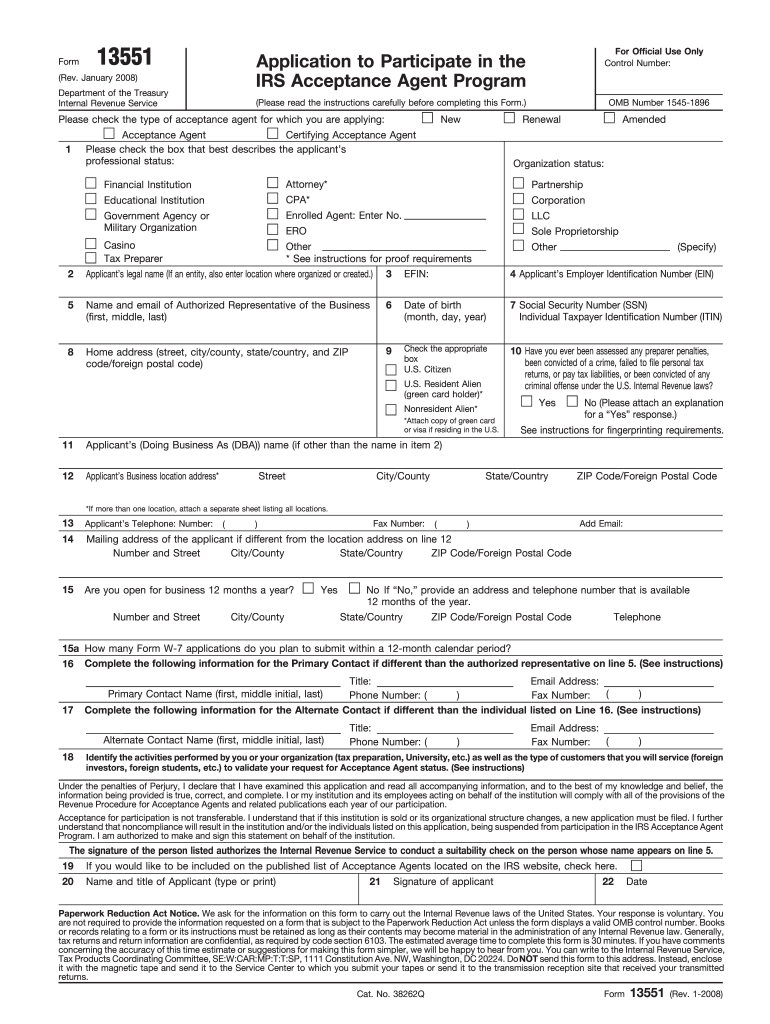

Definition and Meaning of Form 13

Form 13551 is an official application form for individuals or entities who wish to participate in the IRS Acceptance Agent Program. This form is essential for those looking to assist foreign persons in obtaining a Taxpayer Identification Number (TIN). The application seeks to gather detailed information regarding the applicant's professional status, organizational structure, and compliance with IRS regulations. By understanding this form, applicants can ensure they provide accurate information to meet IRS requirements.

How to Use Form 13

-

Determine Eligibility: Before filling out the form, ensure you or your organization meets the eligibility criteria set by the IRS for Acceptance Agents.

-

Gather Required Information: Collect all necessary documents, including professional credentials and organizational details. This information will be crucial when completing the form.

-

Complete the Form: Fill in each section carefully, including professional background, authorized representatives, and contact information.

-

Review and Verify: Double-check all entries for accuracy. Ensure that all mandatory fields are completed to avoid any processing delays.

-

Submit the Form: Once completed and verified, submit the form to the IRS as per the submission guidelines.

Steps to Complete Form 13

-

Read the Instructions Carefully: Start by thoroughly reading the instructions provided with the form to understand each requirement.

-

Fill Out Personal and Professional Details: Enter your name, address, and professional qualifications. Provide relevant organizational details if applying as an entity.

-

Specify Authorized Representatives: If applicable, list all individuals authorized to represent your application.

-

Compliance and Certification: Agree to the compliance terms outlined by the IRS and certify that the information provided is accurate to the best of your knowledge.

-

Attach Necessary Documentation: Include any supporting documents that validate the information in your application.

Important Terms Related to Form 13

-

Acceptance Agent: An entity or individual authorized by the IRS to assist applicants in obtaining a TIN.

-

Taxpayer Identification Number (TIN): A unique identifier used by the IRS for tax purposes.

-

Authorized Representative: An individual permitted to act on behalf of the applicant entity in dealings with the IRS.

-

Compliance: Adhering to the rules and regulations set by the IRS for Acceptance Agents.

Filing Deadlines and Important Dates

The IRS does not typically set a strict filing deadline for Form 13551. However, applicants should aim to file as soon as they decide to participate in the Acceptance Agent Program. Doing so allows ample time for processing and any required corrections.

Key Elements of Form 13

- Organization and Professional Information: Crucial for determining applicant eligibility.

- Authorized Representatives: Ensures clarity on who can legally act on behalf of the applicant.

- Compliance Attestations: Demonstrates adherence to IRS expectations and regulations.

- Contact Information: Provides a reliable way for the IRS to communicate with the applicant.

Who Typically Uses Form 13

Form 13551 is primarily utilized by tax professionals, accounting firms, and legal entities seeking to become IRS Acceptance Agents. By using this form, these entities can help individuals, especially foreign persons, obtain a TIN, which is a vital step in fulfilling U.S. tax obligations.

IRS Guidelines for the Form 13

The IRS sets specific guidelines for completing Form 13551. It is essential for applicants to understand these guidelines to ensure they meet all requirements for participation in the Acceptance Agent Program. This includes knowing the documentation needed, deadlines, and the correct methods of submission.

Required Documents for Form 13

Applicants must provide documentation that supports their eligibility, such as professional licenses, association memberships, and compliance records. These documents verify the applicant's capability to fulfill the roles and responsibilities of an IRS Acceptance Agent effectively.

Each section and explanation aims to equip applicants with the necessary knowledge and insights to complete Form 13 accurately, ensuring successful participation in the IRS Acceptance Agent Program.