Definition and Meaning of Maine Tax

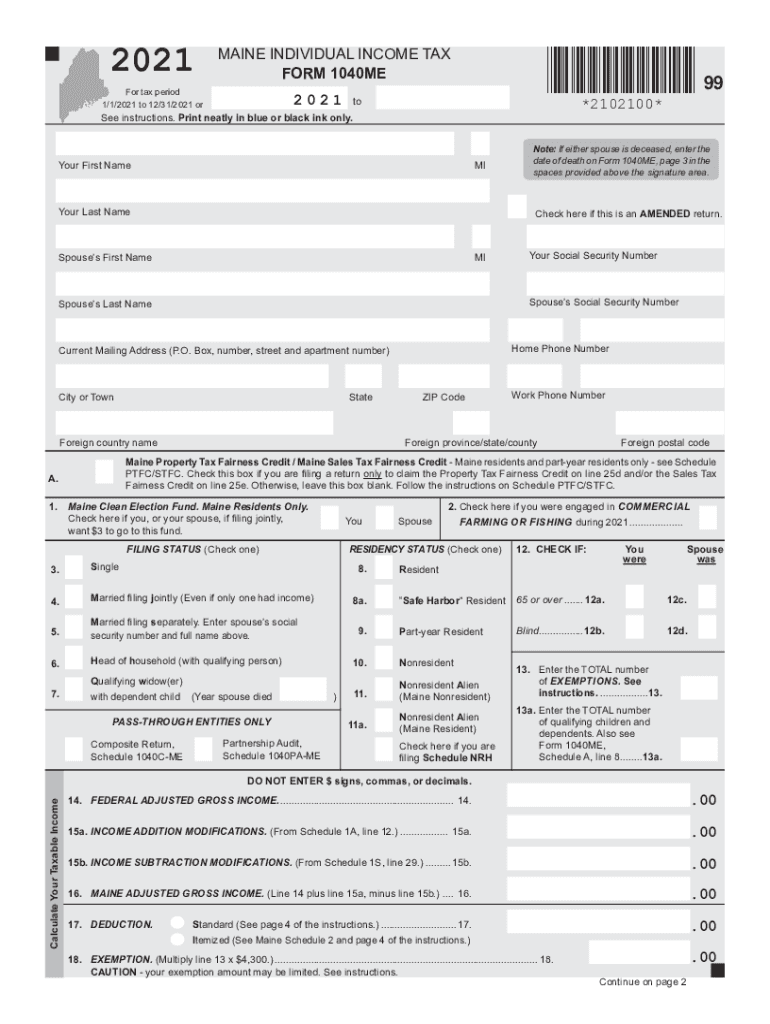

Maine tax refers to the collection of various taxes imposed by the State of Maine, including income taxes, sales taxes, property taxes, and other specific taxes. The Maine Individual Income Tax Form 1040ME is a crucial component of the state’s income tax system, allowing residents to report their income, claim deductions, and calculate their overall tax liability or refund. Understanding the specifics of the form and associated tax regulations is essential for accurately filing taxes and ensuring compliance with state tax laws.

Types of Maine Taxes

- Income Tax: Imposed on earned income, including wages, salaries, and some types of unearned income.

- Sales Tax: Applicable to the sale of goods and services within the state.

- Property Tax: Levied on real estate owned by individuals or businesses, calculated based on the property’s assessed value.

Steps to Complete Maine Tax Form 1040ME

Completing the Maine Individual Income Tax Form 1040ME requires several systematic steps to ensure accuracy and compliance. Following these steps will help taxpayers fill out their forms correctly and maximize any potential refunds.

-

Gather Required Documents:

- Collect W-2 forms from employers.

- Compile 1099 forms for additional income.

- Gather any other supporting documentation, such as receipts for deductions.

-

Determine Filing Status:

- The form requires selecting the appropriate filing status, such as single, married filing jointly, married filing separately, or head of household.

-

Fill Personal Information:

- Enter personal details, including name, address, and Social Security number, as required on the form.

-

Report Income:

- List all sources of income, including wages, pensions, and any taxable interest or dividends, in the corresponding sections of the form.

-

Claim Deductions and Credits:

- Identify and input all applicable deductions, like standard deductions or itemized deductions.

- Be aware of available tax credits that can reduce liability.

-

Calculate Tax Liability:

- Follow the provided instructions on calculating tax due or refund based on reported income and deductions.

-

Choose Direct Deposit or Mailing Option:

- Decide whether to receive a refund via direct deposit into a bank account or receive a check through the mail.

Important Terms Related to Maine Tax

Familiarity with specific terminology related to Maine tax can aid taxpayers in understanding the filing process and avoiding common pitfalls. Here are some key terms often associated with Maine income tax:

- Taxable Income: The total income subject to tax after deductions and exemptions.

- Standard Deduction: A fixed dollar amount that reduces the income on which you are taxed, varying based on filing status.

- Exemption: A specific dollar amount that can be deducted for each dependent or individual taxpayer, reducing taxable income.

Filing Deadlines and Important Dates

Being aware of deadlines and important dates is essential for timely filing of the Maine Individual Income Tax Form 1040ME. Here are key dates to note:

- Tax Year: The tax period for individuals typically runs from January 1 to December 31.

- Filing Deadline: The standard deadline for filing the 1040ME is April 15 of the following year, unless it falls on a weekend or holiday, in which case it may shift to the next business day.

- Extension: If additional time is needed, taxpayers can request an extension, which is generally granted until October 15, but any owed taxes must still be paid by the original deadline to avoid penalties.

Required Documents for Maine Tax Filing

To effectively complete the Maine Individual Income Tax Form 1040ME, taxpayers should gather an array of documentation that supports their income, deductions, and tax liability calculations. Key documents include:

- W-2 Forms: Provided by employers, detailing annual wages and taxes withheld.

- 1099 Forms: Reporting income received as independent contractors or from other sources.

- Proof of Deductions: Receipts or statements for mortgage interest, educational expenses, and other deductible items.

Having these documents readily available facilitates a smoother and more accurate filing experience.

Digital vs. Paper Version of the Maine Tax Form

Taxpayers can choose between submitting their Maine income tax returns electronically or using a paper version of the 1040ME. Both methods have distinct advantages and potential drawbacks.

Electronic Filing (E-filing)

- Advantages:

- Faster processing times and quicker refunds.

- Immediate confirmation of receipt and potential to reduce errors through automated guidance.

- Disadvantages:

- Requires access to a computer or mobile device and internet connectivity.

Paper Filing

- Advantages:

- Familiarity for individuals who prefer traditional methods of filing.

- Does not require technology, making it accessible for those less comfortable with digital formats.

- Disadvantages:

- Longer processing times and potential delays in receiving refunds.

Taxpayers should choose the method that best suits their preferences and comfort level, while also considering deadlines to ensure timely submission.