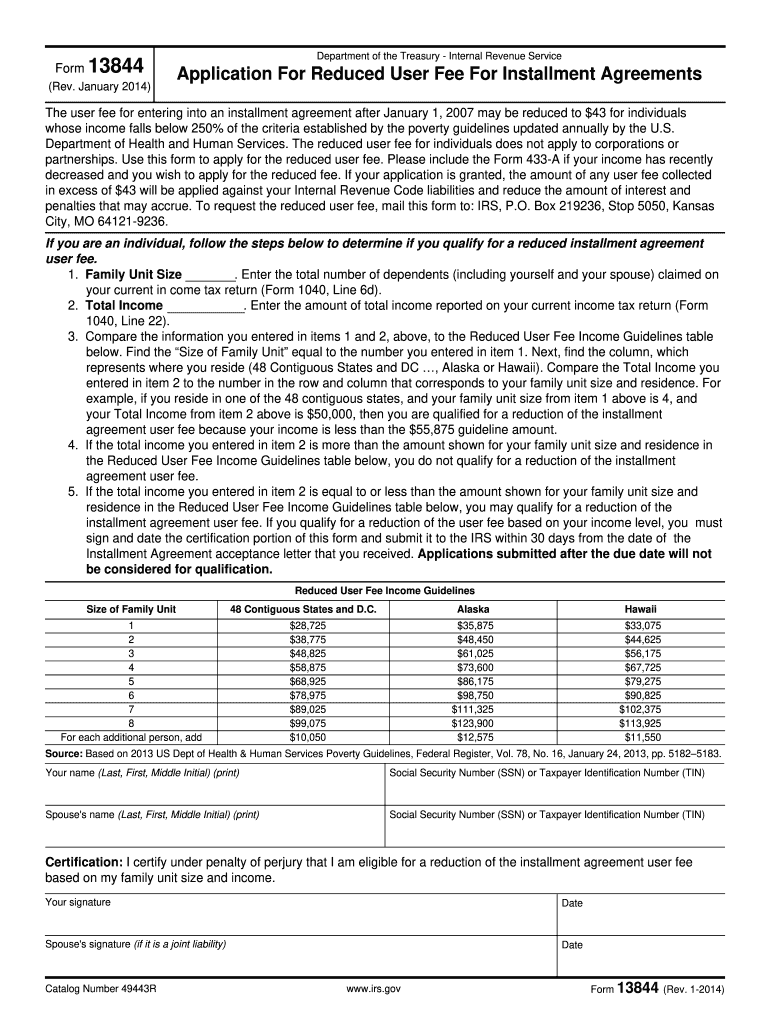

Definition and Purpose of IRS Form 13844

IRS Form 13844 is a crucial document designed for individuals seeking a reduced user fee for installment agreements if they meet specific income criteria. This form is particularly relevant for taxpayers with total income levels at or below 250% of the federal poverty guidelines. It's primarily intended to ease the financial burden of establishing an installment payment plan by lowering the standard fee to $43. Understanding the purpose of this form and its requirements is essential for eligible individuals looking to manage their tax liabilities in a financially efficient manner.

How to Obtain IRS Form 13844

Acquiring IRS Form 13844 can be done through various methods to ensure accessibility and convenience for all users. The form is available for download in PDF format on the official IRS website, where it can be printed or filled out digitally. Physical copies can also be obtained by visiting local IRS offices or by requesting a mailed copy through the IRS forms request hotline. For individuals seeking digital solutions, accessing the form through platforms like DocHub provides additional tools for editing and electronic form completion.

Eligibility Criteria for IRS Form 13844

Eligibility for completing IRS Form 13844 hinges on specific income and family size criteria outlined by the IRS. To qualify for the reduced user fee, the applicant's adjusted gross income must not exceed 250% of the federal poverty level for their family size. Applicants must be prepared to provide detailed documentation to substantiate their income and residency status. Understanding these criteria ensures that eligible taxpayers can properly apply and benefit from reduced fees.

- Income Verification: Applicants must provide recent income proof, such as pay stubs or tax returns.

- Family Size Consideration: The IRS defines family size as the number of exemptions claimed on the latest tax return, affecting the poverty level threshold.

Steps to Complete IRS Form 13844

Completing IRS Form 13844 involves a structured process designed to ensure accuracy and eligibility. The form requires applicants to provide detailed personal and financial information, following these steps:

-

Enter Personal Details: Provide your name, social security number, and contact information.

-

Income Information: Clearly outline your adjusted gross income and include all necessary supporting documentation.

-

Calculation of Family Size: Determine family size based on IRS guidelines, considering all dependents.

-

Submit Application: Attach relevant documents and mail the completed form to the provided IRS address or submit it digitally using secure platforms.

Important Terms Related to IRS Form 13844

Understanding the technical terminology associated with IRS Form 13844 is essential for accurate completion and submission. Key terms include:

-

Adjusted Gross Income (AGI): A key financial metric defined by reaching gross income minus adjustments, critical for determining eligibility.

-

Federal Poverty Level: A threshold used to define economic standing, influencing eligibility based on family size and income.

-

Installment Agreement: A payment agreement allowing taxpayers to pay their tax debts over time, with reduced fees contingent on completing Form 13844 successfully.

Legal Use of IRS Form 13844

IRS Form 13844 is legally binding and must be completed with accurate and truthful information. It serves not only as an application for reduced fees but also extols legal compliance with federal tax requirements. Misrepresentation of facts can result in penalties, including dismissal of the reduced fee request and potential fines. Therefore, understanding the legal implications of the form and adhering to guidelines is of utmost importance.

Filing Deadlines and Important Dates

While IRS Form 13844 itself does not have a strict filing deadline, aligning its submission with any applications for installment agreements ensures the possibility of reduced fees. Taxpayers should file this form concurrently with their initial request for an installment plan or at the earliest possible opportunity to align with billing cycles. Awareness of these timelines assists in planning financial commitments.

Examples of Using IRS Form 13844

Real-world scenarios highlight the practical use of IRS Form 13844. Consider a single parent with two children, earning just below 250% of the poverty guideline. By completing Form 13844, they secure a lowered installment fee, enabling more manageable tax payments. Similarly, retirees living on limited fixed income can leverage this form to reduce their financial burden when setting up payment plans with the IRS. These examples underscore the form's potential benefits and its role in helping taxpayers streamline their financial obligations.