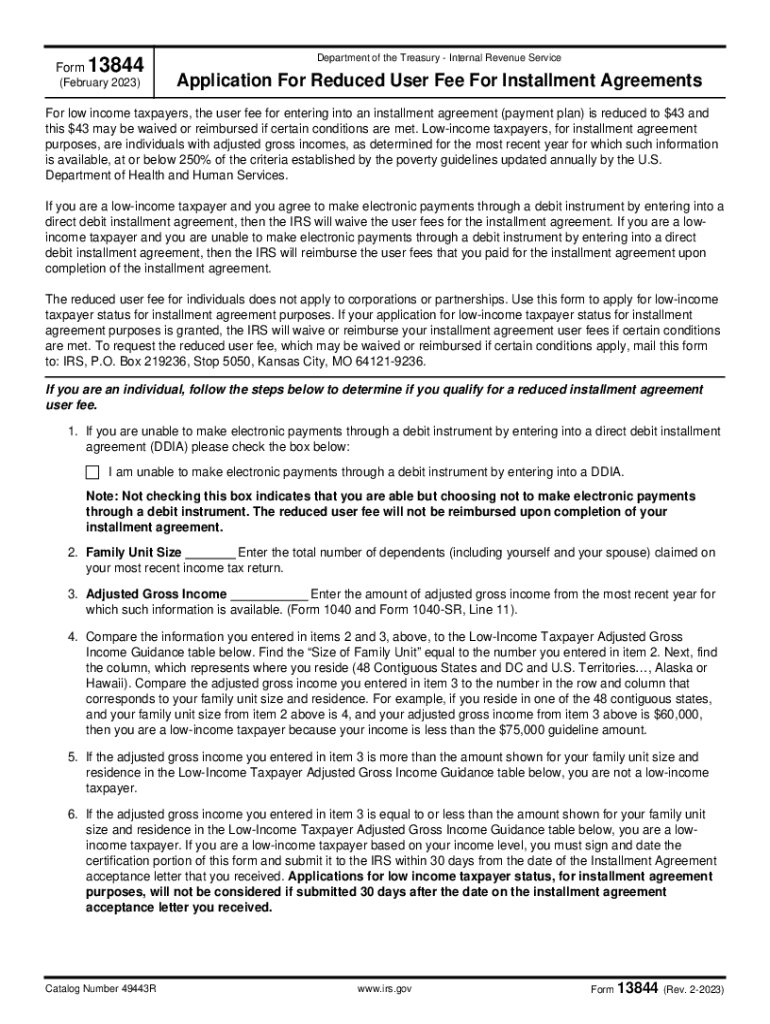

Understanding IRS Form 13844: Application for Reduced User Fee

IRS Form 13844 is specifically designed for low-income taxpayers requesting a reduced user fee for installment agreements with the Internal Revenue Service (IRS). This application is significant for taxpayers who qualify based on their adjusted gross income relative to current poverty guidelines. Through this form, they may obtain financial relief when managing their tax liabilities.

Key Definitions Related to Form 13844

- Installment Agreement: A payment plan allowing taxpayers to pay unpaid taxes over time.

- User Fee: A fee associated with setting up an installment agreement which can vary depending on payment options.

- Low-Income Taxpayer: A taxpayer whose income falls below a certain threshold, making them eligible for reduced fees.

Who Typically Uses IRS Form 13844?

Form 13844 is primarily utilized by low-income taxpayers seeking to set up an installment agreement with the IRS at a reduced cost. This includes:

- Individuals with low Adjusted Gross Income (AGI): Such taxpayers benefit from the reduced fees that can alleviate some financial burden.

- Self-employed individuals: Those whose fluctuating income may put them in a low-income bracket during certain periods.

- Individuals with other financial constraints: This applies to those who may be retired or facing financial difficulties.

How to Fill Out IRS Form 13844 Online

Filling out Form 13844 electronically streamlines the application process. Here are the essential steps to complete the form online:

- Access the Form: Visit the IRS website or a trusted service provider to access the PDF version of IRS Form 13844.

- Provide Personal Information: Complete sections requiring personal details such as your name, address, Social Security number, and filing status.

- Determine Income Eligibility: Refer to the IRS guidelines to evaluate if your income falls below the established poverty guidelines. This is necessary to qualify for the reduced fee.

- Indicate the User Fee Requested: Specify the fee you wish to be considered for reduction.

- Signature: Use an electronic signature feature available in online document platforms for signing the form securely.

Important Considerations When Filling Out the Form

- Ensure that all information is accurate and up-to-date.

- Be prepared to provide additional documentation if requested.

- Double-check the eligibility criteria before submission to avoid processing delays.

Submission Methods for IRS Form 13844

There are various ways to submit Form 13844, especially when utilizing electronic platforms like DocHub:

- Online Submission: After filling out the form through an online service, you can submit it directly to the IRS.

- Email Submission: Some online platforms offer secure options to email the completed forms directly to the IRS.

- Mail Submission: For those preferring a traditional approach, print the filled form and send it to the designated address provided by the IRS.

Key Dates for Form Submission

- The form must be submitted within 30 days of receiving your installment agreement acceptance letter.

- Familiarize yourself with any specific tax deadlines that may affect your submission timing.

Legal Requirements for IRS Form 13844

IRS Form 13844 adheres to legal standards established by the IRS to protect taxpayer rights and ensure compliance with federal regulations. Understanding these legalities is crucial:

- Compliance with the ESIGN Act: When signing electronically, the signature must comply with electronic signature laws to be legally binding.

- Documentation Requirements: Be prepared to present documentation that proves income and supports your claim for a reduced fee.

- Record Keeping: Maintain copies of submitted forms and correspondence with the IRS for future reference.

By grasping the key elements associated with IRS Form 13844, users can effectively manage their tax obligations while ensuring compliance with IRS guidelines.