Understanding the State of Maine Taxes

The state of Maine imposes several types of taxes that affect individuals and businesses. This includes but is not limited to personal income tax, corporate income tax, sales tax, and property tax. Each tax has its own set of rules, rates, and regulations.

Key Components of Maine Taxes

Maine taxes encompass various tax obligations that individuals and businesses need to be aware of for compliance. Understanding these components ensures accurate filing and payment.

- Personal Income Tax: Maine's personal income tax system is progressive, meaning tax rates increase as income rises. The tax brackets and rates can change annually, so reviewing current tax tables is essential.

- Sales Tax: Maine's statewide sales tax rate is currently five and a half percent (5.5%). Certain items, such as groceries and most clothing, are exempt from this tax, making it important for consumers to understand applicable exemptions.

- Corporate Income Tax: Corporations operating in Maine must pay corporate income tax, which is applied to the business's taxable income. The rates can vary based on income levels.

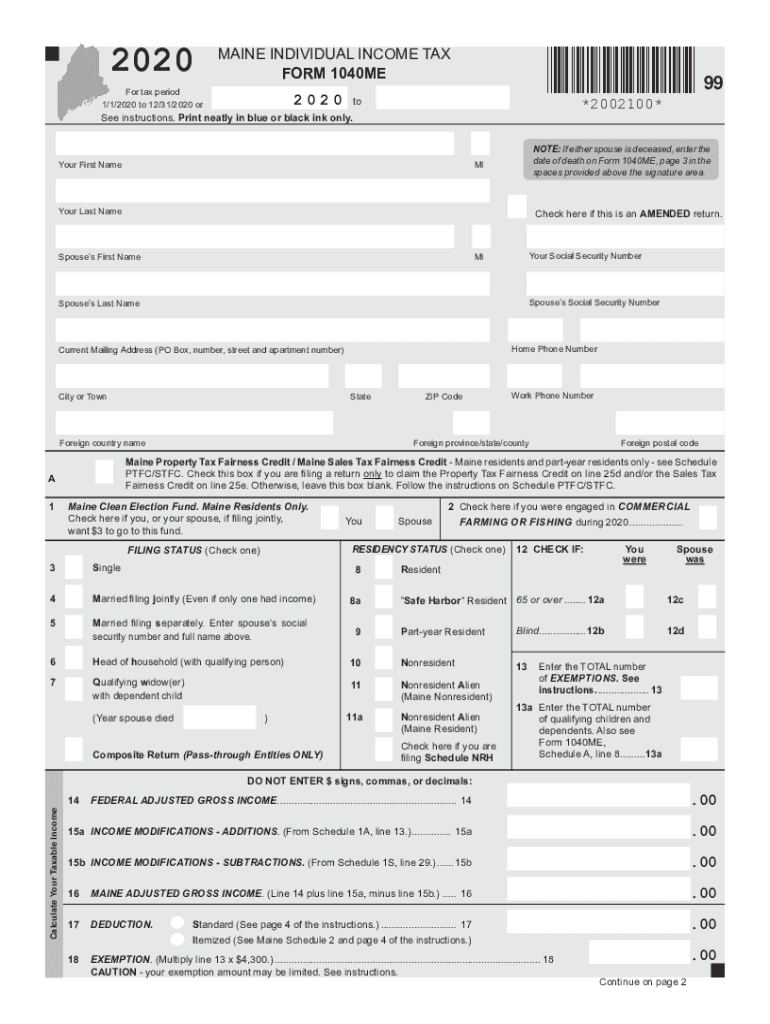

Steps to Complete Maine Taxes

Filing Maine taxes involves several steps that taxpayers should follow carefully to ensure compliance and accuracy.

- Gather Necessary Documentation: Collect all pertinent financial documentation, including W-2s, 1099s, and any records of deductions or credits.

- Determine Filing Status: Identify your filing status (e.g., single, married filing jointly, head of household) as it affects tax computations.

- Complete State Tax Forms: Use the appropriate Maine tax forms, such as the 1040ME for individuals, to report income and calculate tax liability.

- Claim Deductions and Credits: Review eligible deductions and credits, such as the Homestead Exemption for property taxes, to reduce tax liability.

- Submit Your Tax Return: File your completed tax return electronically or by mail, adhering to deadlines to avoid penalties.

Important Dates and Deadlines

Timeliness is crucial in tax filing. Taxpayers in Maine should be aware of key deadlines to avoid fines.

- Tax Filing Deadline: Typically, individual income tax returns are due on April 15, unless that date falls on a weekend or holiday.

- Estimated Tax Payments: For self-employed individuals or those with significant income not subject to withholding, estimated taxes may be due quarterly.

- Amendment Deadlines: Should corrections be necessary, amended returns must be filed within specific timeframes following the original submission.

Common Taxpayer Scenarios

Different taxpayer situations in Maine can affect filing requirements and tax obligations. Understanding these scenarios can help ensure accurate tax filings.

- Self-Employed Individuals: Self-employed taxpayers must fill out Schedule C along with their 1040ME to report business income and expenses.

- Students and Dependents: Students residing in Maine may have unique tax situations, particularly if they have part-time jobs or receive scholarships.

- Retired Individuals: Maine offers tax benefits for retirees, including pension and Social Security exemptions, which can significantly impact the amount of taxable income reported.

Legal Use of Maine Taxes

Compliance with the legal requirements surrounding Maine taxes is essential for all residents and businesses.

- Tax Registrations: Businesses operating in Maine must properly register for sales tax accounts and corporate income tax obligations with the Maine Revenue Services to legally operate.

- Filing and Payment: Regular and timely filing of tax forms, as well as payment of any taxes due, is essential to avoid legal repercussions.

Understanding the nuances of state of Maine taxes is vital for residents and businesses to fulfill their tax obligations effectively. This comprehensive knowledge facilitates smoother filing processes and greater compliance with state laws.