Understanding Schedule J for 2017

Schedule J (Form 1040) for 2017 is an IRS form used predominantly by farmers and fishermen to average their taxable income over a three-year period. This form can significantly impact the calculation of tax liability, potentially reducing taxes owed for the year. It enables eligible taxpayers to stabilize their tax obligations by evening out income spikes across multiple years.

How to Use Schedule J for 2017

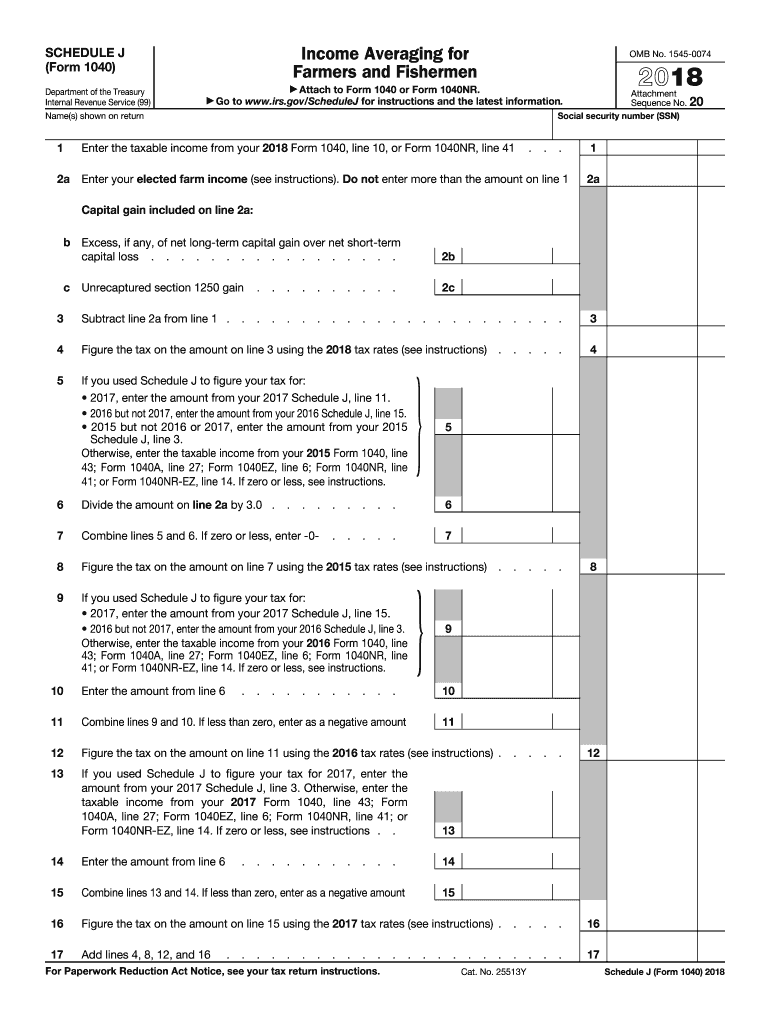

Using Schedule J involves understanding and following specific IRS instructions. Taxpayers must first gather relevant financial documents to accurately enter information about their income, deductions, and credits. They then follow a series of steps to calculate the average income and related tax liability, ensuring all figures adhere to IRS guidelines.

- Collect Financial Documents: Gather W-2s, 1099s, and records of farm or fishing income.

- Calculate Taxable Income: Determine total taxable income for each of the past three years.

- Apply Income Averaging: Use Schedule J to average income and calculate taxes as if the income were spread over the previous three years.

Steps to Complete Schedule J

Completing Schedule J requires a methodical approach to ensure all calculations are correct. The form is available on the IRS website and typically involves entering details in sequential steps.

- Identify Income Types: Specify all sources of farm and fishing income.

- Enter Previous Year Taxes: Locate and enter the tax liabilities for each of the preceding three years.

- Perform Calculations: Follow IRS instructions to compute the averaged income and new tax liability.

- Review and Submit: Ensure all information is accurate before filing with your tax return.

Who Typically Uses Schedule J

Farmers and fishermen who have earned fluctuating income levels over the years are the primary users of Schedule J. This form accommodates the unique financial situations often faced by individuals in these professions, where income can vary greatly due to factors like crop yields or market prices.

- Eligibility Criteria: Must have farm or fishing income.

- Taxpayer Scenarios: Often used by self-employed farmers and independent fishermen.

Required Documents for Schedule J

To complete Schedule J accurately, having the right documents is crucial. This ensures that all income and deductions are accounted for correctly.

- Income Documents: W-2s, 1099s, and farm income records.

- Previous Year Tax Returns: Previous three years' Form 1040 and any relevant schedules.

Filing Deadlines and Important Dates

Adhering to IRS deadlines is critical to avoid penalties or missed opportunities for tax benefits. Generally, Schedule J should be submitted along with your tax return by the standard tax deadline.

- Regular Tax Deadline: Typically April 15, unless otherwise specified by the IRS.

- Extended Filing: If applicable, file for an extension to provide additional time for completion.

Penalties for Non-Compliance

Failure to submit Schedule J correctly and on time could result in penalties from the IRS. Understanding these can help taxpayers mitigate risks associated with late or incomplete filing.

- Late Filing Penalties: Potential fines for missed deadlines.

- Incorrect Filing: Possible audits or adjustments to submitted tax returns.

Software Compatibility

Several tax preparation software platforms support the use of Schedule J, making the filing process more manageable.

- Compatible Software: TurboTax, QuickBooks, and other IRS-approved tax software.

- Digital Filing Options: Availability of e-filing for quick and safe submission.

Examples of Using Schedule J

To fully grasp the benefits of Schedule J, it's helpful to consider scenarios in which this form is used effectively.

- Farmer Example: A farmer with fluctuating yields can use Schedule J to average high-income years with lower-income years, reducing overall tax burdens.

- Fisherman Example: A fisherman who experiences significant income variations due to seasonal shifts in catch volumes can stabilize his reported income, potentially lowering taxes.

Each example showcases how Schedule J functions to make the tax process fairer for individuals with non-standard income patterns. By understanding these applications, eligible taxpayers can leverage the form to optimize their tax strategy.