Definition & Meaning

A form request is a structured document designed to solicit specific information or services from an individual or organization. This request can encompass a wide range of needs, from applying for government benefits to initiating a service application. The components of a form request typically include personal identification information, the purpose of the request, and any documentation required for its processing. It is important to understand the context in which a form request is used as it can differ by sector or industry. For instance, financial institutions may use form requests for loan applications, while government agencies may issue form requests for tax-related purposes.

Importance of Understanding Form Requests

Understanding the nuances associated with form requests is vital for several reasons:

- Accuracy: Completing a form request accurately ensures that the information is processed correctly without delays.

- Legitimacy: Knowing the right context and purpose can help individuals avoid fraudulent requests and ensure they are requesting valid services or information.

- Efficiency: Properly filled form requests can expedite service delivery, ensuring timely responses from the organizations involved.

A well-defined form request can improve communication between parties and enhance the effectiveness of service delivery across various sectors.

How to Use the Form Request

Using a form request typically involves several deliberate steps to ensure the process is successful.

- Identify the Purpose: Determine the specific information or service you need, as this will guide you on which form to request and how to fill it out.

- Gather Required Information: Before completing the form request, collect necessary documents and personal information relevant to your request. This may include identification numbers, previous correspondence, or financial records.

- Complete the Form: Carefully fill out the form request with clear and accurate information. Ensure all fields are completed to avoid processing delays.

- Review Before Submission: Double-check for any errors or missing information. This step is crucial to ensure that the request is processed efficiently.

- Submit the Form: This can often be done through various channels, including online, via mail, or in person, depending on the requirements specified by the entity receiving the request.

Steps to Complete the Form Request

Completing a form request effectively involves several key steps, each contributing to the overall success of your submission.

-

Obtain the Form: Visit the appropriate website or office to access the form request needed for your application. Verify that you have the most current version to ensure compliance with guidelines.

-

Read Instructions Thoroughly: Familiarize yourself with any instructions attached to the form. These will provide detailed guidelines on how to fill out the form accurately and what information is necessary.

-

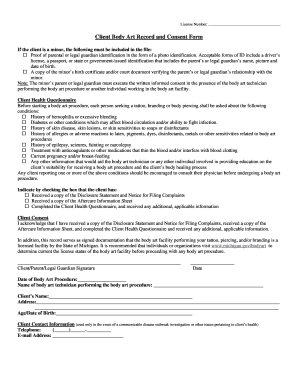

Fill Out Personal Information: Provide accurate personal and contact information, ensuring all details are up-to-date and precise. This includes:

- Full name

- Address

- Social Security Number or Tax Identification Number

-

Specify the Nature of Your Request: Clearly state what you are requesting from the organization. This clarity can prevent misunderstandings and expedite processing.

-

Attach Supporting Documentation: Include any required documents or identification. This might be tax returns, identification documents, or previous correspondence associated with your request.

-

Submit the Form: After completing the form, follow the specified submission method—either online, by mail, or in-person, based on the organization's guidelines.

-

Track Your Submission: If applicable, keep a copy of the submitted form and note any confirmation numbers, which can be used to track the status of your request.

Legal Use of the Form Request

A form request may have various legal applications, depending on the context in which it is used. Understanding the legal implications is essential for compliance and to avoid potential legal issues.

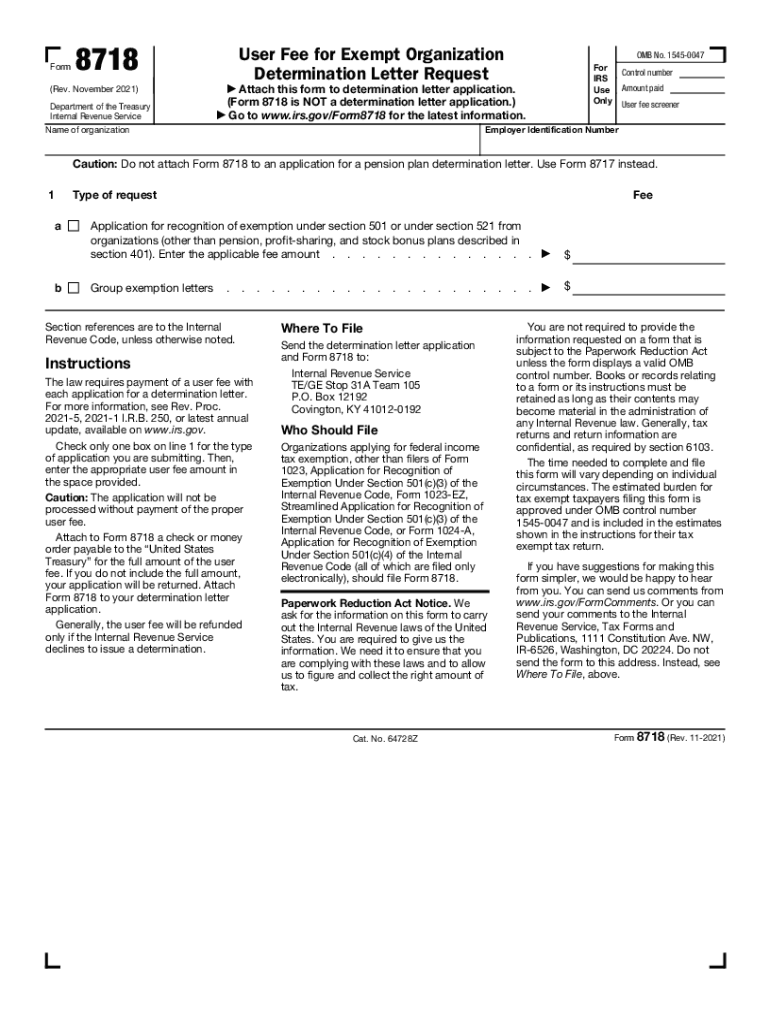

- Compliance with Regulations: Many form requests are provided to ensure compliance with local, state, or federal laws. For example, tax-related form requests must adhere to IRS guidelines to ensure proper processing and validity.

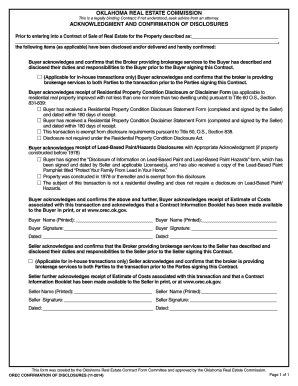

- Documentation of Transactions: Form requests can serve as official documentation for transactions or claims. This is particularly important in legal contexts, where proper records can serve as evidence.

- Liability Considerations: Misuse or fraudulent completion of a form request can lead to legal repercussions. Understanding the legal ramifications of the form is crucial before submitting it, ensuring adherence to all relevant laws.

Examples of Using the Form Request

Form requests can be utilized across a wide range of scenarios, providing clarity and formalization to the processes involved. Here are a few illustrative examples:

Tax Purposes

- IRS Form W-9: Used by businesses to request taxpayer identification number (TIN) from a contractor or vendor for tax reporting purposes.

- State Tax Form Requests: Various states may have their own forms for collecting state taxes or exemptions.

Financial Applications

- Loan Applications: Financial institutions often have specific form requests for individuals seeking loans, which require detailed financial backgrounds and credit histories.

- Account Opening Forms: Banks require completed form requests to open new accounts, gathering necessary customer information.

Government Services

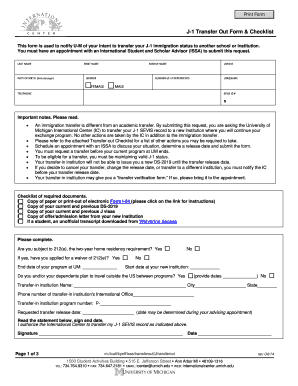

- Benefit Applications: Individuals may submit form requests to apply for government benefits such as unemployment insurance or welfare assistance.

- Travel Authorization: A form request may be needed for international travel authorization or visa applications, requiring personal and travel information.

These examples demonstrate the versatility and importance of form requests across various contexts, ensuring that essential information is gathered and processed efficiently.