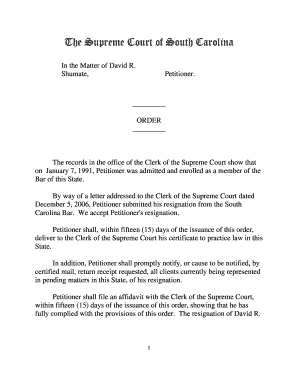

Definition & Meaning of the Maine Form 1040ME 2015

The Maine Form 1040ME for the year 2015 is the official state income tax return form used by residents of Maine to report their annual income and calculate their state tax obligations. This document is vital for taxpayers filing their individual income taxes, as it includes essential information about income sources, tax deductions, and credits available to Maine residents. By completing this form, individuals can determine their total taxable income, the amount of taxes owed, and any possible tax refunds.

The 1040ME form consists of various sections that require taxpayers to detail their income, including wages, interest, and any other earnings. Additionally, it provides spaces for claiming adjustments and credits, such as the Property Tax Fairness Credit, aimed at reducing the overall tax burden for eligible individuals. Understanding the specific components of the form is crucial for taxpayers to ensure accurate filings and compliance with state tax laws.

Steps to Complete the Maine Form 1040ME 2015

Completing the Maine Form 1040ME involves several structured steps to ensure accurate reporting of income and tax obligations. Follow these key steps:

-

Gather Required Documents:

- Collect W-2 forms from employers.

- Obtain 1099 forms for any freelance or additional income.

- Ensure you have information regarding any business income, dividends, and other sources of income.

-

Fill in Personal Information:

- Provide your name, address, and Social Security number.

- Indicate your filing status (e.g., single, married filing jointly, or head of household).

-

Report Income:

- Enter total wages, salaries, and any other income in the appropriate sections.

- Make sure to account for taxable interest and dividends.

-

Calculate Adjusted Gross Income:

- Subtract any adjustments to income to find your adjusted gross income (AGI).

- Adjustments may include retirement contributions or student loan interest.

-

Determine Deductions and Credits:

- Review the available deductions and select the most beneficial for your situation.

- Include any eligible credits, like the Property Tax Fairness Credit.

-

Compute Tax and Payment:

- Use the tax tables provided with the 1040ME instructions to determine your tax owed based on AGI and applicable rates.

- If applicable, include any penalties or interest for late payment.

-

Complete Signature and Date:

- Sign and date the form where indicated to validate your submission.

-

Submit Your Return:

- Choose between electronic submission or mailing your completed form to the state Department of Revenue.

Each of these steps is crucial for ensuring a correct and complete filing of the Maine Form 1040ME, which impacts the taxpayer's tax liability and potential refunds.

Who Typically Uses the Maine Form 1040ME 2015

The Maine Form 1040ME is primarily used by individuals who are residents of Maine and are required to file individual income tax returns for the tax year 2015. The following groups typically utilize this form:

- Individual Taxpayers: Single filers, married couples, and heads of households who earn income must file this form to report earnings and taxes owed to the state.

- Self-Employed Individuals: Sole proprietors and freelancers need to use the 1040ME to report earned income, expenses, and related deductions.

- Retired Residents: Individuals receiving pensions or Social Security benefits may also be required to complete this form to report income and determine tax liabilities.

- Students: Those who receive scholarships, grants, or work-study income must file if they meet the minimum income thresholds.

By understanding the demographics of those who typically use the Maine Form 1040ME, it becomes evident why accurate reporting is critical for compliance and proper tax administration.

Key Elements of the Maine Form 1040ME 2015

The Maine Form 1040ME consists of several critical elements that taxpayers must be aware of to correctly complete their tax filings. Key components of the form include:

- Personal Information Section: This includes the taxpayer's name, address, Social Security number, and filing status.

- Income Reporting Section: This segment details sources of income, including wages, interest, investment income, and any other taxable earnings.

- Adjustments to Income: Taxpayers can list adjustments, such as IRA contributions or student loan interest, to arrive at the adjusted gross income (AGI).

- Deductions and Credits: The form provides space for taxpayers to claim standard or itemized deductions and available credits, with specific forms like the Property Tax Fairness Credit detailed for easy reference.

- Tax Calculation and Refund/Payment Section: This segment guides users through calculating total taxes owed or refunds due based on income, deductions, and tax rates.

Each element is designed to ensure that taxpayers can report their financial situations accurately while maximizing available deductions and credits available in Maine.

Important Terms Related to the Maine Form 1040ME 2015

Understanding key terms associated with the Maine Form 1040ME is essential for accurate filing and comprehension of the tax process. Some of the most important terms include:

- Adjusted Gross Income (AGI): This is the total income of the taxpayer minus specific deductions and adjustments.

- Taxable Income: This is the income on which taxes are levied, calculated after accounting for deductions and exemptions.

- Deductions: Amounts that reduce taxable income, which can be claimed as standard or itemized deductions.

- Tax Credit: An amount that directly reduces taxes owed, as opposed to deductions, which reduce taxable income.

- Filing Status: A category that defines the tax rates and deductions applicable to a taxpayer, including options like single, married filing jointly, and head of household.

- Property Tax Fairness Credit: A specific credit aimed at assisting taxpayers who meet eligibility requirements based on property taxes paid relative to their income.

Familiarity with these terms equips taxpayers with the knowledge necessary to navigate the filing process efficiently and understand their rights and responsibilities within the Maine tax system.