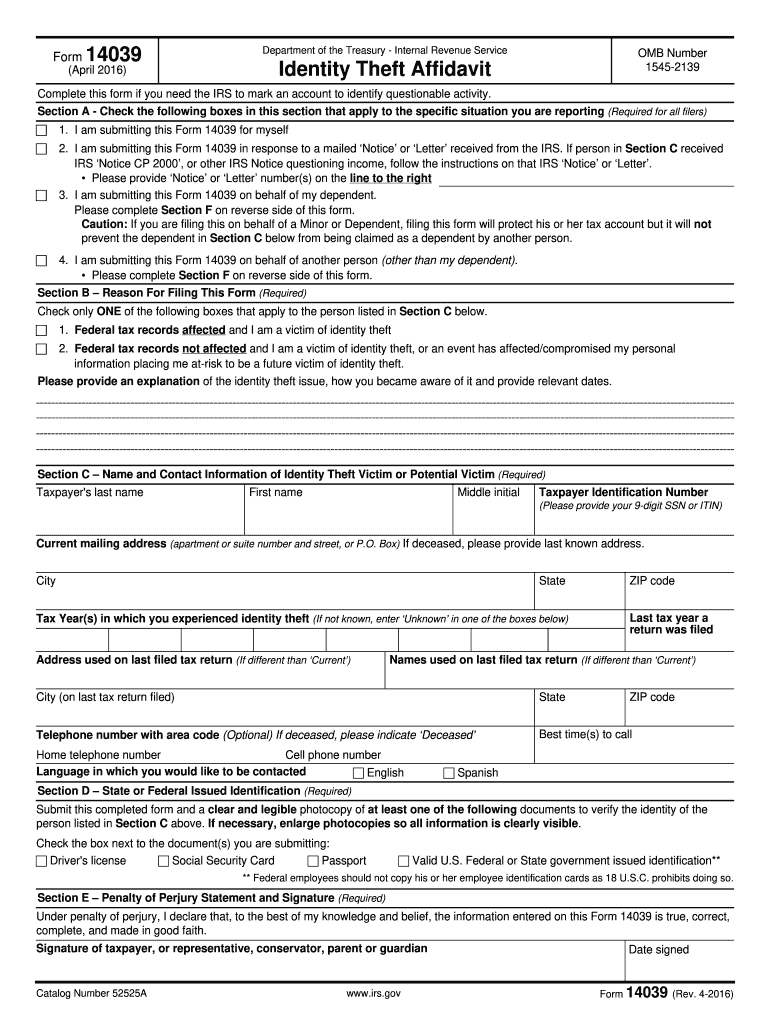

Understanding IRS Form 14039

IRS Form 14039, known as the Identity Theft Affidavit, is utilized to alert the IRS that your personal information may be compromised and used for fraudulent tax filing. It's a critical tool for individuals suspecting identity theft affecting their tax status. The form also supports requests to place an alert on your IRS account, aiming to prevent further unauthorized activity.

Purpose and Importance

IRS Form 14039 is essential for protecting taxpayers from identity theft repercussions. Filing this form is crucial for individuals who've had their Social Security numbers misused or have experienced other identity theft forms impacting their federal tax records. Once submitted, it helps the IRS take necessary steps to secure your tax account and investigate suspicious activities.

Obtaining IRS Form 14039

Where to Find the Form

The Identity Theft Affidavit can be downloaded directly from the IRS website. This ensures you are accessing the most current version without potential third-party inaccuracies.

Additional Sources

Additionally, you can request the form by contacting the IRS Identity Protection Specialized Unit. They can provide guidance and ensure you receive the correct form version tailored to your situation.

Steps to Complete IRS Form 14039

-

Personal Information: Provide your name, last four digits of your Social Security number, and contact details.

-

Identity Theft Details: Explain the specific identity theft issue, such as unauthorized tax returns filed under your Social Security number.

-

Supporting Documentation: Attach copies of valid identification, such as your passport or driver's license, to confirm your identity.

-

Submission: Complete and sign the form, then mail or fax it to the IRS as instructed on the form. Follow up if you do not receive a response within the expected timeframe.

Submission Methods

- Mail: Send the completed form and attached documents to the IRS address specified in the form's instructions.

- Fax: Alternatively, fax the documents to the IRS. Ensure confirmation of successful transmission for your records.

Who Should Use IRS Form 14039

The form is primarily used by:

- Individuals whose personal information has been compromised and misused for tax filings

- Taxpayers notified by the IRS of a potential issue with fraudulent filings

- Parents or guardians filing on behalf of dependents whose information has been compromised

Key Elements of IRS Form 14039

Required Information

- Personal and contact information for verification

- A detailed explanation of how identity theft impacted your tax records

- Any IRS notices received related to identity theft

Supporting Documentation

Attach copies of government-issued identification documents to validate your identity. This supports the IRS's measures in authenticating and rectifying your situation.

Legal Considerations

IRS Guidelines

It's vital to adhere to IRS instructions for accurately completing and submitting the form. Failure to comply might delay the resolution of identity theft issues or lead to further complications.

Penalties for Non-Compliance

While there are no direct penalties for failing to file Form 14039, neglecting to address identity theft promptly can lead to tax discrepancies and potential legal issues.

Examples of Using IRS Form 14039

Consider hypothetical scenarios:

-

Case Study 1: Jane Doe receives a notice from the IRS about multiple tax returns filed under her Social Security number. She uses Form 14039 to report this discrepancy and prevent further fraudulent filings.

-

Case Study 2: John Smith discovers tax records under his dependent's Social Security number that he did not authorize. By submitting the form on behalf of his child, he aims to protect their identity and correct the records.

Filing Deadlines and Important Dates

There is no strict deadline for filing IRS Form 14039; however, it is essential to submit the form promptly once identity theft is suspected to prevent further unauthorized tax activity. Immediate action facilitates quicker resolution and protection of your tax records.