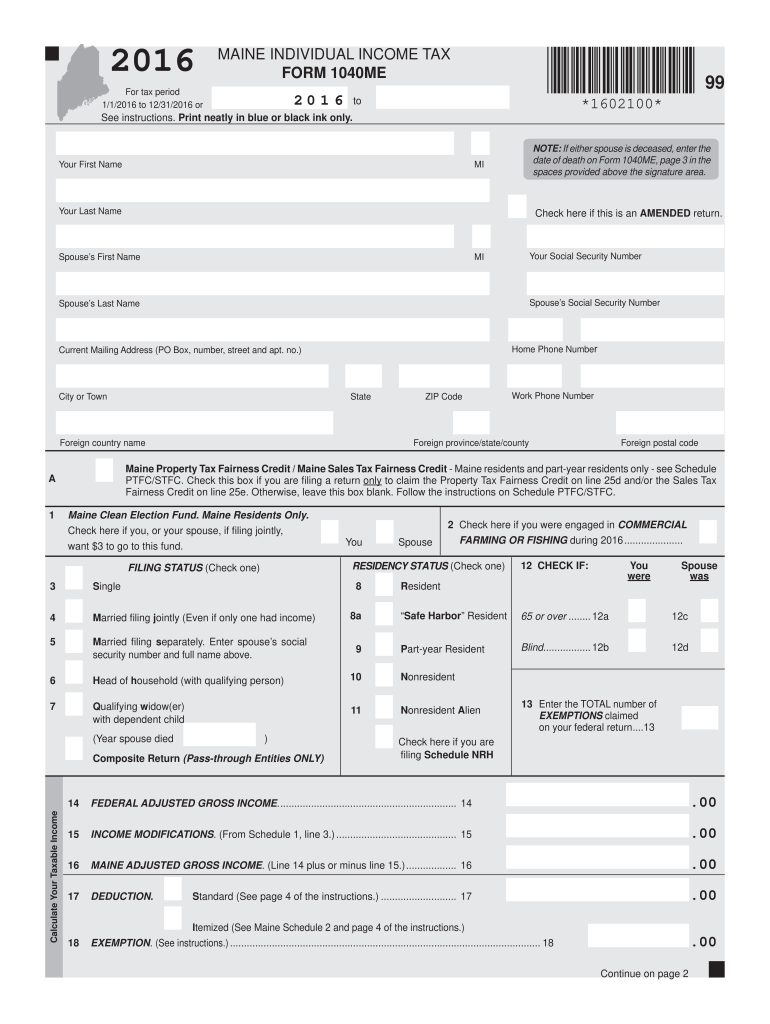

Definition and Purpose of the 2016 Maine Form 1040ME

The Maine Form 1040ME for the tax year 2016 is an official document used by residents to report their individual income taxes. This form serves multiple purposes, including:

- Income Reporting: Taxpayers disclose their total income, including wages, interest, dividends, and other earnings.

- Tax Calculations: The form guides taxpayers through calculating their tax liability based on their reported income, deductions, and credits.

- Credit Claims: Taxpayers can claim various tax credits available to them, which may reduce the amount owed or increase refunds.

The form is essential for fulfilling state tax obligations and ensures that individuals comply with Maine tax laws.

Steps to Complete the 2016 Maine Form 1040ME

Completing the 2016 Maine Form 1040ME involves several key steps that guide taxpayers from start to finish:

- Gather Necessary Information: Collect all relevant documents, including W-2 forms, 1099 forms, and statements regarding other income.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form, along with your spouse’s information, if applicable.

- Report Income: Complete the income section by listing all sources of income. This may include wages, rental income, and any miscellaneous income. Use the correct lines on the form to ensure accuracy.

- Calculate Adjusted Gross Income (AGI): Deduct any allowable adjustments (like student loan interest or contributions to retirement accounts) to arrive at your AGI.

- Determine Tax Liability: Utilize the state’s tax tables or tax rate schedules as indicated on the form to calculate how much tax you owe based on your taxable income.

- Apply Deductions and Credits: Enter any deductions and tax credits for which you qualify to reduce your total tax liability.

- Review and Sign: After completing the form, review it for errors and omissions. Sign and date the form to validate your submission.

- Submit the Form: Decide on your submission method and send the completed form to the Maine Revenue Services by the deadline.

Completing these steps carefully ensures that taxpayers fulfill their legal obligations while maximizing potential refunds.

Important Terms Related to the 2016 Maine Form 1040ME

Understanding significant terms associated with the 2016 Maine Form 1040ME can enhance comprehension. Key terms include:

- Adjustable Gross Income (AGI): The income figure that determines your eligibility for various deductions and credits after accounting for specific adjustments.

- Standard Deduction: A fixed dollar amount that reduces the income subject to taxation. For many taxpayers, this often offers a straightforward way to lower taxable income without itemizing.

- Tax Credits: Dollar-for-dollar reductions in tax liability. Some common examples include the Earned Income Tax Credit and the Child Tax Credit.

- Electronic Filing: The process of submitting the tax return electronically to the Maine Revenue Services, which may expedite the processing time.

- Refund: The amount of money returned to the taxpayer when total tax payments exceed the actual tax liability.

Familiarizing oneself with these terms allows for a better grasp of the overall tax filing process and its implications.

Filing Deadlines and Important Dates for 2016 Maine Tax Forms

Staying informed about critical deadlines is essential to avoid penalties and ensure timely submission. For the 2016 Maine Form 1040ME, the important dates include:

- Filing Deadline: Typically, individual tax returns are due on April 15 of the year following the tax year. For 2016 returns, this date is April 15, 2017.

- Extension Request: If you need more time, you can file a request for an extension, usually extending the deadline by six months. However, any owed taxes must still be paid by the original deadline to avoid interest and penalties.

- Estimated Tax Payments: Taxpayers may need to make quarterly estimated tax payments throughout the year. These are typically due on April 15, June 15, September 15, and January 15 of the following year.

Being aware of these key dates helps taxpayers to plan accordingly and avoid unnecessary stress during the tax season.

Who Typically Uses the 2016 Maine Form 1040ME

The 2016 Maine Form 1040ME is primarily utilized by individual residents of Maine who have earned income during the tax year. Specific groups that frequently use this form include:

- Wage Earners: Individuals who receive income from employers and require tax documentation to report their earnings.

- Self-Employed Individuals: Those who run their businesses or work as independent contractors must report income and can also claim business expenses.

- Retirees: Residents receiving pensions, Social Security benefits, or other retirement income must report these amounts to ensure compliance with state law.

- Students: College or university students may use the form to report income from part-time work or internships, as well as to claim educational tax credits.

By understanding who typically uses the Form 1040ME, individuals can better recognize their obligations and rights related to state taxation.

How to Obtain the 2016 Maine Form 1040ME

There are several ways to obtain the 2016 Maine Form 1040ME for those who need to file their taxes:

- Online Access: The form is available for download from the Maine Revenue Services website. Taxpayers can access the form in PDF format, which allows for easy printing.

- Local Tax Offices: Individuals may also visit local tax offices or libraries where tax forms are commonly made available.

- Tax Preparation Software: Many tax preparation software programs include the Maine Form 1040ME as part of their package, guiding users through the filling process without needing a separate download.

Accessing the form through these methods allows taxpayers to select their preferred approach based on convenience and familiarity with the tax process.