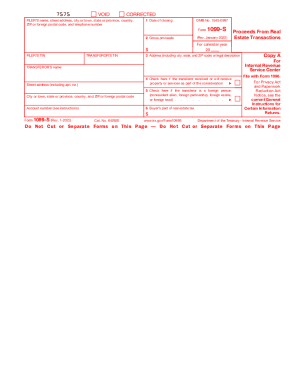

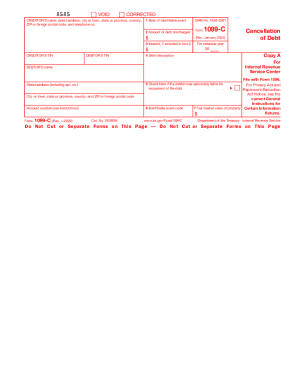

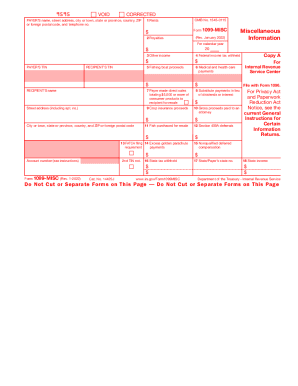

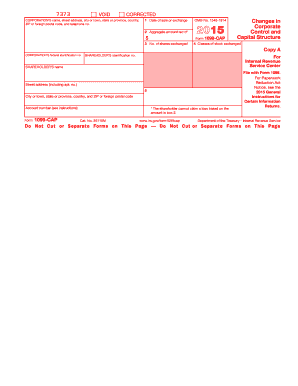

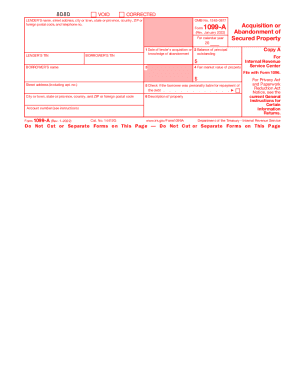

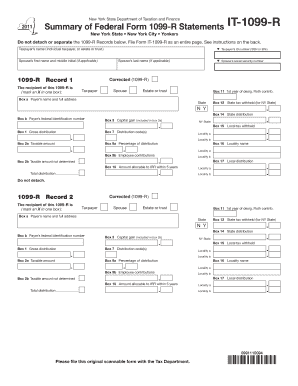

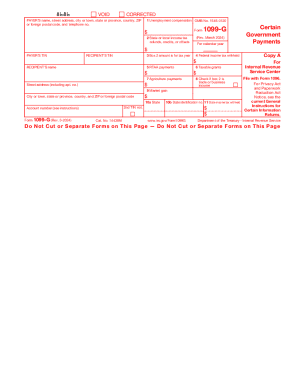

Save time and effort with our comprehensive collection of case-specific 1099 s from irs Order Forms. Pick from a range of pre-made templates or personalize your own.

Document management can overpower you when you can’t discover all of the documents you need. Luckily, with DocHub's vast form library, you can find everything you need and promptly handle it without the need of changing between software. Get our 1099 s from irs Order Forms and start working with them.

Using our 1099 s from irs Order Forms using these basic steps:

Try out DocHub and browse our 1099 s from irs Order Forms category with ease. Get your free profile today!