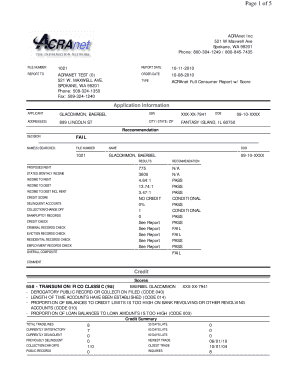

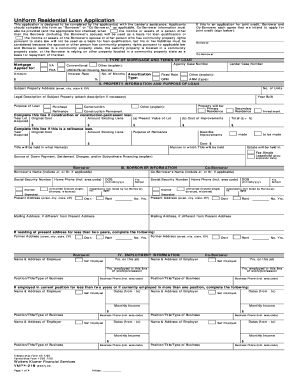

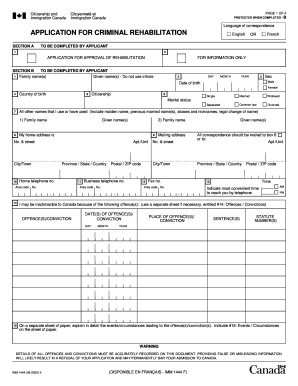

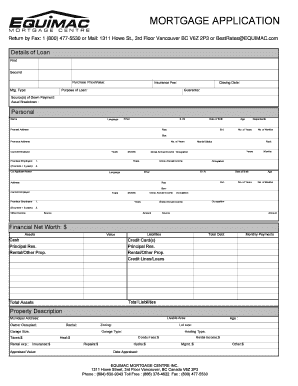

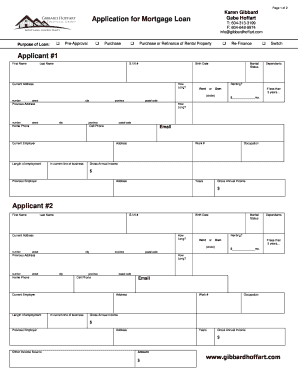

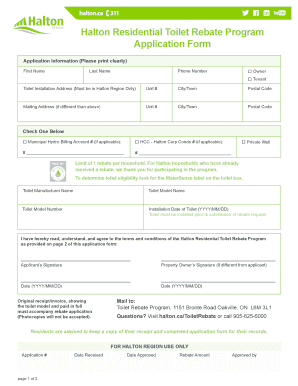

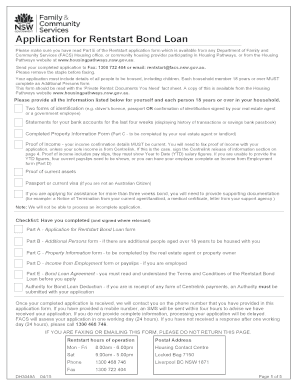

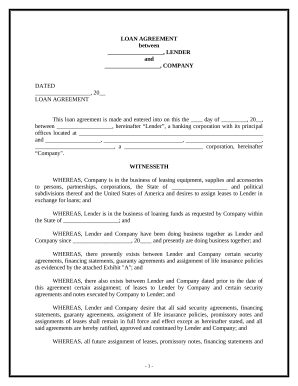

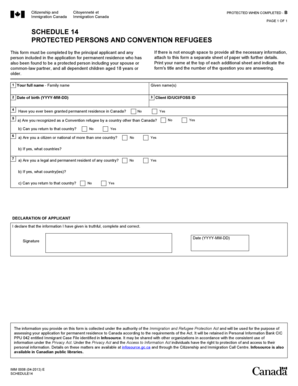

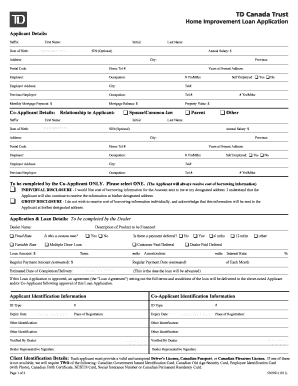

Obtain and simplify handling of Loan Canada Forms. Locate relevant forms for your business or personal use, modify, and distribute your templates without difficulty.

Your workflows always benefit when you can easily obtain all of the forms and documents you will need on hand. DocHub offers a vast array of forms to relieve your daily pains. Get a hold of Loan Canada Forms category and quickly browse for your form.

Begin working with Loan Canada Forms in several clicks:

Enjoy smooth file managing with DocHub. Check out our Loan Canada Forms collection and get your form right now!