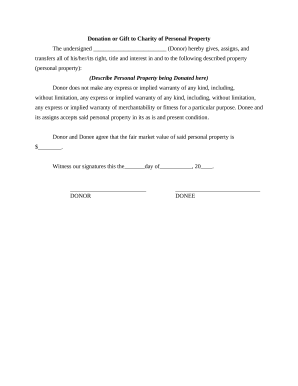

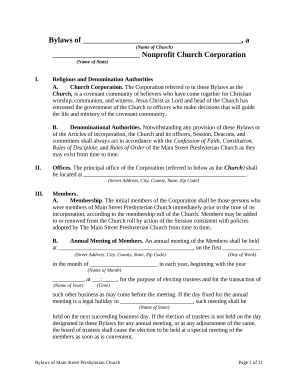

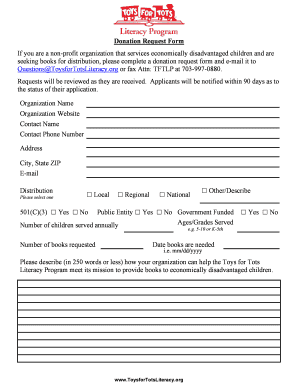

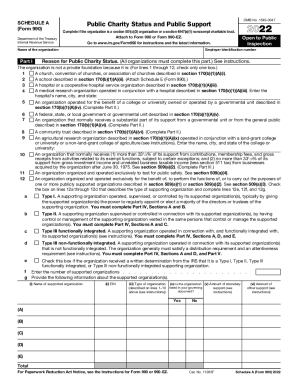

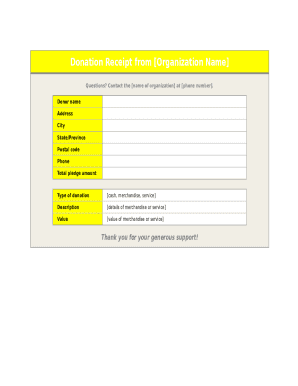

Enhance your donation workflows with Simple non profit charitable Donation Forms templates. Stay adherent with regulations by effortlessly filling out documents and distributing forms.

Accelerate your file managing with our Simple non profit charitable Donation Forms online library with ready-made form templates that suit your requirements. Get your document, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with the documents.

The best way to use our Simple non profit charitable Donation Forms:

Explore all of the possibilities for your online document administration with our Simple non profit charitable Donation Forms. Get your free free DocHub account right now!