towards those who genuinely need assistance in managing their tax payments.

Step-by-Step Instructions for Completing Form 13844

Completing Form 13844 requires careful attention to detail to ensure all conditions are met. The following steps outline the process systematically:

-

Download the Form: Access the IRS website or relevant tax resource to obtain Form 13844.

-

Provide Personal Information: Fill in the required personal details, including name, address, and Social Security number. This section establishes your identity with the IRS.

-

Detail Household Information: Accurately fill out information regarding household size and income. This includes specifying the number of individuals living in your home and total household income details.

-

Attach Supporting Documents: Include any relevant documentation that verifies income and household size. This may include pay stubs, tax returns, or benefits statements.

-

Review for Accuracy: Before submission, review the form meticulously to ensure there are no errors or omissions which might delay processing.

-

Submit the Form: Choose your preferred submission method (online or mail) to send the completed form to the IRS, ensuring that you verify the submission options based on your location.

Following these steps thoroughly will enhance the chances of a successful application for the reduced fee.

Important Terms Related to Form 13844

Understanding key terminology related to Form 13844 aids in navigating the application process and ensuring compliance. Key terms include:

-

Installment Agreement: A payment plan that allows taxpayers to pay their tax liabilities over time rather than in a lump sum. Form 13844 applies to such agreements.

-

Poverty Guidelines: Annual income thresholds established by the federal government that determine eligibility for various assistance programs, including the fee reduction for Form 13844.

-

Eligibility: The criteria that determine whether an applicant qualifies for the reduced fee, based on income and household size.

-

User Fee: The charge imposed by the IRS for processing installment agreements, which can be waived or reduced through Form 13844 for qualifying applicants.

Familiarity with these terms enables clearer communication and understanding when completing Form 13844 or seeking assistance from tax professionals.

Form Submission Methods for 13844

There are several methods available to submit Form 13844 to the IRS. Each method offers distinct advantages depending on the taxpayer's situation:

-

Online Submission: Some taxpayers may have the option to submit their applications electronically, which can provide faster processing times. Check the IRS's official website for online submission availability.

-

Mail-in Submission: If the online method is unavailable or preferred, Form 13844 can be printed and mailed to the designated IRS address. Be sure to use a reliable mailing method to ensure timely delivery.

-

In-Person Submission: Certain taxpayers may opt to bring their form to a local IRS office. This can be beneficial for individuals requiring immediate assistance or clarification on the application process.

Choosing the appropriate submission method is critical in ensuring the timely and efficient processing of the request for reduced user fees.

Filing Deadlines and Important Dates for Form 13844

Timeliness is vital when dealing with tax matters. Key deadlines regarding Form 13844 include:

-

Application Submission: Taxpayers should aim to submit Form 13844 prior to initiating an installment agreement request to allow for fee reduction processing.

-

Tax Year Considerations: Be aware that applications may be influenced by the tax year in which the tax liability occurred. Ensure timely submission in relation to the tax filing season to avoid penalties.

Understanding these dates enables taxpayers to effectively manage their applications and maintain compliance with IRS requirements.

Common Use Cases for Form 13844

Form 13844 is predominantly used by individuals who are struggling to meet their tax obligations due to financial constraints. Common scenarios include:

-

Low-Income Taxpayers: Individuals who have lost jobs or have a significantly reduced income may require an installment agreement to manage outstanding taxes without incurring high fees.

-

Families with Dependent Children: Households where the total income is impacted by the need to care for multiple dependents often find this form beneficial to manage their financial responsibilities.

-

Individuals Facing Financial Hardship: Whether due to medical expenses or other unforeseen circumstances, many taxpayers leverage Form 13844 to extend their ability to pay taxes without excessive costs.

These scenarios illustrate the practical relevance of Form 13844 in real-world situations, highlighting its importance in tax planning and compliance for eligible individuals.