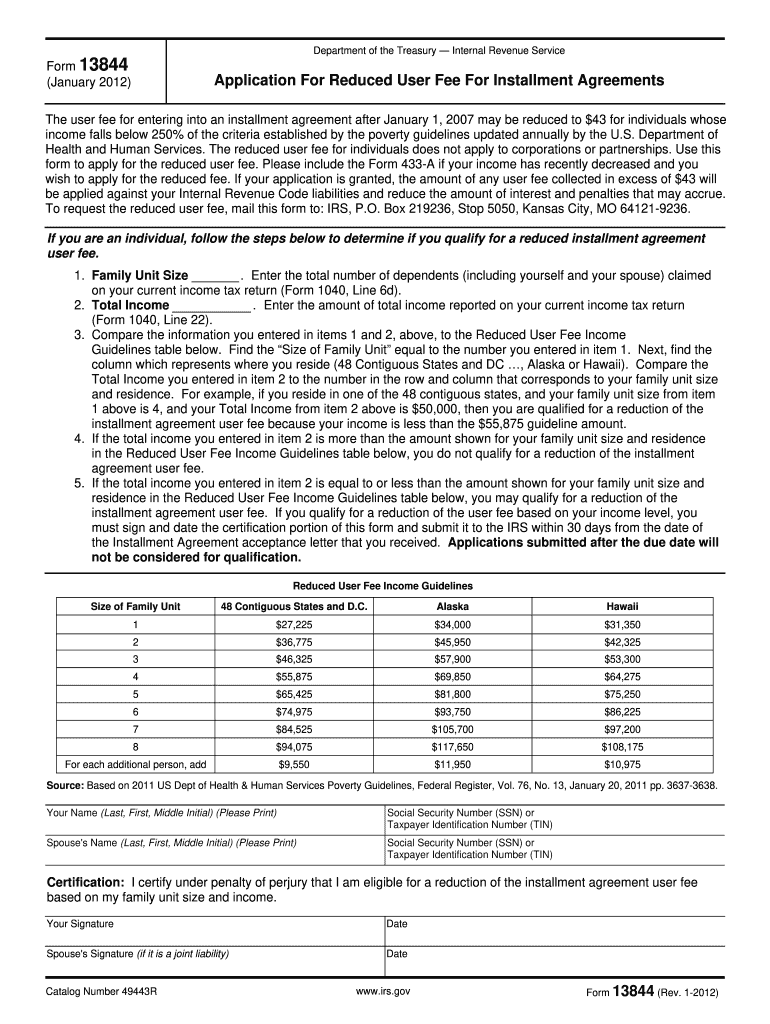

Definition and Purpose of IRS Form 13844

IRS Form 13844 is a critical document issued by the Internal Revenue Service that allows individuals to request a reduced user fee for setting up an installment agreement for tax payments. The primary purpose of this form is to enable qualifying taxpayers, particularly those with low income, to initiate monthly payment plans with the IRS without incurring the standard user fee, which can be a financial barrier for many. Specifically, if an individual's income is at or below 250% of the federal poverty line, they may qualify to pay a reduced fee of $43 rather than the standard fee of $105.

This form not only streamlines the process for eligible taxpayers but also provides essential guidelines regarding the income qualifications based on family size. Understanding the form's criteria is crucial for taxpayers looking for relief in managing their tax obligations.

Eligibility Criteria for IRS Form 13844

To utilize IRS Form 13844, individuals must meet specific income limits that reflect their economic circumstances. The eligibility requirements are centered on two primary factors: family size and total annual income.

- Family size: Applicants need to identify the number of individuals living in their household, which influences the poverty threshold applicable to them.

- Income limits: The IRS specifies income limits based on the federal poverty guidelines. Taxpayers must calculate their total income against these limits to determine eligibility.

For example, a single person may qualify for reduced fees if their income is below approximately $31,720 for the 2023 tax year. A family of four, on the other hand, might need to stay below around $65,500.

How to Complete IRS Form 13844

Completing IRS Form 13844 involves a few straightforward steps. The following guide outlines the process from beginning to end:

- Download the form: Obtain IRS Form 13844 either from the IRS website or through authorized channels.

- Fill in personal details: Enter your name, address, Social Security number, and other identifying information.

- Report income: Include your total annual income along with your family size information.

- Review eligibility: Confirm that your calculated income falls below the specified thresholds based on your household size.

- Sign the form: Ensure you sign and date the form before submission, as this authenticates your application.

The accuracy of the information provided is crucial, so taxpayers should double-check each section to avoid delays in processing the application.

Submission Methods for IRS Form 13844

Taxpayers have several options to submit IRS Form 13844:

- Online Submission: If completed through an IRS e-filing program, certain systems might allow for direct submission.

- By Mail: Taxpayers can print the completed form and mail it directly to the IRS at the address specified in the form instructions.

- In-Person: Individuals may also choose to deliver the form in person at their local IRS office where they can receive further assistance.

It is essential for taxpayers to retain a copy of their submitted form and any associated documentation for their records.

Key Elements to Understand about IRS Form 13844

Understanding the key elements of IRS Form 13844 is vital to a successful application:

- User Fee Reduction: The form specifically applies to the user fee associated with installment agreements. If accepted, this can significantly lessen the financial burden.

- Processing Time: Once submitted, the IRS may take time to process your form, typically a few weeks. Financial planning around this timeframe can be essential for those counting on the installment agreement.

- Written Confirmation: After processing the form, the IRS will provide a confirmation of acceptance or denial, which outlines any additional steps that may be necessary.

Being aware of these important components can help taxpayers navigate this process more effectively.

Important Instructions and IRS Guidelines

For those completing IRS Form 13844, adhering to specific IRS guidelines is paramount:

- Proper Documentation: Include all necessary documents that substantiate income claims, such as pay stubs, tax returns, or official letters of income.

- Timeliness: The form must be submitted within a specific timeframe to ensure eligibility for the reduced fee.

- Follow Up: After submission, it may be prudent to follow up with the IRS if no communication has been received within a reasonable timeline.

Compliance with these guidelines maximizes the chances of a timely and favorable outcome.