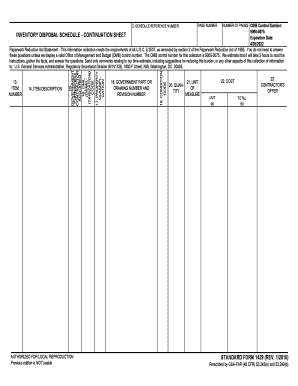

Definition and Meaning of the Form

The "September 1996) Department of the Treasury Internal Revenue Service OMB No - irs" refers to an official document issued by the IRS, designed for specific purposes within the context of U.S. tax regulations. The Office of Management and Budget (OMB) number associated with this form indicates it has met federal requirements for approval and data collection. Understanding this form is crucial for individuals and organizations involved with tax filings or compliance in the United States.

The form functions primarily as a means for taxpayers to provide the IRS with necessary information about their financial transactions, tax obligations, or compliance status. It typically includes fields that require detailed input about income, deductions, and other financial activities relevant to tax liability.

Key Features of the Form:

- OMB Approval: Indicates adherence to federal data collection standards.

- Purpose Specificity: Tailored for unique tax situations or reporting requirements.

- Compliance Requirement: Necessary for lawful reporting and tax obligations.

Steps to Complete the Form

Correctly filling out the September 1996) Department of the Treasury Internal Revenue Service OMB No - irs involves several steps to ensure compliance and accuracy. It’s essential to adhere to the specific guidelines provided by the IRS.

Step-by-Step Instructions:

-

Obtain the Form:

- Access the form from the IRS website or other authorized sources.

- Ensure you are using the most recent version, as older versions may not be accepted.

-

Gather Necessary Information:

- Collect financial documents such as W-2s, 1099s, and previous tax returns.

- Review your financial activities for the relevant tax year.

-

Complete the Form:

- Fill in personal identification information, including your name, social security number, and address.

- Input financial data in the designated sections, ensuring figures are accurate and verifiable.

-

Review for Errors:

- Double-check all entries for accuracy and completeness.

- Utilize IRS instructions associated with the form for guidance.

-

Submit the Form:

- Determine whether to file electronically or via mail.

- If submitting by mail, ensure it is sent to the correct IRS address based on your locality and the form type.

Important Terms Related to the Form

Understanding tax-related terminology is crucial for users of the September 1996) Department of the Treasury Internal Revenue Service OMB No - irs. This knowledge can enhance comprehension of the form's requirements and facilitate accurate completion.

Common Terms Explained:

- Filing Status: Defines your tax situation (e.g., single, married).

- Deductions: Expenses subtracted from total income to reduce overall taxable income.

- Tax Liability: The total amount of tax that individual taxpayers owe to the IRS.

- Exemption: A deduction allowed for certain categories of taxpayers, reducing taxable income.

Having a solid grasp of these terms will streamline the completion and understanding of the form, ensuring that users avoid common pitfalls during the filing process.

Legal Use of the Form

Using the September 1996) Department of the Treasury Internal Revenue Service OMB No - irs legally is imperative for compliance with federal tax laws. Misuse or inaccuracies can result in penalties or legal ramifications.

Compliance Aspects:

- Accurate Reporting: Users must provide truthful and accurate data as required by law.

- Timely Submission: Filing must adhere to IRS deadlines to avoid late penalties.

- Validation of Information: Users should retain documentation that supports their claims made on the form.

Engaging with the form within these legal confines ensures that individuals and businesses uphold their responsibilities, fostering transparency and accountability in tax matters.

Who Typically Uses the Form?

The September 1996) Department of the Treasury Internal Revenue Service OMB No - irs is utilized by various groups, including individuals, businesses, and tax professionals. Each category has specific needs and responsibilities relating to the form.

Primary Users:

- Individuals: Taxpayers filing their annual returns or specific claims with the IRS.

- Businesses: Organizations that need to report financial data for compliance or tax purposes.

- Tax Preparers: Professionals who assist clients in accurately completing the form and ensuring its compliant filing.

These users must understand the implications of the form's contents, as the accuracy of their reporting can affect their financial health and legal standing with the IRS.

Filing Deadlines and Important Dates

Adhering to deadlines for submitting the September 1996) Department of the Treasury Internal Revenue Service OMB No - irs is essential for meeting tax obligations. The IRS provides specific dates that should be monitored to avoid penalties.

Key Deadlines:

- April 15: The typical deadline for individual tax returns.

- Extended Filing: Those who file for extensions must ensure submission by October 15.

- Annual Changes: It is important to verify if any new deadlines have been established by the IRS for the current tax year.

Awareness of these dates helps taxpayers effectively manage their financial documentation and ensure timely compliance with IRS guidelines.

Examples of Using the Form

Applying the September 1996) Department of the Treasury Internal Revenue Service OMB No - irs in practical scenarios can enhance understanding of its functionality and requirements.

Practical Scenarios:

- Self-Employment: An individual who is self-employed may need to report income and expenses using this form to ensure accurate assessment of tax liability.

- Business Deductions: A small business owner could utilize the form to claim deductions related to operational expenses, impacting the overall taxable income.

These examples highlight the form's importance in real-world situations where accurate financial reporting is crucial to compliance and effective tax management.