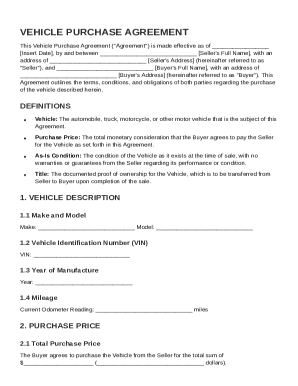

Definition and Purpose of Form 8812 for 2017

Form 8812, known as the Additional Child Tax Credit (ACTC) form, is used for the 2017 tax year to help taxpayers determine if they qualify for the refundable portion of the Child Tax Credit. This form specifically allows taxpayers to claim a credit amount exceeding what their tax liability would cover, potentially resulting in a refund. It plays a crucial role in ensuring eligible families receive additional financial support for their qualifying children.

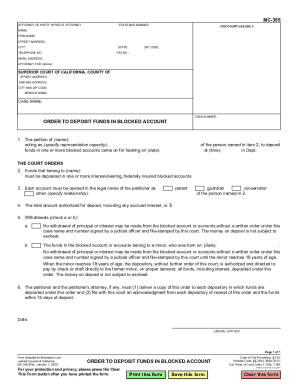

How to Use Form 8812 for 2017

To use Form 8812 for 2017, you need to complete it along with your annual tax return. It involves calculating if you're entitled to the additional credit by factoring in your earned income and the number of qualifying children. The form helps taxpayers identify the refundable portion of their Child Tax Credit that exceeds their tax liability. Detailed instructions accompany the form to assist in accurately completing each part.

Necessary Steps

- Determine Eligibility: Ensure you meet the eligibility criteria for the Child Tax Credit.

- Calculate Tax Liability: Consider your total income and applicable tax to understand your liability.

- Calculate the Credit: Follow the instructions to calculate the refundable portion of the Child Tax Credit.

- Complete the Form: Fill out each section of Form 8812 with the required details.

- Submit with Return: Attach Form 8812 to your federal tax return.

How to Obtain Form 8812 for 2017

Form 8812 for the 2017 tax year can be obtained through several means:

- IRS Website: Download the PDF version directly from the official IRS website.

- Tax Software: Use tax preparation software, which usually includes Form 8812 as part of its package of documents.

- Professional Tax Service: Request the form through a tax professional or accountant.

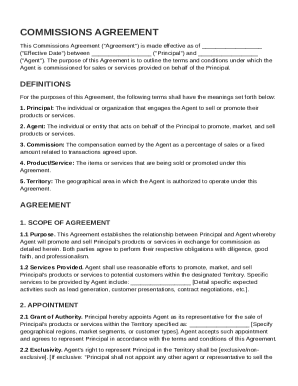

Important Terms Related to Form 8812 for 2017

Understanding the terminology associated with Form 8812 is essential for accurately completing the form. Here are a few critical terms:

- Qualifying Child: A minor who meets age, relationship, residency, and support tests outlined by the IRS.

- Earned Income: Includes wages, salaries, tips, and net self-employment earnings.

- Refundable Credit: A credit that can reduce your tax liability below zero, resulting in a refund.

Eligibility Criteria for Form 8812 for 2017

Eligibility to benefit from Form 8812 depends on several factors:

- Number of Children: You must have a qualifying child under 17 at the end of the tax year.

- Income Limits: Your modified adjusted gross income must fall within specified limits.

- Residency Requirements: The children in question must meet residency tests, having lived with you for more than half the year.

Steps to Complete Form 8812 for 2017

Completing Form 8812 requires accurate information and careful attention to detail. Here is an outline of the process:

- Start with Basic Information: Fill in your personal details, including your name and Social Security number.

- Calculate Eligible Children: Use the worksheet to determine the number of qualifying children.

- Assess Earned Income: Enter your earned income figures to see if you meet the income thresholds.

- Determine Additional Credit: Calculate the additional credit amount based on your qualifying factors.

- Finalize the Form: Complete the remaining sections and check for accuracy before submission.

Why Use Form 8812 for 2017

The primary reason to use Form 8812 is to potentially receive a higher tax refund. By assessing eligibility for the Additional Child Tax Credit, taxpayers can maximize their refund amounts, which is particularly beneficial for families with multiple dependents.

Benefits

- Increased Refund: Access refunds beyond tax liability limits.

- Financial Support: Receive additional funds to support family and childcare expenses.

- Tax Incentive: Encourages accurate tax filings with benefits for eligible taxpayers.

IRS Guidelines for Form 8812 for 2017

Adhering to IRS guidelines when completing Form 8812 is vital for compliance and maximizes benefits. Key IRS directives include:

- Documentation: Maintain records of income and child eligibility.

- Accuracy: Complete all calculations with precision to avoid errors.

- Compliance: Follow all instructions related to income thresholds and eligibility.

By following these guidelines, taxpayers can ensure they receive the correct credit amount and avoid potential issues during audits or reviews.