Definition & Meaning

Form 2441, officially known as the "Child and Dependent Care Expenses" form, is a crucial document for taxpayers in the United States looking to claim tax credits for childcare and dependent care expenses. The 2016 instructions for Form 2441 guide taxpayers on accurately reporting expenses incurred while paying for care services necessary for them to work or search for employment. Understanding this form's purpose helps ensure that eligible individuals maximize their care-related tax credits.

Qualifying Criteria

To use Form 2441, taxpayers must have paid for care services for a qualifying person—usually a dependent under the age of 13 or a physically or mentally incapable dependent. Additionally, the taxpayer must have earned income during the year, and the care expenses must be explicitly to enable the taxpayer to work or look for work.

How to Use the 2016 Instructions Form 2441

Using the 2016 instructions involves a sequential approach to complete Form 2441 correctly. Taxpayers should first ensure eligibility by reviewing the qualifying person definition and understanding the types of care costs covered.

Comprehensive Guidance

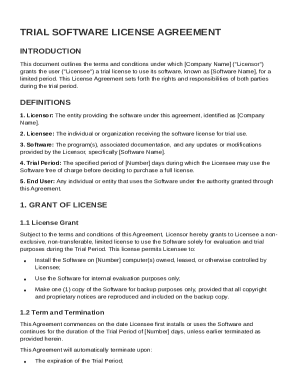

- Step-by-Step Sections: The instructions detail every section of Form 2441, helping users navigate lines to report their care expenses accurately.

- Examples and Scenarios: The provided examples in the instructions help clarify complex situations, such as when care services are shared between divorced parents.

- Error Avoidance Tips: Highlighting common mistakes and pitfalls, the instructions aim to reduce errors that could delay or negate credit eligibility.

Steps to Complete the 2016 Instructions Form 2441

Completing Form 2441 requires a careful step-by-step process. The instructions provide explicit details for each part of the form.

- Identify Qualifying Persons: List dependents who meet the eligibility criteria for child and dependent care credits.

- Calculate Care Expenses: Determine the total amount paid for qualifying care services during the tax year.

- Report Income: Ensure that earned income and any supplied dependent care benefits from employers are accurately reported on the form.

- Compute the Credit: Use the IRS formula provided in the instructions to calculate the eligible credit amount.

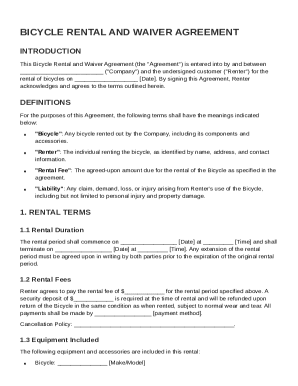

Documentation Required

- Receipts or statements from care providers

- Proof of income and dependent care benefits received

- Identification details for each qualifying person

Key Elements of the 2016 Instructions Form 2441

Understanding the core components of Form 2441 helps in accurate completion.

Important Sections

- Part I: Person(s) and Expense Summary: Details about each qualifying person and approximate care expenses.

- Part II: Credit Calculation: Instructions for tallying total credits based on expenses and income.

- Part III: Dependent Care Benefits: Covers any financial benefits or credits received directly through employers.

IRS Guidelines

The IRS guidelines for Form 2441 aim to create clarity around the acceptable uses of child care credits and the documentation needed for justification.

Filing Requirements

Adhering to IRS requirements ensures the legitimacy of claims made using Form 2441. Taxpayers must maintain comprehensive records of their care expenses and income data, like W-2 forms, for verification purposes.

Eligibility Criteria

Eligibility for using Form 2441 hinges on several important conditions.

Essential Conditions

- The taxpayer must have earned income.

- Care must be for a dependent allowing the taxpayer to work.

- Expenses must be directly related to care services provided during employment hours.

Penalties for Non-Compliance

There are stringent penalties for incorrect claims using Form 2441.

Possible Penalties

- Tax Credit Revocation: Misstated claims could lead to the revocation of child care credits.

- Fines and Interest: The IRS may levy fines or accrued interest charges on unpaid taxes due to incorrect credits.

- Audits: Persistent errors might trigger extensive IRS audits into past and present taxes.

Taxpayer Scenarios

Form 2441 applicability goes beyond standard family units, addressing diverse taxpayer situations.

Scenario Examples

- Self-Employed Individuals: These taxpayers benefit by claiming expenses directly linked to running their business while ensuring their dependents' care.

- Working Students: Part-time working students can claim dependent care expenses if they meet the income requirements specified in the IRS guidelines.

- Retired Individuals: Occasionally, retirees may qualify if they continue part-time employment while caring for dependents.