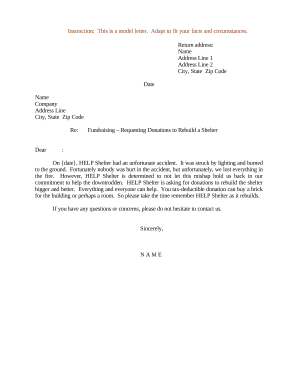

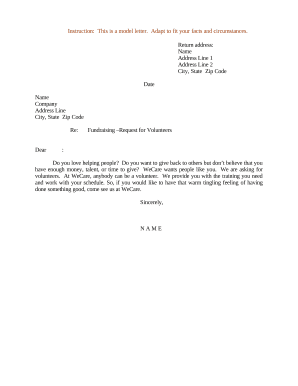

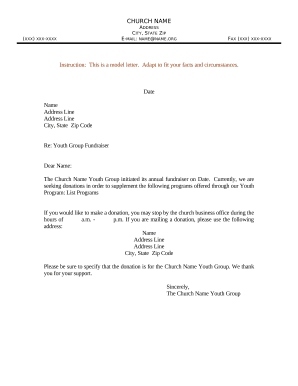

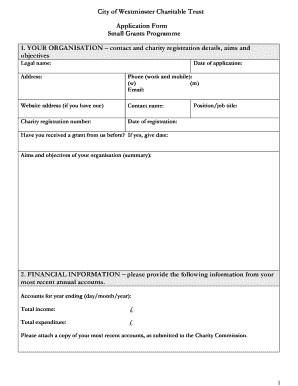

Monitor all your fundraising contributions effortlessly with Charitable request small business Donation Forms collection. Obtain them at any time, wherever you are, and never lose crucial donor details again.

Your workflows always benefit when you can easily discover all the forms and documents you need on hand. DocHub offers a wide array of document templates to ease your day-to-day pains. Get a hold of Charitable request small business Donation Forms category and easily discover your form.

Start working with Charitable request small business Donation Forms in a few clicks:

Enjoy easy document administration with DocHub. Explore our Charitable request small business Donation Forms category and find your form today!