Definition & Meaning of the 1120 Form

The 1120 form, officially recognized as the U.S. Corporation Income Tax Return, is a tax document utilized by corporations in the United States to report their income and calculate their federal tax liability. This form is critical for C corporations, as it outlines the corporation's total income, deductions, profits, and tax due for the given tax year. The Internal Revenue Service (IRS) mandates its use for corporations to ensure transparency and compliance with tax laws.

Key features of Form 1120 include:

- Reporting gross income, including business revenue and capital gains.

- Deductions for ordinary business expenses such as salaries, rent, and utilities.

- Allowance for tax credits that reduce the overall tax liability.

- Calculation of taxable income to determine the tax owed.

Corporations must utilize this form regardless of whether they are making a profit or experiencing a loss during the tax year, as it provides a complete picture of the corporation’s financial activities.

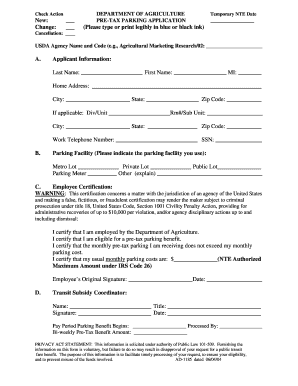

Steps to Complete the 1120 Form

Completing the Form 1120 involves several systematic steps to ensure accuracy and compliance with IRS regulations. The following outline details the essential stages of the process:

- Gather Financial Records: Compile all necessary documentation, including income statements, balance sheets, and prior tax returns.

- Fill Out Identification Information: Provide basic corporate information, including the corporation name, address, Employer Identification Number (EIN), and the tax year.

- Report Income: List all sources of income under specific sections of the form, clearly itemizing gross receipts and any additional income types.

- Claim Deductions: Document all allowable deductions for business expenses to reduce taxable income. Common deductions include operational costs and contributions to employee benefit plans.

- Calculate Taxable Income: Subtract total deductions from total income to ascertain the corporation's taxable income.

- Determine Tax Liability: Apply the appropriate corporate tax rates to the taxable income to calculate the tax owed.

- Complete Additional Schedules: Depending on the corporation's activities, it may need to attach additional schedules to the 1120 form (e.g., Schedule C for dividends).

- Review and Sign: Ensure all information is accurate and complete. An authorized person must sign the form before submission.

Failure to accurately follow these steps may result in penalties or incomplete submissions.

How to Obtain the 1120 Form

The 1120 form can be conveniently acquired through multiple channels. Corporations can obtain the form by:

- Visiting the IRS Website: The IRS provides a digital copy of the 1120 form available for download in PDF format. Users can also access instructions directly from the site to assist in completing the form accurately.

- Tax Preparation Software: Many tax preparation platforms, such as TurboTax and H&R Block, include the 1120 form in their suite of services. These tools often provide step-by-step guidance in completing the form.

- Local IRS Offices: Corporations can visit a local IRS office to request a physical copy or speaking with a representative for assistance.

- Professional Accountants or Tax Preparers: Engaging a professional can prove beneficial in obtaining the form, as they may supply version-specific recommendations based on the corporation's unique tax situation.

Ensuring that the correct and up-to-date version of the 1120 form is obtained is crucial for compliance with current tax regulations.

Filing Deadlines / Important Dates for Form 1120

Understanding the filing deadlines for Form 1120 is pivotal for ensuring compliance and avoiding penalties. For corporate tax returns, the following deadlines apply:

- Regular Filing Deadline: The form is typically due on the fifteenth day of the fourth month following the close of the corporation’s tax year, which for a calendar year-end corporation is April 15.

- Extended Deadline: Corporations can apply for an extension using Form 7004, which allows for an additional six months to file. This means that the new deadline would be October 15 for calendar-year corporations.

- Estimated Tax Payments: Corporations are required to make estimated tax payments throughout the year, generally due on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year.

Failing to meet these important dates can result in late filing penalties and interest charges on unpaid taxes.

Important Terms Related to the 1120 Form

Understanding specific terminology associated with the 1120 form is vital for accurate filing and compliance. Some important terms include:

- Corporate Income: Refers to the total earnings generated by the corporation from its regular business activities and investments during the tax year.

- Deductions: Expenses that reduce a corporation's taxable income, including operating costs, losses, and allowable credits that can be claimed on the form.

- Taxable Income: The amount of income that is subject to taxation after all deductions and exemptions have been applied.

- Estimated Tax Payments: These are advance payments made throughout the year, anticipated based on expected income and tax liabilities, to avoid owing a large sum at year-end.

An understanding of these terms enhances clarity and facilitates better interaction with tax professionals and resources associated with corporate tax filings.

Who Typically Uses the 1120 Form

The primary users of Form 1120 are C corporations, which are distinct legal entities separate from their owners for tax and liability purposes. These corporations can take advantage of several benefits, including potential deductions and limited liability protection. Other users of the form may include:

- Domestic Corporations: Businesses incorporated in the United States, filing the 1120 to report their income and tax obligations.

- Foreign Corporations: Non-U.S. corporations with income effectively connected to a trade or business in the United States must file Form 1120-F.

- Certain Associations and Organizations: While primarily used by corporations, some associations and cooperative businesses may also be required to file this form based on their specific circumstances.

Understanding who typically uses Form 1120 aids in determining if a corporation complies with federal tax requirements.