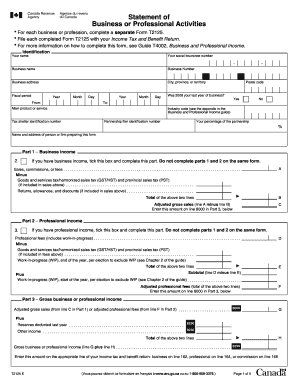

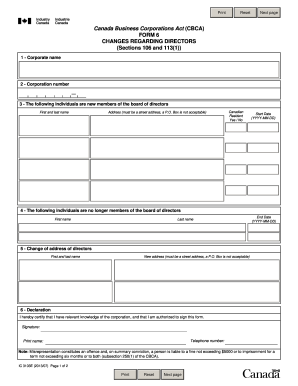

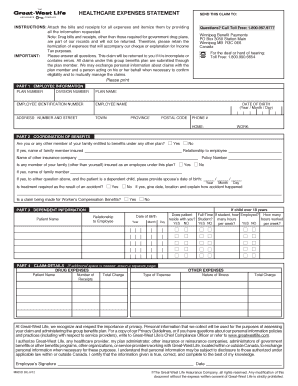

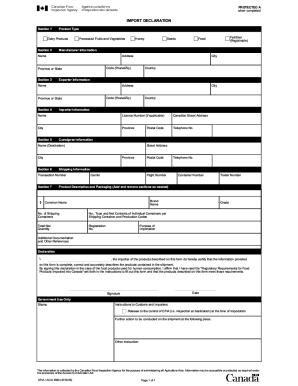

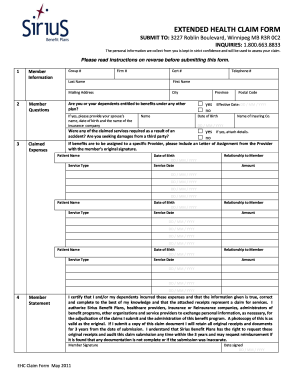

Locate business Business expenses Canada Forms and effortlessly personalize them with DocHub adaptive document editing tools. Fill out and share your forms with other contributors in a few clicks.

Form management occupies to half of your office hours. With DocHub, you can easily reclaim your office time and boost your team's productivity. Get Business expenses Canada Forms online library and investigate all document templates related to your everyday workflows.

The best way to use Business expenses Canada Forms:

Accelerate your everyday file management with our Business expenses Canada Forms. Get your free DocHub profile today to discover all templates.