Definition and Meaning of Form 13551DocHubcom 2014

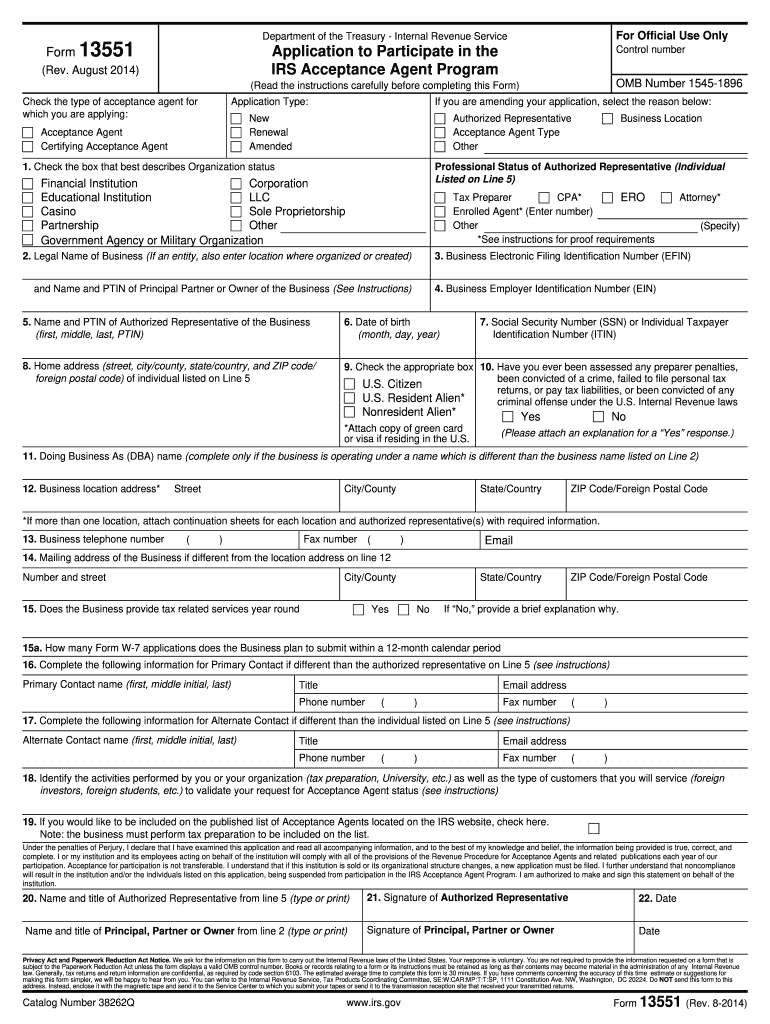

Form 13551, known formally as the Application to Participate in the IRS Acceptance Agent Program, is a critical document for entities assisting foreign individuals in obtaining their Taxpayer Identification Numbers (TINs) in the United States. This form is essential for any organization, whether businesses or individuals, seeking to become IRS-approved Acceptance Agents. Acceptance Agents act as intermediaries between the IRS and taxpayers, ensuring proper documentation and verification of identity for TIN applications. By completing Form 13551, entities commit to understanding and adhering to the IRS’s requirements for identifying and supporting foreign taxpayers.

How to Use Form 13551DocHubcom 2014

Utilizing Form 13551 effectively ensures seamless participation in the IRS Acceptance Agent Program. Here's a detailed guide on using the form:

-

Download the Form: Obtain the 2014 version of Form 13551 from the official IRS website or through trusted document management platforms like DocHub.

-

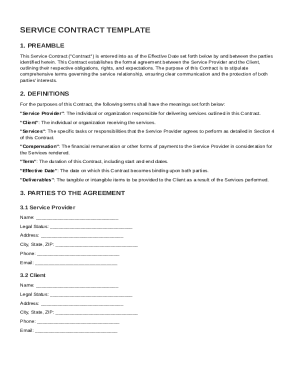

Organizational Information: Enter details about your organization including name, address, and type of entity you represent (e.g., business, individual, non-profit).

-

Authorized Representatives: Identify the representatives authorized to conduct IRS Acceptance Agent activities, including their contact information.

-

Compliance Declarations: Declare adherence to IRS rules, ensuring compliance with all regulations related to TIN application processing.

-

Submission and Review: After completing, review thoroughly to avoid errors, as inaccuracies can delay approval. Submit following the IRS's preferred methods, either online or via mail.

Steps to Complete Form 13551DocHubcom 2014

Completing Form 13551 efficiently requires systematic efforts. Below are the key steps:

-

Gather Required Information: Before starting the form, collect all necessary details about your organization and its representatives.

-

Fill Out Organizational Details: Complete the section pertaining to the name, EIN, and address of your organization.

-

Designate Authorized Individuals: List all individuals who will act as representatives or contact persons in dealings with the IRS. Include their positions and qualifications.

-

Business Information: Provide detailed descriptions of your business activities, including the services provided to clients in relation to their TIN applications.

-

Attest to IRS Requirements: Sign the declaration confirming your understanding and commitment to IRS requirements and standards for Acceptance Agents.

-

Review and Correct: Double-check information for accuracy and completeness before submission.

Key Elements of Form 13551DocHubcom 2014

- Organizational Identifiers: Vital for the IRS to uniquely identify your entity.

- Representatives Section: Lists individuals authorized to act on the organization’s behalf, including necessary credentials.

- Business Descriptions: Explains the types of services offered, particularly in relation to TIN assistance.

- Compliance Statements: Contains declarations to assure the IRS of your adherence to TIN application regulations and procedures.

IRS Guidelines for Form 13551DocHubcom 2014

The IRS sets specific guidelines for securing approval as an Acceptance Agent:

- Eligibility Criteria: Agencies or individuals must demonstrate their ability to appropriately handle sensitive taxpayer information.

- Training and Compliance: Acceptance Agents must complete IRS-mandated training programs and consistently adhere to updates and changes in IRS regulations.

- Evaluation and Approval: The IRS evaluates applications through a defined process, focusing on the readiness and capability of the organization or individual to fulfill their roles effectively.

Important Terms Related to Form 13551DocHubcom 2014

- Acceptance Agent: An individual or business authorized by the IRS to assist applicants in acquiring ITINs.

- Taxpayer Identification Number (TIN): A unique code assigned to individuals and entities for tax purposes.

- Internal Revenue Service (IRS): The U.S. government agency responsible for tax collection and enforcement.

Legal Use of Form 13551DocHubcom 2014

Form 13551 is legally required to engage in activities related to assisting nonresident aliens and other foreign persons in obtaining a TIN. Participation as an IRS Acceptance Agent mandates strict compliance with all relevant federal laws and IRS rules. Failure to comply can result in penalties, including suspension from the program.

Filing Deadlines and Important Dates

While Form 13551 itself does not have a specific annual deadline, timely submission is crucial for continual participation in the Acceptance Agent Program. Ensure all documentation is submitted well before any changes in IRS regulations or deadlines to avoid disruptions in authorization status.

Penalties for Non-Compliance

Non-compliance with IRS guidelines as an Acceptance Agent can result in:

- Revocation of Agent Status: Loss of the ability to operate as an Acceptance Agent.

- Financial Penalties: Fines or penalties for incorrect or fraudulent processing of TIN applications.

- Legal Consequences: Potential involvement of legal action against the organization or individuals involved.

By ensuring thorough understanding and correct usage of Form 13551DocHubcom 2014, entities can effectively participate in the IRS Acceptance Agent Program, supporting foreign taxpayers’ tax identification needs while complying with federal regulations.