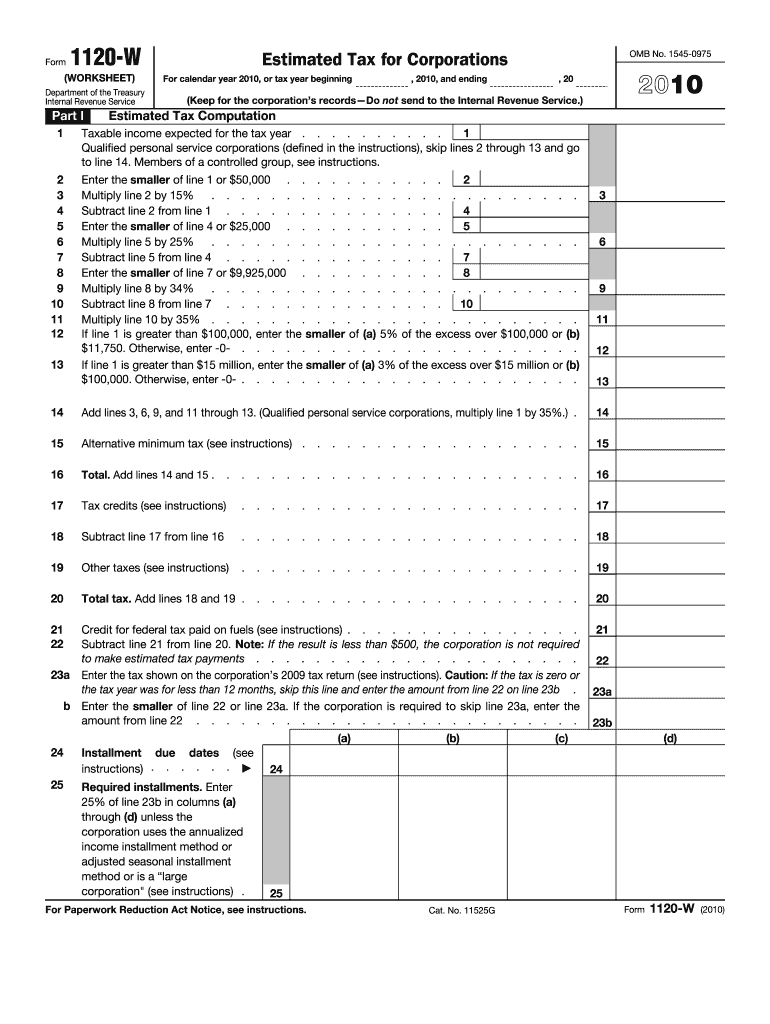

Definition & Purpose of Form 1120-W

Form 1120-W is a worksheet used by corporations to estimate their tax liabilities for the given tax year. This form is crucial for complying with IRS requirements for estimated tax payments. Corporations must use Form 1120-W to calculate their taxable income, determine their tax rate, and figure out any necessary tax credits or adjustments. This calculation ensures that they remit appropriate quarterly tax installments and avoid underpayment penalties.

Importance of Accurate Estimations

- Accurate estimations prevent interest charges and penalties.

- It helps in financial planning and cash flow management by projecting tax liabilities.

- Correct figures ensure that the corporation remains compliant with federal tax laws.

Example Scenarios for Usage

- A tech corporation foresees significant R&D tax credits; they must integrate these credits into their estimated tax calculations.

- A manufacturing company predicts an increase in sales revenue and adjusts its estimated tax accordingly to avoid penalties.

Steps to Complete Form 1120-W

To complete Form 1120-W, corporations must first gather relevant financial documents such as profit and loss statements and prior tax return records.

Step-by-Step Instructions

- Determine Gross Income: Start by calculating projected annual gross income.

- Calculate Deductions and Credits: Subtract allowable deductions and credits. Pay attention to specifics such as R&D credits and carried-forward losses.

- Compute Tax Liability: Use the calculated taxable income to figure out tax liability based on current corporate tax rates.

- Calculate Required Installments: Divide the annual estimated tax into quarterly installments.

- Complete Worksheets: Use each section of the 1120-W to input respective values and calculations.

Practical Examples

- A seasonal retail business estimates its income based on peak periods to ensure correct quarterly tax payments.

- A corporation with foreign income considerations adjusts their calculations for foreign tax credits.

Filing Deadlines & Important Dates

Corporations are required to make quarterly estimated tax payments with specific due dates throughout the year.

Key Dates

- First Quarterly Payment: Due April 15

- Second Quarterly Payment: Due June 15

- Third Quarterly Payment: Due September 15

- Fourth Quarterly Payment: Due December 15

IRS Compliance

Adhering to these payment dates ensures tax compliance. Failure to pay on time may result in penalties and interest charges.

Legal Use of Form 1120-W

Form 1120-W is essential for corporations to legally declare their estimated taxes.

IRS Guidelines

- Corporations are required to pay at least 100% of their prior year's tax liability or 90% of their current year's tax liability to avoid penalties.

- Accurately maintained records support the figures reported in Form 1120-W.

Penalties for Non-Compliance

- Corporations that underpay may face federal penalties.

- Interest may accrue on underpaid taxes, increasing the overall tax liability.

Key Elements of Form 1120-W

Primary Sections

- Income Estimation: Corporations provide projected income and taxable amounts.

- Deduction Breakdown: This includes sections for business expenses and deductible items.

- Credit Applications: Areas to apply eligible tax credits are vital for accurate tax estimation.

Worksheet Utility

- Guides businesses in aligning financial planning with IRS regulations.

- Provides a structured approach to handling estimated payments.

Who Typically Uses Form 1120-W

Corporations of all sizes leverage Form 1120-W to align with their financial and tax obligations.

Business Types

- LLCs taxed as corporations: Use this form to predict tax dues.

- C Corporations: Required for estimating installment payments.

Specific Scenarios

- International corporations with fluctuating income need this form for calculated estimations.

- Corporations undergoing mergers may use it to project tax liabilities accurately.

Examples of Using Form 1120-W

Corporations should carefully apply the form to avoid misestimating their taxes.

Real-World Use Cases

- Tech Startups: Leveraging projected research credits against anticipated sales.

- Manufacturing Units: Estimating tax dues against seasonal production peaks.

Common Misconceptions

- Assuming a one-time filing suffices; quarterly updates are paramount.

- Misapplication of credits due to misunderstanding eligibility requirements.

State-Specific Rules

While the IRS governs Form 1120-W, state variations might exist, affecting tax estimations.

Variation by State

- Some states necessitate additional forms or worksheets.

- Differences in state tax calculations can impact federal estimated tax computations.

Considerations for Compliance

- Research state laws impacting corporate filings.

- Consult with state tax advisors to integrate state-specific nuances into federal filings.