Definition & Meaning

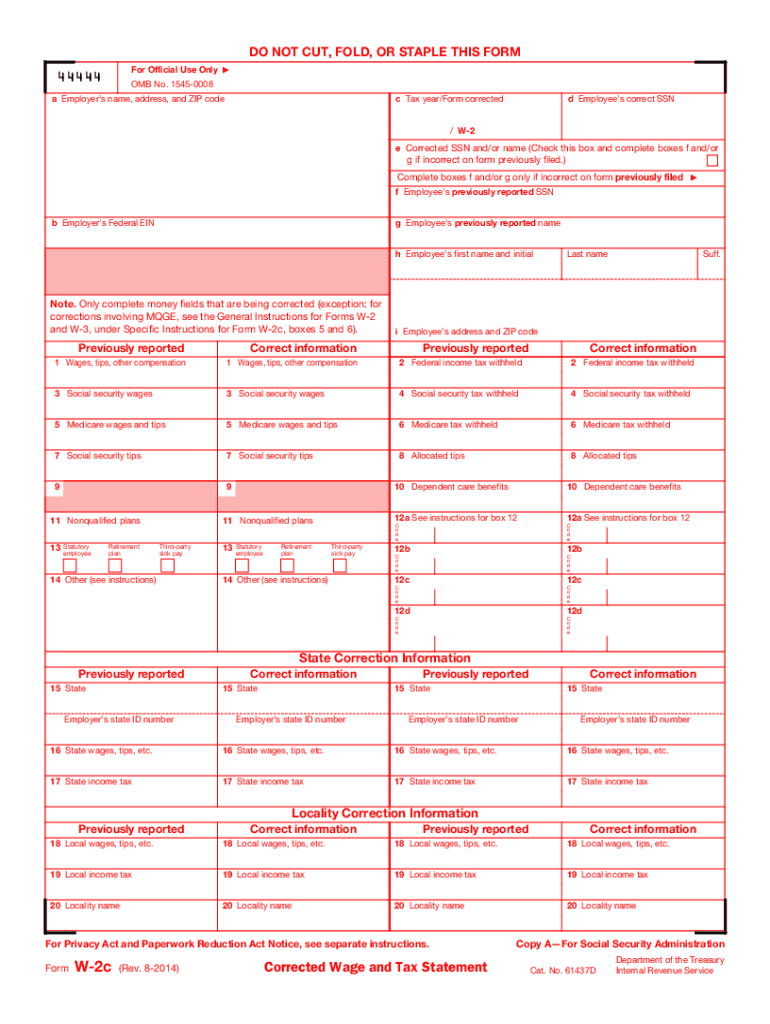

The Form W-2c, Corrected Wage and Tax Statement, is used to amend errors on previously filed W-2 forms. This form is essential when discrepancies are identified in the information initially reported to the IRS and the Social Security Administration (SSA). Common corrections made using this form include inaccurate employee names, incorrect Social Security numbers, or errors in wage or tax data.

How to Use the W-2c Form

Using the W-2c form involves a systematic process to ensure accurate correction of previously filed W-2 statements. Employers must fill out the form by entering the correct information alongside the data initially reported on the W-2 form. This parallel display clarifies the corrections made, aiding both the IRS and the SSA in updating their records efficiently.

How to Obtain the W-2c Form

The W-2c form can be obtained from the official IRS website, where it is available for download in a PDF format. Employers can also order physical copies of the form from the IRS by mail, though it is important to note that only the official IRS version of the form is scannable and acceptable for submission to the SSA.

Steps to Complete the W-2c Form

- Gather all necessary information, including the original W-2 and details that need corrections.

- Enter the correct data alongside previously reported incorrect data in the corresponding fields on the W-2c.

- Double-check the corrected information for accuracy to avoid further amendments.

- File the completed form with the SSA using the procedures outlined for electronic filing, or mail if necessary.

Why You Need the W-2c Form

Correcting inaccuracies in reported income and tax withholdings using the W-2c form is crucial to ensure the IRS and SSA have accurate records. Inaccurate wage data can lead to discrepancies in tax assessments for both the employee and employer. Additionally, it ensures employees' Social Security benefits are calculated on the correct earnings figure.

Who Typically Uses the W-2c Form

Employers who identify errors in previously filed W-2 forms typically use the W-2c form to rectify these mistakes. The form is also crucial for accounting departments responsible for ensuring accurate payroll and tax reporting. Employees may not directly use the W-2c but are affected by the changes it enacts on their records.

Key Elements of the W-2c Form

- Employee and Employer Information: Both must be correctly represented to ensure all corrections link to the appropriate records.

- Corrected Data Sections: Include fields for corrected wage, tax, and other payroll details contrasted with the initially reported figures.

- Instructions for Amendments: Detailed guidelines ensure accurate completion and submission of the form.

IRS Guidelines

The IRS provides detailed instructions on how to properly complete and submit the W-2c form to correct previously reported wage and withholding details. Employers are advised to follow these guidelines to avoid penalties and ensure corrected data is recorded correctly with the SSA.

Filing Deadlines / Important Dates

While there is no specific deadline for filing a W-2c, it is crucial to submit corrections as soon as errors are discovered. Timely submissions are necessary to avoid penalties for incorrect reporting and to ensure employee records are updated promptly, minimizing impacts on tax and Social Security benefits.

Required Documents

Employers must have the original W-2, accurate wage and tax details needing correction, and any supporting documentation that verifies the corrected information. This documentation ensures the process is transparent and verifiable by the IRS or SSA if required.

Form Submission Methods

- Online Submissions: Electronic filing via the SSA's Business Services Online (BSO) portal is recommended for its ease and efficiency.

- Mail Submissions: Physical copies of the W-2c can be mailed to the SSA, but only official IRS forms should be used to ensure acceptance.

Penalties for Non-Compliance

Employers who fail to file corrected W-2c forms when necessary may face penalties from the IRS. These penalties can arise from inaccuracies in tax reporting or delays in submitting corrected information, further underlining the importance of timeliness and accuracy in handling wage statements.