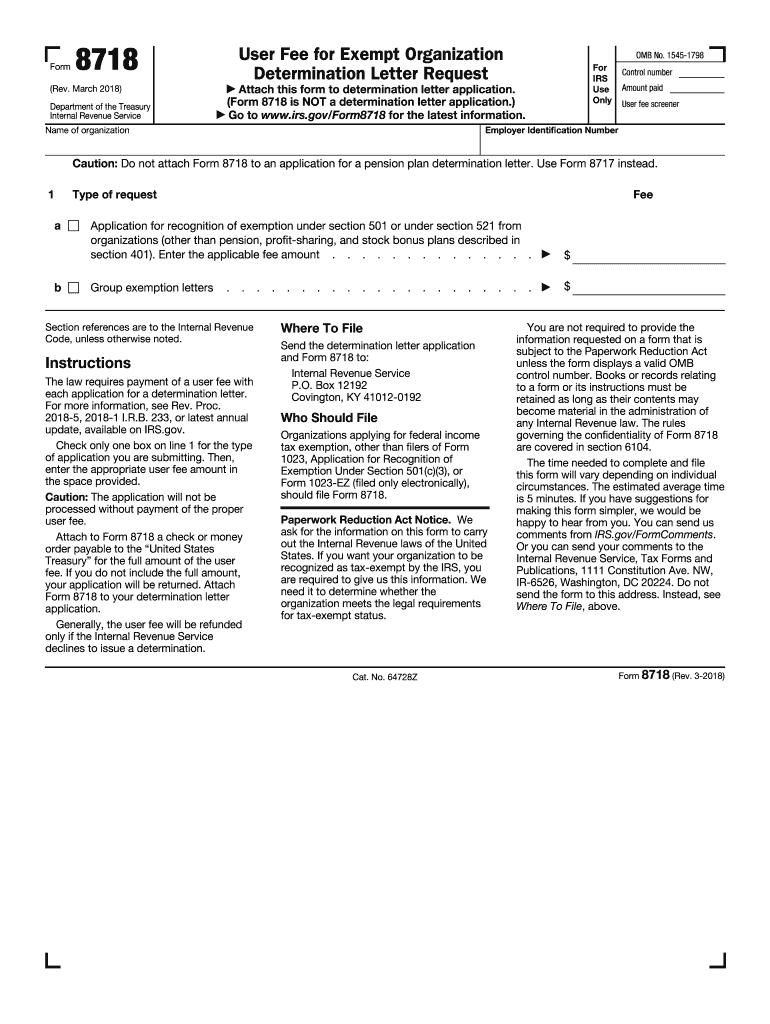

Definition and Purpose of IRS Form 8718

IRS Form 8718 is a necessary document for certain organizations applying for a determination letter regarding their federal income tax-exempt status. It serves to request a user fee related to this application, excluding pension plans. The form outlines the required payment, which accompanies the application to the IRS. Understanding the purpose of this form is crucial for organizations seeking federal tax benefit recognition as it directly relates to tax-exempt status confirmation, a process which solidifies an organization's compliance with federal tax laws.

How to Use IRS Form 8718

Using IRS Form 8718 involves several straightforward steps. It's primarily attached to the determination letter application and submitted to the IRS, ensuring that the required user fee is included. Here’s a step-by-step guide:

- Download the Form: Obtain the form from the IRS website or through authorized platforms like DocHub for easy editing and signing.

- Complete Required Information: Fill in the entity's name, address, and other pertinent details requested on the form.

- Determine the User Fee: Reference the current IRS fee schedule to ascertain the correct amount required for submission.

- Attach the Form: Securely attach Form 8718 to your determination letter application.

- Send to the IRS: Submit both the application and fee to the appropriate IRS address for processing.

Steps to Complete IRS Form 8718

Completing IRS Form 8718 requires precision due to its impact on the application’s validity. Follow these detailed steps:

- Identify Applicable Sections: Ensure familiarity with each part of the form, including entity details and payment information.

- Accurate Information Entry: Enter the entity's name, taxpayer identification number, and contact information correctly to avoid delays.

- Calculate and Verify User Fee: Accurately determine the user fee specific to your organization type and designation request.

- Provide Payment Method: Select and record the method of payment, ensuring it aligns with IRS guidelines.

- Review and Confirm Details: Double-check all form entries for accuracy before submission to prevent potential processing issues.

Key Elements of IRS Form 8718

Several critical components define IRS Form 8718, responsible for its function:

- Entity Information: Requires detailed identification of the organization, including name, address, and taxpayer ID.

- User Fee Specification: Dictates the necessary payment amount, ensuring compliance with IRS fee structures.

- Authorized Signature and Date: Confirms the authenticity and timing of the filing, ensuring legal acceptance.

Eligibility Criteria for Filing IRS Form 8718

Organizations intending to apply for federal income tax exemption must check their eligibility for using IRS Form 8718. Generally, this document pertains to:

- Nonprofit Organizations: Such as charities or social welfare organizations.

- Educational and Religious Entities: Seeking to confirm tax-exempt status.

- Organizations excluding Pension Plans: As outlined by the IRS, those exempt from pension-related tax benefits.

Required Documents for IRS Form 8718 Submission

Ensuring complete and accurate documentation accompanies IRS Form 8718 is critical:

- Determination Letter Application: The primary document indicating the request for tax-exempt status.

- User Fee Payment: Evidence of fee submission, such as a check or validated payment receipt.

- Supporting Documentation: Any additional materials enhancing the application's validity and completeness.

Legal Implications of IRS Form 8718

Submitting IRS Form 8718 opens an organization to various legal engagements under federal tax law:

- Verification of Tax-Exempt Status: Establishes eligibility and compliance with IRS regulations.

- Potential Audits: Failure or inaccurate submissions could trigger IRS reviews or audits.

- Legal Standing for Tax Advantages: Submission formalizes an entity’s right to federal tax exemptions.

Who Typically Uses IRS Form 8718?

This form is primarily utilized by:

- Nonprofit Entities: Seeking tax-exempt confirmation.

- Civic Organizations and Educational Institutions: Filing for formal tax exemption under IRS Code Section 501(c).

- Legal Representatives: Individuals filing on behalf of eligible organizations.

IRS Guidelines for Form 8718

The IRS issues comprehensive guidance on using Form 8718:

- Instructions for Accurate Fee Calculation: Ensures applicants remit the proper fee.

- Submission Protocols: Details proper filing addresses and procedures for submission.

- Updates and Changes: Keep abreast of annual fee updates or procedural modifications directly from IRS publications.

Filing Deadlines and Important Dates

Understanding the timeline for IRS Form 8718 submissions is essential:

- Flexible Submission Dates: Aligns with an organization’s determination letter request timing.

- IRS Processing Timeframes: Expect standard IRS processing times post-submission, often ranging from several weeks to months, depending on complexity.