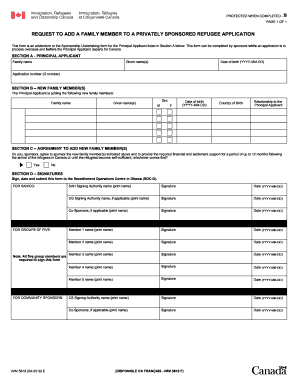

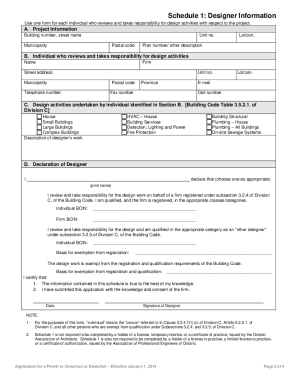

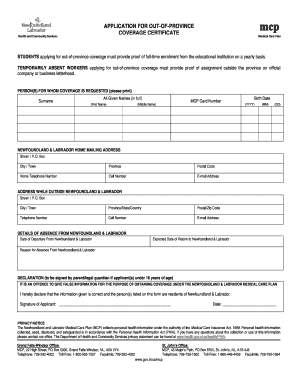

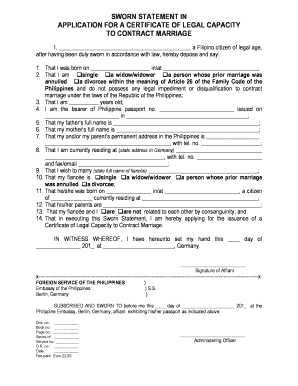

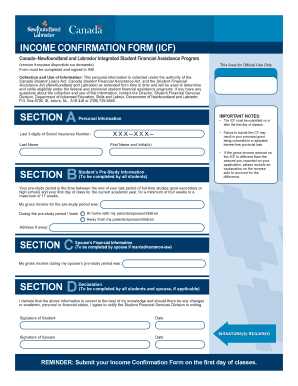

Obtain up-to-date Cd Canada Forms and effortlessly control them according to your requirements. Edit, fill out, and securely send your forms with local authorities.

Your workflows always benefit when you are able to find all the forms and documents you will need at your fingertips. DocHub supplies a wide array of forms to alleviate your day-to-day pains. Get a hold of Cd Canada Forms category and easily discover your document.

Start working with Cd Canada Forms in several clicks:

Enjoy smooth document management with DocHub. Check out our Cd Canada Forms online library and get your form right now!