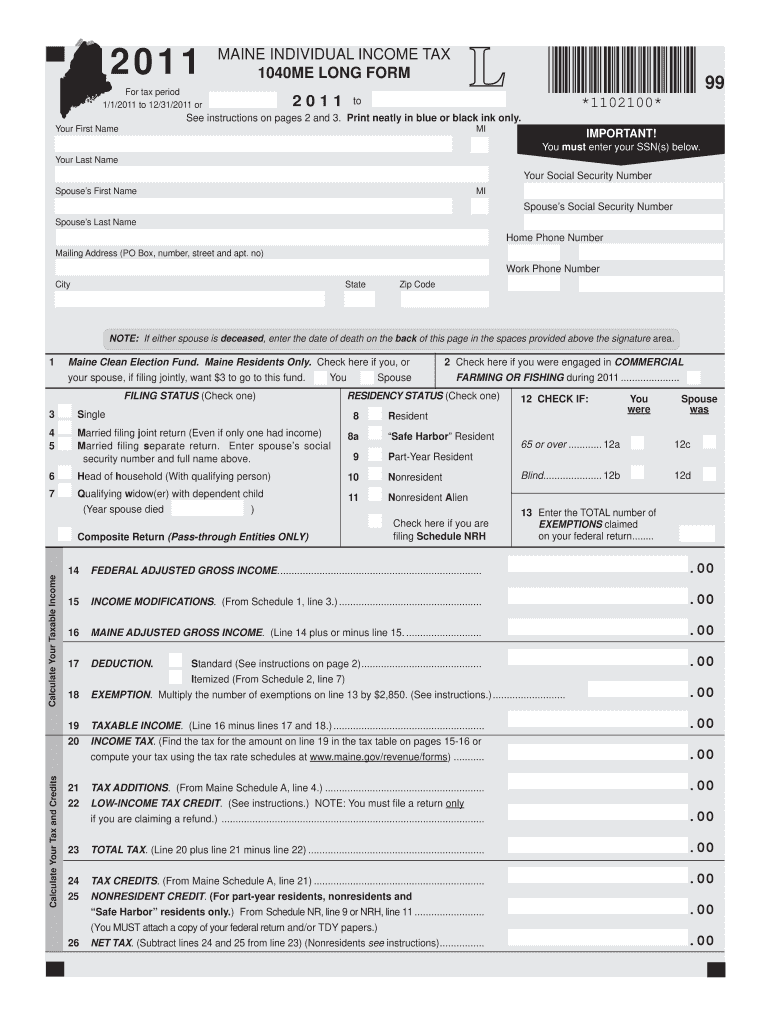

Definition and Purpose of the 2011 Maine Form

The 2011 Maine form refers to the official tax document utilized by residents of Maine to file their individual income tax for the year 2011. Specifically, this form can be categorized as the 1040ME Long Form, which is designed for taxpayers to report various income sources, calculate their taxable income, and determine their tax obligations. It plays a critical role in the tax filing process, allowing individuals to legally declare their earnings and ensure compliance with state tax regulations.

The primary functionalities of the 2011 Maine form include:

- Reporting income: Taxpayers can account for wages, self-employment income, rental income, and any other applicable earnings.

- Claiming deductions: The form allows individuals to claim specific deductions, such as those for mortgage interest, state taxes paid, and medical expenses.

- Calculating tax liabilities: After reporting income and claiming deductions, users can compute their overall tax obligations and potential refunds or payments due.

By utilizing the 2011 Maine form, taxpayers can ensure they meet Maine's tax requirements while maximizing eligible deductions that may reduce their taxable income.

Steps to Complete the 2011 Maine Form

Completing the 2011 Maine Individual Income Tax 1040ME Long Form requires careful attention to detail to ensure accuracy and compliance. Familiarity with the form sections streamlines the process. Here are the essential steps to complete this tax form:

-

Gather Necessary Documents: Collect all relevant financial documents, including W-2s from employers, 1099s for other income, and receipts for deductible expenses.

-

Personal Information: Input your name, address, Social Security number, and other identifying information at the top of the form. Ensure this is accurate to avoid issues with the processing of your return.

-

Filing Status: Select your filing status, as this will influence your tax rates and potential deductions. The options include single, married filing jointly, married filing separately, and head of household.

-

Income Section: Detail all sources of income in the corresponding section. Add together wages, interest, dividends, and any alternative sources of revenue to calculate your total income.

-

Deductions and Exemptions: Report any allowable deductions, such as standard deductions or itemized deductions, and exemptions that apply to your situation. This step is critical for accurately reducing your taxable income.

-

Tax Calculation: Use the provided tables and instructions to determine your tax liability based on your taxable income after deductions. This step involves referencing state tax rates and brackets for precise calculations.

-

Sign and Date: Sign the form to certify that the information provided is truthful and accurate. Date the form to indicate when it is being submitted.

-

Submit the Form: File your completed form by either mailing it to the designated Maine Revenue Services address or filing electronically if applicable. Ensure you adhere to all submission guidelines.

Completing the 2011 Maine form accurately and filing on time is essential to avoid penalties or complications with state tax authorities.

Important Terms Related to the 2011 Maine Form

To effectively navigate the 2011 Maine form, it is important to be familiar with several key terms specific to state tax regulations. Understanding these terms can help taxpayers meet their filing obligations and comprehend the nuances of the tax process.

-

Taxable Income: This represents the total income subject to taxation after all deductions and exemptions have been applied. It is calculated by subtracting allowable deductions from the total income amount.

-

Deductions: These are specific expenses that can be subtracted from taxable income, thereby lowering the total tax liability. Examples include charitable contributions, medical expenses, and state income taxes paid.

-

Exemptions: These are allowances that reduce taxable income based on the number of dependents claimed on the tax return. This helps in lowering overall tax obligations.

-

Filing Status: Refers to the category under which an individual reports their income and pays taxes. Common statuses include single, married filing jointly, and head of household.

-

Tax Credits: These are dollar-for-dollar reductions in tax liability. For example, a $1,000 tax credit reduces the taxpayer's liability by $1,000. Examples might include credits for education expenses or energy-efficient home improvements.

Understanding these essential terms enhances clarity during the filing process and enables taxpayers to maximize their deductions and credits appropriately.

Filing Deadlines and Important Dates for the 2011 Maine Form

Adhering to tax deadlines is crucial for compliance with Maine state tax regulations. The 2011 Maine form has specific deadlines that affect filing and payment obligations. Below are critical dates associated with the submission of the form:

-

Filing Deadline: The deadline for filing the 2011 Maine Individual Income Tax return (1040ME Long Form) typically falls on April 15, 2012. If April 15 falls on a weekend or holiday, the deadline may be adjusted to the next business day.

-

Extensions: Taxpayers may request an automatic six-month extension to file, which extends the deadline until October 15, 2012. However, it is essential to pay any estimated taxes owed by the original filing deadline to avoid penalties.

-

Payment Due Date: Any taxes owed to the State of Maine must also be paid by the original filing deadline. Failure to pay taxes owed by this date can result in interest charges and penalties.

-

Refund Issuance: If a taxpayer is due a refund, the processing and issuance timeline can vary but typically occurs within six to eight weeks after the return has been filed.

Being aware of these important dates ensures that taxpayers can plan their returns effectively and avoid fees or complications related to late submissions.

Who Typically Uses the 2011 Maine Form?

The 2011 Maine Individual Income Tax form is primarily utilized by various individuals and households that meet specific criteria for filing state income tax. Understanding the demographic and occupational categories helps clarify who this form is relevant for:

-

Resident Taxpayers: Maine residents who earn income through various sources, including wages, self-employment, or investment returns, are required to use the 2011 Maine form to report their income and tax liabilities.

-

Self-Employed Individuals: Those operating their own businesses or freelancing in Maine must file this form to ensure compliance with state tax regulations and report earnings accurately.

-

Individuals with Multiple Income Streams: Taxpayers who receive income from various sources, like rental properties or dividends, will typically rely on the 2011 Maine form to compile and report these earnings accurately.

-

Dependents: College students or others who might be claimed as dependents must also file this form if they have earned income. They are accountable for reporting their income to Maine Revenue Services.

-

High Earners and Itemizers: Individuals with more complex tax situations, such as those claiming significant deductions or credits, will use the 1040ME to navigate their tax obligations effectively.

Identifying these groups helps underscore the diverse individuals who must responsibly adhere to Maine's tax regulations via the 2011 Maine form.